Prices verified June 9, 2025

Jump to a question:

What is the palm oil price today?

Palm oil trades at US $907.58 per metric ton as of May 2025 (Reuters). Malaysia palm oil prices are measured in US dollars per metric ton on commodity markets.

The current price reflects an 8.73% decline from the previous month. However, traders note a 5.64% increase from the previous year (World Bank). Daily palm rates appear in tables across major trading platforms from Kuala Lumpur to Chicago.

Most palm oil plantations operate in Indonesia and Malaysia. These tropical Southeast Asian countries control over 85% of global production. The World Wildlife Fund estimates around 90% of world oil palm trees grow on these islands.

Key market data points: • December 2024 peak: US $986.10/MT • 2025 trading range: US $814.00 to $954.00/MT • Current spot price: US $907.58/MT • Month-over-month change: -8.73%

Malaysia palm oil prices serve as the global benchmark. The country maintains its position as one of the largest palm oil producers in the world. Kuala Lumpur commodity exchange sets reference prices for international trade.

Summary: Today’s palm oil price sits at the May spot level. Historical and current prices, along with daily palm rates, are provided in tables across major exchanges. Consider our bulk oil procurement services for commercial needs.

Grease Connections

Why are palm oil prices high?

Palm oil prices remain elevated due to unpredictable weather patterns in Malaysia and Indonesia. Supply constraints meet growing biofuel demand, pushing oil prices higher.

The price of palm oil fluctuates based on multiple factors. Weather, competing oils, environmental concerns, and biofuel demand create volatility. Import policies and regulations by importing countries serve as trade barriers, affecting palm oil demand globally.

Climate disruptions in Southeast Asia reduce fruit production from oil palm trees. Traders monitor weather forecasts closely as rainfall patterns directly impact supply. Palm kernel oil production also suffers during extreme weather events.

Price pressure factors: • Unpredictable weather reducing Malaysia yields • China and India import demand surge • Biofuel mandates increasing industrial use • Environmental concerns limiting new plantations • Competition from other edible oils

Asia regions such as China and India remain key importers for palm oil. Their combined demand represents 40% of global consumption. Population growth and rising incomes in these markets support long-term price trends.

Summary: High palm oil prices result from weather-related supply constraints meeting robust Asian demand. Environmental concerns and biofuel requirements add upward pressure on the market price.

Grease Connections

What is the price of 1 litre of palm oil?

Retail palm oil costs US $1.20 to 1.80 per liter in global markets (USDA). Prices vary by region, with cooking oil grades commanding lower prices than specialty products.

Consumers find palm oil among the most affordable cooking oils available. Standard palm oil for cooking applications costs less than olive or avocado alternatives. Virgin palm oil commands premium pricing due to higher vitamin E and antioxidant content.

Fractioned palm oil divides into liquid fats and solid fats for various purposes. This processing allows manufacturers to create products with specific melting points. Food industry buyers appreciate the versatility for different applications.

Retail price breakdown: • Standard cooking oil: US $1.20 to 1.40/liter • Virgin palm oil: US $1.60 to 1.80/liter • Palm kernel oil: US $1.50 to 1.70/liter • Bulk purchases: Save 15 to 20%

India represents a major consumer of edible oils, particularly palm oil. The country’s massive population drives significant retail demand. Local prices reflect import duties and distribution costs above global commodity rates.

Summary: Palm oil retails at US $1.20 to 1.80 per liter depending on grade and location. It remains the most affordable option among major cooking oils globally.

Grease Connections

Why was palm oil banned?

Several countries restricted palm oil imports due to environmental concerns about deforestation and habitat destruction. The EU implemented labeling requirements rather than outright bans (European Commission).

Environmental concerns led to significant criticism from environmental groups regarding palm oil production. Deforestation for new plantations threatens orangutan habitats in Malaysia and Indonesia. These issues prompted consumer boycotts and regulatory responses.

Iceland supermarket chain banned palm oil from own-brand products in 2018. France attempted blocking palm oil biofuels but faced World Trade Organization challenges. Most jurisdictions now focus on sustainable certification rather than complete bans.

Regulatory landscape: • EU requires “contains palm oil” labeling • UK considers due diligence laws for deforestation • US maintains no federal restrictions • RSPO certification gaining mandatory status

Palm oil alternatives like olive oil and coconut oil replace various uses. However, these substitutes require more land to produce equivalent yields. This paradox complicates environmental policy decisions globally.

Summary: Palm oil faced restrictions over environmental concerns rather than complete bans. Most countries now mandate sustainable sourcing certification instead of prohibiting imports entirely.

Grease Connections

Is palm oil a cheap oil?

Yes, palm oil ranks as the cheapest major cooking oil globally at the May spot price (IMF). It costs 30 to 50% less than competing edible oils like soybean or sunflower.

Oil palm trees produce exceptional yields per hectare compared to other oil crops. This efficiency translates into lower production costs for farmers. Malaysia and Indonesia benefit from ideal growing conditions and established infrastructure.

Palm oil has several applications including cooking, lubricants, and candle-making. The versatility allows producers to maximize revenue from each harvest. Cosmetics manufacturers also rely on palm derivatives for products.

Cost comparison per metric ton: • Palm oil: Current May spot • Soybean oil: US $1,250 • Sunflower oil: US $1,262 • Canola oil: US $1,180

The overall demand for palm oil continues growing due to expanding industrial sectors. Adding commodities like palm to investment portfolios offers inflation protection. Low production costs ensure palm maintains its price advantage.

Summary: Palm oil remains the cheapest major cooking oil due to high yields and efficient production. It trades 30 to 50% below alternative edible oils consistently.

Grease Connections

How much is 1 ton of palm oil?

One ton of palm oil costs US $907.58 as of May 2025 (Reuters). Futures contracts on commodity markets quote prices per metric ton for international trade.

Investors track palm oil futures through major exchanges in Kuala Lumpur and Chicago. The price per ton fluctuates based on supply and demand dynamics. Technical analysis helps traders identify entry and exit points.

Commodity markets offer various contract sizes for different participants. Standard futures contracts represent 25 metric tons on most exchanges. Mini contracts allow smaller traders to participate with reduced capital requirements.

Contract specifications: • Standard contract: 25 metric tons • Mini contract: 10 metric tons • Current spot: US $907.58/MT • Margin requirement: 5 to 10% of contract value

Palm oil futures provide price discovery for physical market participants. Producers hedge future sales while consumers lock in purchase prices. This risk management function supports stable food prices globally.

One ton of palm oil trades at the May spot level based on supply and demand. Futures contracts multiply this base price by 25 tons for standard trading units. Explore our commercial oil management solutions for bulk procurement.

What is the price of crude palm oil?

Crude palm oil trades at the May spot level in global markets (IMF). This vegetable oil comes from the pulp of fruit from oil palm trees.

Crude palm oil represents the primary product before refining or fractionation. Processors extract it directly from fresh fruit bunches at plantation mills. The reddish oil contains high levels of carotenoids and vitamin E.

Malaysia sets global benchmarks for crude palm oil pricing through Bursa derivatives. The exchange handles massive volumes supporting price discovery. International traders reference these quotes for physical transactions.

Processing stages and values: • Fresh fruit bunches: US $180 to 220/MT • Crude palm oil: Current spot price • Refined palm oil: US $950 to 980/MT • Specialized fractions: US $1,000 to 1,200/MT

Palm kernel oil differs from crude palm oil in composition and price. Extracted from seed kernels rather than fruit pulp, it commands premium pricing. High lauric acid content makes it valuable for cosmetics manufacturing.

Summary: Crude palm oil costs US $907.58/MT as the primary extraction from oil palm fruit. Further processing into refined products adds US $40 to 70 per ton.

Grease Connections

Who are the biggest buyers of palm oil?

India and China dominate as the biggest buyers, importing 16 million and 7 million tons annually (USDA FAS). These Asia regions represent nearly 50% of global palm oil trade.

India leads global palm oil imports to meet cooking oil demands. The country’s 1.4 billion population drives massive edible oils consumption. Government policies favor palm imports over expensive domestic production.

China ranks second in palm oil purchases for food and industrial uses. The nation’s growing middle class increases demand for processed foods. Cosmetic products and toiletries manufacturing also consumes significant volumes.

Top 10 importing countries (million tons/year): • India: 16.0 • China: 7.0 • European Union: 6.5 • Pakistan: 3.5 • Bangladesh: 2.0 • United States: 1.8 • Egypt: 1.5 • Russia: 1.2 • Philippines: 1.0 • Myanmar: 0.8

The European Union imports palm oil primarily for biodiesel production. Food manufacturers also use palm in margarine and salad dressings. Stricter sustainability requirements affect EU purchasing patterns.

Summary: India and China buy 23 million tons annually, representing half of traded palm oil. Asian demand growth continues driving global market expansion.

Grease Connections

Why is palm oil the cheapest?

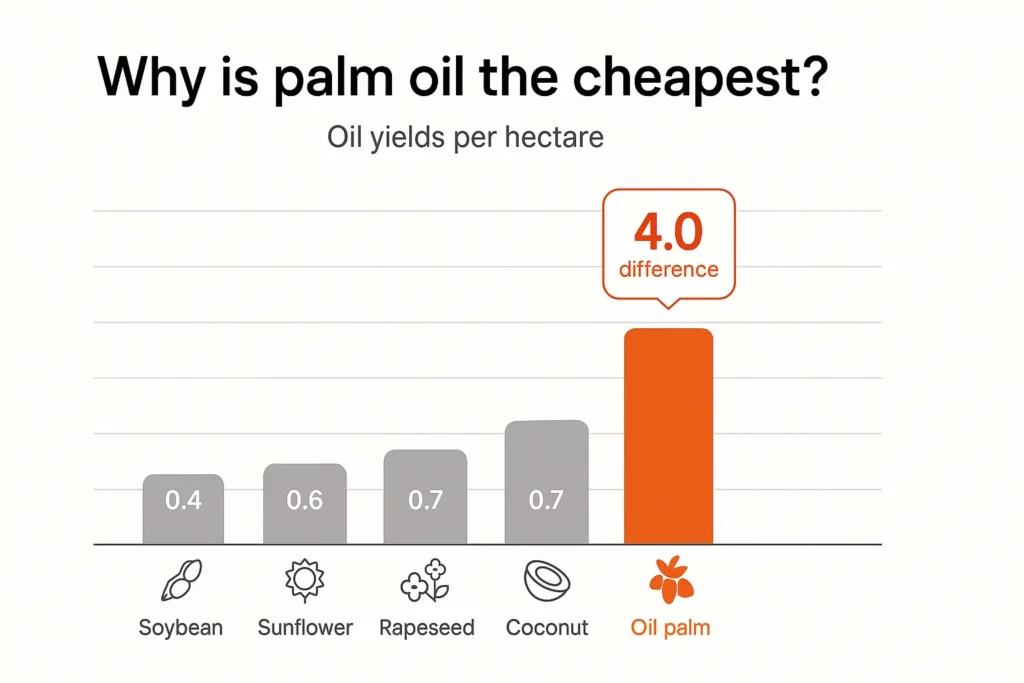

Palm oil achieves the lowest cost through exceptional yield of 4 tons per hectare annually. Oil palm trees produce 10 times more oil per land unit than soybeans (MPOB).

Superior productivity makes palm oil economically unbeatable among edible oils. Mature trees produce fresh fruit bunches year-round in tropical climates. This continuous harvest reduces storage costs and price volatility.

Malaysia developed efficient plantation management over decades. Infrastructure investments in mills and ports minimize transportation expenses. These factors combine to maintain palm oil’s cost leadership position.

Yield comparison (tons oil/hectare/year): • Oil palm: 4.0 • Coconut: 0.7 • Rapeseed: 0.7 • Sunflower: 0.6 • Soybean: 0.4

Labor costs remain low in primary producing countries. Mechanization of harvesting and processing improves efficiency further. Exchange rates often favor exporters, enhancing international competitiveness.

Summary: Palm oil stays cheapest due to 4 ton per hectare yields, 10 times higher than alternatives. Efficient tropical production systems maintain this cost advantage permanently.

Grease Connections

What is the crude palm oil price today?

Crude palm oil futures trade at 3,919 MYR/TNE on Bursa Malaysia Derivatives as of May 2025. This equals approximately US $875/MT at current exchange rates (Bursa Malaysia).

The Kuala Lumpur exchange provides real-time pricing for crude palm oil futures. Traders monitor these futures contracts for market direction. Volume indicators suggest strong participation from international investors.

Technical analysis of palm oil futures shows support at 3,800 MYR/TNE. Resistance appears near 4,100 MYR based on recent trading patterns. These levels guide short-term trading decisions for market participants.

Current market indicators: • Spot price: 3,919 MYR/TNE • 3-month futures: 3,945 MYR/TNE • 6-month futures: 3,980 MYR/TNE • Daily volume: 15,000+ contracts

Reuters reports similar pricing across Asian markets. Singapore and Jakarta exchanges show comparable valuations. This convergence indicates efficient price discovery across regional markets.

Summary: Crude palm oil trades at 3,919 MYR/TNE (US $875/MT) today. Futures contracts suggest modest price appreciation over coming months.

Grease Connections

What are crude palm oil futures?

Crude palm oil futures are standardized contracts to buy or sell 25 metric tons of palm oil at predetermined prices. These futures contracts trade on commodity markets like Bursa Malaysia (BMD).

Futures contracts allow producers and consumers to hedge price risk. Palm oil futures rank among the most liquid agricultural contracts globally. Daily volume exceeds 15,000 contracts on Kuala Lumpur exchange alone.

Investors use palm oil futures for portfolio diversification. Investing in palm oil helps hedge against inflation affecting food prices. The contracts offer exposure without handling physical commodities.

Contract specifications: • Size: 25 metric tons • Quality: RBD Palm Oil • Trading hours: 10:00-18:00 MYT • Margin: 4,000-6,000 MYR • Settlement: Physical delivery

Technical analysis guides futures trading strategies. Chart patterns and volume indicators signal potential price movements. Professional traders combine fundamental and technical factors for decisions.

Summary: Crude palm oil futures represent 25-ton contracts for future delivery. They provide risk management tools and investment opportunities in commodity markets. Learn about sustainable sourcing strategies for your business.

Grease Connections

What is the crude oil rate today?

Crude petroleum oil trades at US $78.50 per barrel for Brent and US $74.20 for WTI (EIA). Palm oil prices often correlate with crude oil due to biodiesel demand.

Energy market fluctuations influence palm oil through biofuel channels. When crude oil rises, biodiesel becomes more competitive economically. This relationship strengthens during periods of high energy prices.

Palm oil serves as feedstock for biodiesel production globally. Shampoo, soap, biodiesel, and many other products utilize palm derivatives. Industrial demand links agricultural and energy commodity markets.

Energy-agriculture price relationships: • Crude oil up 10% → Palm oil up 3-5% • Biodiesel mandates increase correlation • Seasonal patterns affect both markets • Dollar strength impacts all commodities

Investing in commodities requires understanding these interconnections. Risk management strategies must account for cross-market influences. Professional investors monitor energy prices alongside agricultural futures.

Summary: Crude petroleum trades near US $78/barrel while palm oil sits at the May spot level. Biodiesel production creates price linkages between energy and agricultural markets.

Grease Connections

Why is palm oil bad for the environment?

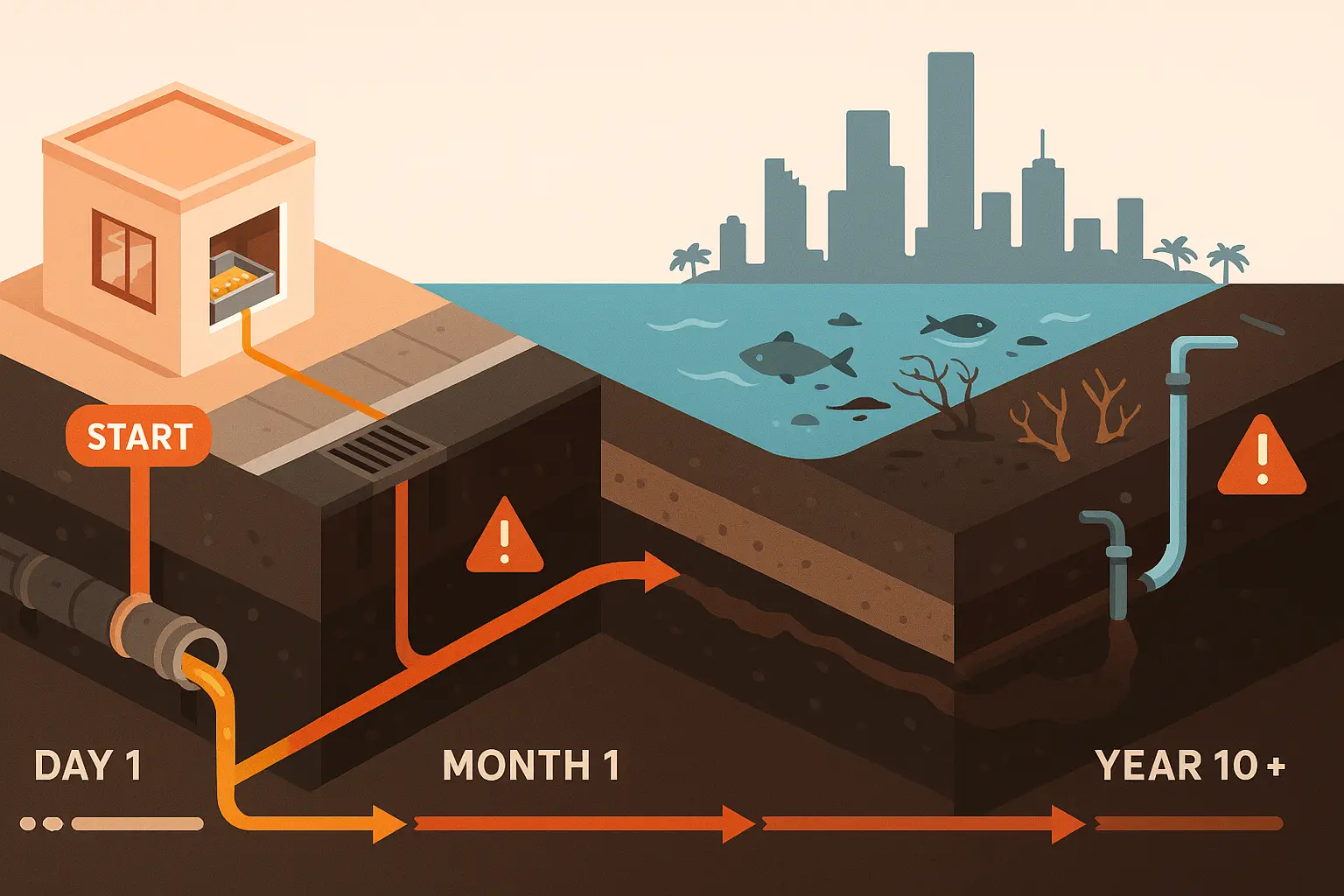

Palm oil production causes deforestation of 300,000 hectares annually in Southeast Asia (WWF). Environmental concerns include habitat loss, carbon emissions, and biodiversity destruction in Malaysia and Indonesia.

Expanding plantations replace tropical rainforests housing endangered species. Orangutans, tigers, and elephants lose critical habitat to oil palm trees. The World Wildlife Fund documents severe ecosystem impacts across production regions.

Carbon emissions from land conversion exceed 1 billion tons annually. Peat soil drainage releases stored carbon accumulated over millennia. These greenhouse gas emissions contribute significantly to climate change.

Environmental impacts: • 300,000 hectares deforested yearly • 50% of orangutan habitat lost since 1990 • 1.5 billion tons CO2 from peat drainage • 193 threatened species affected • Water pollution from mill effluent

Sustainable certification schemes attempt addressing these environmental concerns. However, critics argue enforcement remains weak across remote plantations. Consumer pressure drives slow improvements in production practices.

Summary: Palm oil devastates environments through deforestation, emissions, and biodiversity loss. Sustainable alternatives gain traction but face economic challenges competing with conventional production.

Grease Connections

Which month is palm oil cheap?

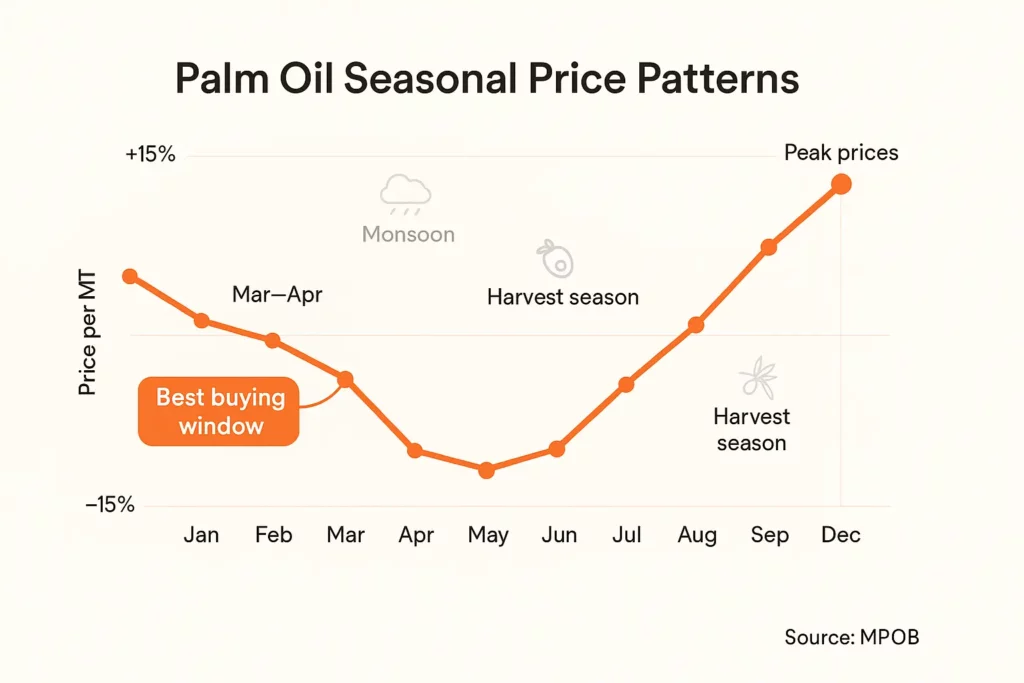

Palm oil prices typically reach annual lows during March-April harvest peak in Malaysia and Indonesia (MPOB). Stocks build during these months, pressuring prices 10-15% below yearly averages.

Seasonal production patterns create predictable price cycles. Oil palm trees yield varies throughout the year based on weather. First quarter typically sees maximum fruit production across plantations.

Traders position for seasonal trends using futures contracts. Buying during harvest season and selling before monsoons offers profit potential. These patterns persist despite overall market volatility.

Seasonal price patterns: • March-April: Harvest peak, lowest prices • June-August: Moderate prices, steady demand • September-November: Monsoon impacts, rising prices • December-February: Peak prices, tight supply

Smart buyers schedule annual purchases during favorable seasons. Food manufacturers often contract March delivery for cost savings. Understanding seasonality improves procurement strategies significantly.

Summary: March and April offer cheapest palm oil prices during peak harvest season. Prices average 10-15% below annual means during these months.

Grease Connections

Why is palm oil so sought after?

Palm oil’s versatility makes it essential for foods, cosmetics, and biofuels globally. It appears in 50% of packaged supermarket products from cookies to shampoo (RSPO).

Unique properties make palm oil irreplaceable in many applications. Semi-solid at room temperature, it creates ideal textures for processed foods. The oil resists oxidation, extending product shelf life naturally.

Virgin palm oil provides rich vitamin E and antioxidants for health benefits. Palm kernel oil’s lauric acid content makes it valuable for soaps. Each component serves specific industrial purposes.

Why industries demand palm oil: • Margarine: Perfect spreading consistency • Cosmetics: Smooth texture, stability • Biodiesel: High energy content • Baked goods: Crispy textures • Toiletries: Foaming properties

Growing industrial sectors worldwide increase palm oil demand continuously. Emerging markets adopt Western consumption patterns requiring more processed foods. This trend supports long-term demand growth projections.

Summary: Palm oil’s unique chemical properties and versatility drive global demand. Its presence in thousands of products makes it commercially irreplaceable despite environmental concerns.

Grease Connections

Complete Palm Oil Market Summary

Global palm oil trades at US $907.58 per metric ton in May 2025 commodity markets. The price declined 8.73% monthly but gained 5.64% yearly (IMF). Malaysia and Indonesia control 90% of production. Their oil palm trees thrive across tropical plantations.

India and China dominate purchasing with 23 million tons imported annually. These Asia regions drive demand as populations expand. Retail prices range US $1.20-1.80 per liter. This makes palm oil the cheapest cooking oil globally.

Crude palm oil futures on Bursa Malaysia trade at 3,919 MYR/TNE. These futures contracts enable risk management for producers. They also provide investment opportunities for traders. Technical analysis suggests support at 3,800 MYR with resistance near 4,100 MYR.

Environmental concerns plague the industry. Deforestation claims 300,000 hectares annually. Sustainable certification attempts balancing economic benefits with ecological protection. March-April harvest seasons offer buying opportunities with prices 10-15% below averages.

Palm oil’s versatility ensures continued demand across multiple sectors. Food, cosmetics, and biodiesel industries rely on steady supplies. Superior yields of 4 tons per hectare maintain permanent cost advantages.

Ready to optimize your palm oil procurement strategy? Contact our commodity specialists today.