Table of Contents

Why Waste Grease Became a Strategic Commodity

Used cooking oil (UCO) was a niche waste stream a decade ago; today it is a $7.43 billion global market projected to hit nearly $13 billion by 2032, thanks to generous carbon reduction credits and aviation fuel mandates. Because UCO cuts lifecycle emissions by 60 80 percent versus fossil diesel, regulators on both sides of the Atlantic treat it as “near gold” feedstock for renewable diesel and sustainable aviation fuel. Every policy tweak now ricochets through fryers, rendering tanks and shipping lanes creating a tug of war that determines where every gallon of grease ultimately flows.

America’s Turn Inward: Import Curbs & New Blending Rules

Washington’s latest Renewable Fuel Standard draft slashes the number of tradable RIN credits available to fuels made from imported feedstocks while boosting domestic biomass based diesel quotas through 2027. The shift is no coincidence: the United States consumed nearly 30 percent of all UCO and other waste oils traded globally in 2023 24, importing a record 5.4 billion lbs more than half from China. Tariffs now as high as 30 percent on Chinese grease, plus proposals to tie future tax credits to North American feedstocks, force refiners to look inward and pressure collectors like Grease Connections to lock up domestic supply before rivals do.

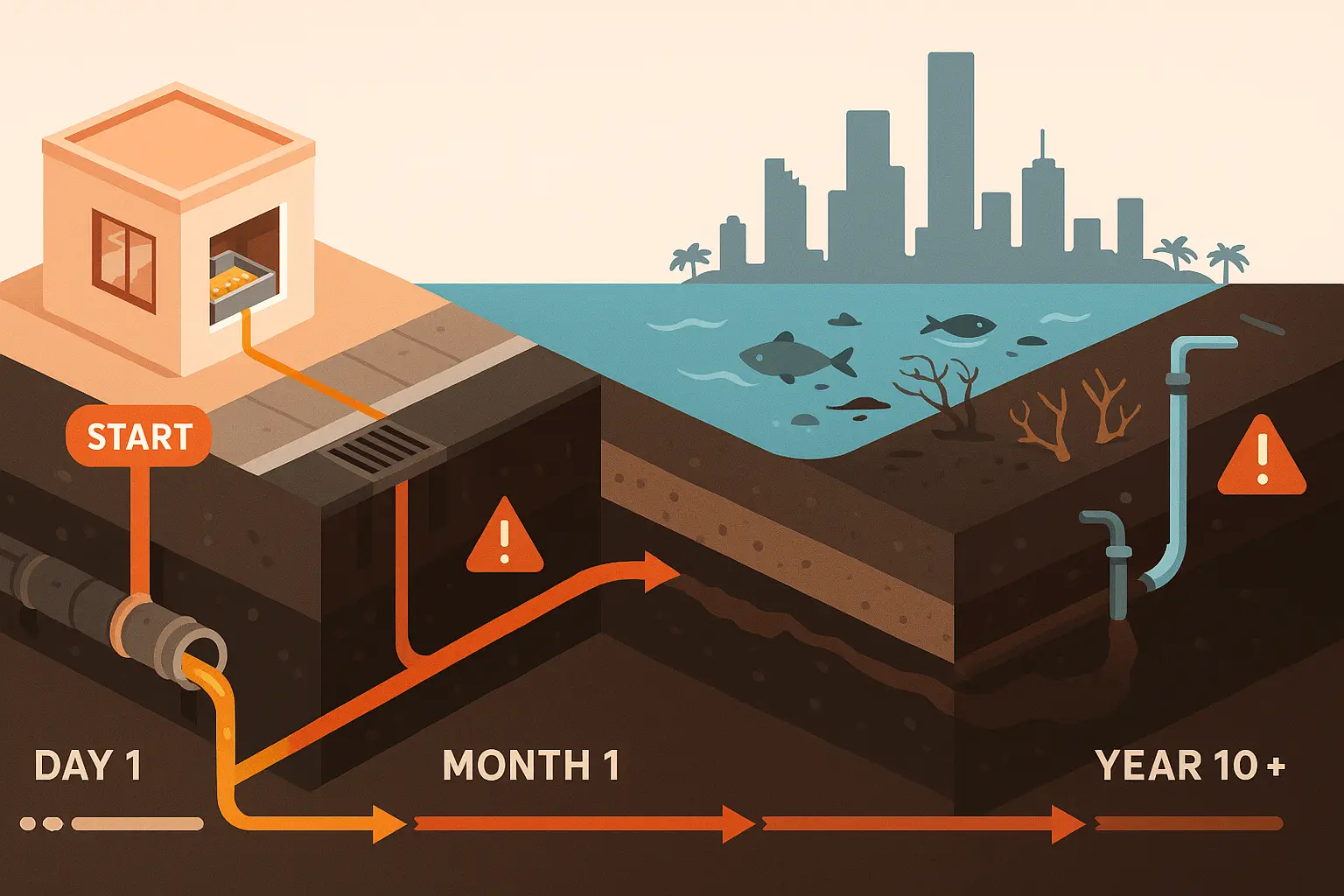

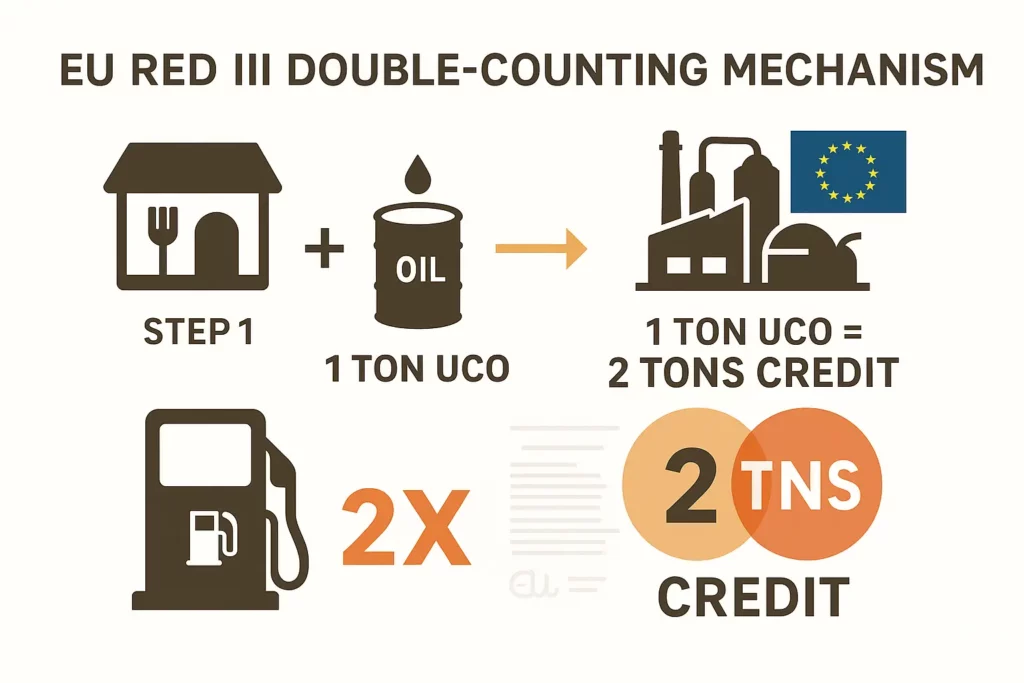

Europe’s 80 Percent Import Habit and Its Fraud Hangover

Across the Atlantic, EU Renewable Energy Directive (RED III) rules double count waste oils toward green fuel targets, making UCO twice as valuable on paper. That incentive has left Europe 80 percent import dependent, with 60 percent of supplies sailing in from China. Watchdogs warn the premium invites fraud virgin palm or soybean oil masquerading as “used” to grab subsidies prompting fresh calls from farm groups and the European Court of Auditors to tighten certification and, in some cases, cap double counting altogether. For market players, every new audit can freeze cargoes and spike spot prices overnight.

Policy Toolbox Shaping Grease Flows

Below is a snapshot of the levers regulators wield and how each tilts trade:

| Policy Lever | Example Region | Immediate Market Effect | Supply Chain Impact |

|---|---|---|---|

| Import Tariff | U.S. 30 % duty on Chinese UCO | Raises landed cost; diverts cargoes to EU | Forces U.S. blenders to source domestic grease |

| Double Counting Credit | EU RED III Annex IX | Doubles book value of waste oils | Spurs import dependence; raises fraud risk |

| Feedstock Specific Tax Credit | U.S. Clean Fuel Credit draft | Excludes foreign UCO, rewards local soy oil | Re prices feedstock basket, benefits farmers |

| Cap on Waste Oils | Proposed 10 % cap (selected EU states) | Limits UCO in blending target | Encourages shift to advanced e fuels |

Inside the Tank: How Grease Connections Navigates Volatility

“Our collection trucks now function like hedging instruments,” notes Grease Connections COO Carla Ruiz. When tariffs threaten imports, refineries scramble for every domestic gallon, letting the company pre sell volumes on multi year contracts at premiums unheard of five years ago. The firm has also diversified logistics building rail served depots near Gulf Coast biorefineries to shorten hauls when U.S. coasts face import bottlenecks. Meanwhile, its European team uses blockchain based chain of custody tags to reassure buyers spooked by fraud headlines. The result: a supply chain that can swing between U.S. and EU demand peaks in weeks, not months.

Winners, Losers and the Carbon Math

Tariff walls make Midwestern soybean crushers smile, yet carbon accountants warn that replacing imported waste grease with virgin crop oil erodes climate gains. According to EPA modeling, giving soybean oil an equivalent carbon intensity score to UCO could add 6 8 g CO₂e/MJ to finished fuel enough to miss several state low carbon benchmarks. In Europe, double counting keeps headline emissions low on paper but fails if the underlying feedstock is fraudulent. The core dilemma: policymakers want both climate integrity and energy security, but rarely get both from a single lever.

What to Watch Next

- U.S. Court Verdicts: Appeals on emergency tariff rulings could reopen import floodgates or cement a long term pivot to local grease.

- EU Cap Decisions: Germany and France weigh ending double counting in 2026; other member states may follow, reshuffling demand overnight.

- Union Database Rollout: Brussels plans a full public ledger for waste oil movements by 2026, potentially naming and shaming fraudulent traders.

- Asian Retention Moves: Indonesia and China consider domestic SAF mandates that could siphon UCO away from export markets.

- For suppliers, agility beats scale: those able to verify origin data, pivot routes and lock in forward contracts will out compete rivals as the policy tug of war intensifies.