Table of Contents

Used cooking oil (UCO) has emerged as aviation’s most circular, climate smart fuel source. Because it is a waste, UCO avoids the land use emissions that plague crop based biofuels, yet it can be hydro processed into a “drop in” jet fuel that slashes life cycle greenhouse gas (GHG) emissions by up to 80 percent compared with kerosene. Commercial HEFA (Hydroprocessed Esters and Fatty Acids) plants already scale the pathway, and strong policy signals in the EU, United States and China are expanding certified supply. Below, each section unpacks the technical, environmental and economic reasons UCO now tops expert lists of sustainable aviation fuel (SAF) feedstocks.

From Fryer to Flight: Closing the Waste Loop

Every litre of used cooking oil (UCO) collected keeps fats out of sewers and landfills while creating a renewable hydrocarbon stream. ICAO’s CORSIA framework classifies UCO as a “waste” feedstock, assigning it no cultivation emissions, only the modest energy used in collection. World Energy notes that such waste oils deliver the lowest carbon intensity among today’s SAF options, turning a disposal cost for restaurants into a revenue stream and a climate win for airlines.

Proven Carbon Cuts Over the Full Life Cycle

Neste reports up to an 80 percent GHG reduction for UCO based SAF when calculated with CORSIA LCA rules. National Renewable Energy Laboratory analyses confirm that HEFA UCO fuels typically score below 30 g CO₂e/MJ, about one third of fossil jet fuel’s 89 g CO₂e/MJ. Because no new cropland is required, the risk of indirect land use change is essentially zero, a key reason regulators give UCO preferential treatment.

How HEFA Technology Unlocks Jet Ready Fuel

HEFA hydrogenates triglycerides from UCO, cracking and isomerizing them into synthetic paraffinic kerosene that meets ASTM D7566 before being blended up to 50 percent with Jet A 1. The process fits inside existing refinery hydrotreaters, letting producers co process waste oils with renewable diesel or even fossil streams, lowering capital cost and accelerating scale up, according to DOE supported research. Airlines can therefore drop the fuel into current aircraft without engine or infrastructure modifications.

Global Supply and Scalability Outlook

China exported a record 2.95 million t of UCO in 2024, up 43 percent year on year, as demand from U.S. and EU refiners surged. The International Energy Agency projects biojet use will climb to five billion by 2028, with HEFA supplying the bulk. Analysts at ICCT caution, however, that even aggressive collection would cover only a fraction of 2050 jet demand, underscoring the need for additional feedstocks and Power to Liquid fuels.

Policy & Certification Safeguards

The EU’s ReFuelEU Aviation law “double counts” UCO derived SAF toward airline blending targets, signalling regulatory preference while capping crop oils. RSB’s Advanced Fuels Standard and U.S. 45Z clean fuel tax credits both require chain of custody documentation to verify that shipments are genuine waste oil. Such safeguards help airlines meet ICAO’s sustainability criteria and protect climate integrity.

Operational & Economic Advantages for Airlines

Because HEFA UCO SAF is molecularly similar to Jet A 1, it preserves fuel density and freezing point performance, avoiding payload or range penalties, United Airlines notes in its SAF program. Waste oil feedstocks also earn the highest carbon credit premiums under California’s LCFS and the EU ETS, narrowing the price gap that still exists versus fossil jet and crop oil SAF.

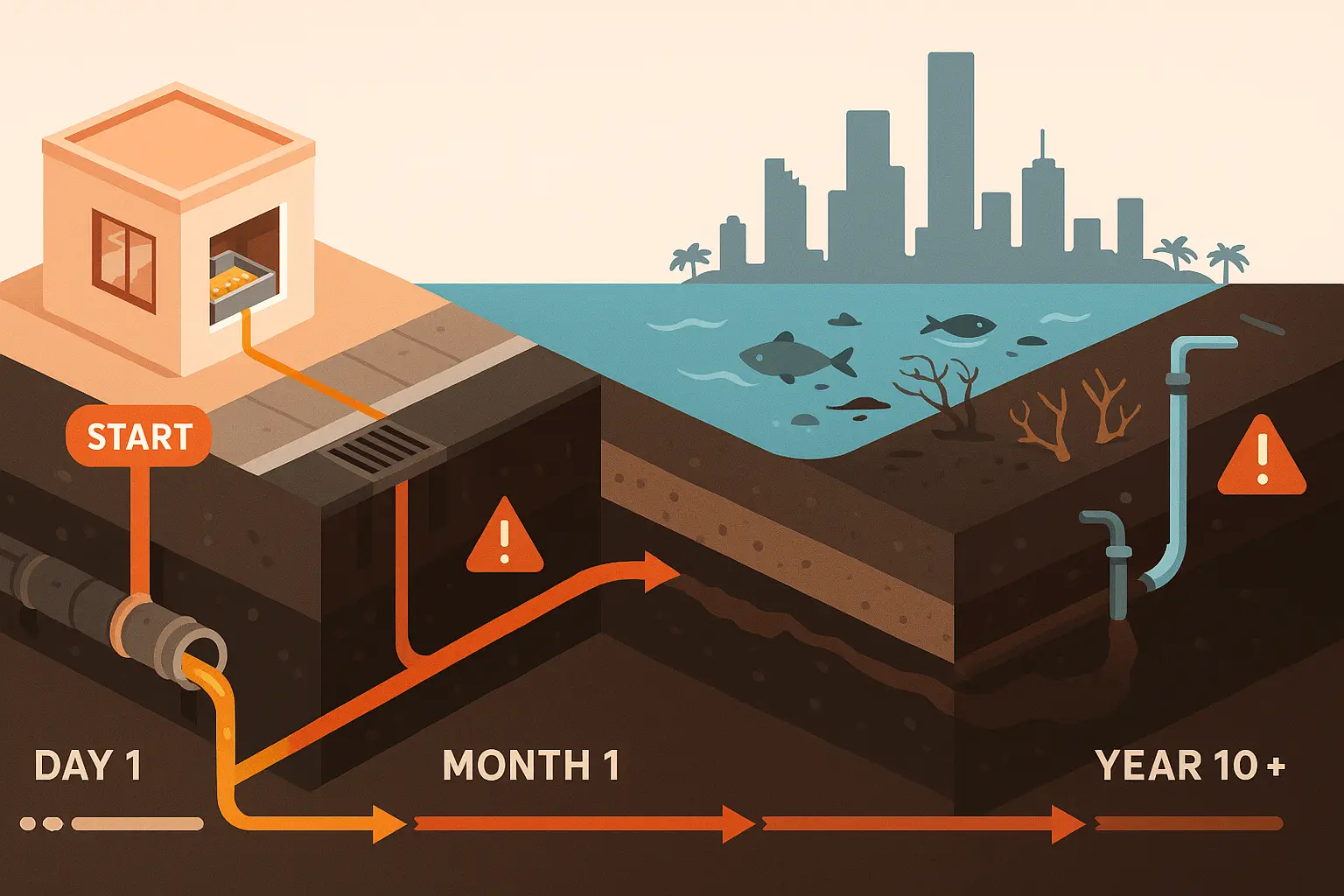

Risks, Fraud and Industry Response

Rapidly rising Asian exports have sparked investigations into fake UCO, virgin palm oil relabelled to capture subsidies, prompting audits by the U.S. EPA and calls for tighter EU checks. Blockchain traceability pilots and real time isotopic fingerprinting are being deployed to authenticate origin, reinforcing market credibility and ensuring real emission cuts.

Innovation Horizons

Researchers are testing hybrid HEFA HDCJ processes that co feed UCO with pyrolysis oils, boosting jet yields beyond 40 percent and cutting hydrogen demand. Airlines are also trialing 100 percent UCO based fuel on select routes as ASTM readies a specification for “neat” synthetic paraffinic kerosene, signaling the pathway’s long term potential.

How UCO Stacks Up Against Other SAF Feedstocks

| Feedstock | Typical life cycle GHG cut vs Jet A | Land use change risk | Commercial status | Key reference |

|---|---|---|---|---|

| Used cooking oil | up to 80% | None | Fully commercial HEFA | neste.com |

| Virgin vegetable oil | 20 to 40% | High | Commercial HEFA | worldenergy.net |

| Cover crop camelina | 60 to 70%* | Low | Pilot HEFA | worldenergy.net |