Florida’s fryer drippings are liquid gold; airlines, freight fleets, and chemical blenders now compete for every gallon of this low‑carbon feedstock; spot prices swing wildly, making yellow grease one of the Sunshine State’s most volatile—and lucrative—commodities. The demand for yellow grease is the force behind increasing prices, as industries seek sustainable alternatives to traditional fuels.

Let’s first talk about Yellow Grease

Economists study it because the price chart looks like a seismograph—yellow grease spikes and dives with every market ripple. In Florida’s crowded kitchen corridors—from Miami Beach cafés to Orlando’s theme‑park hotels—this once wasted cooking oil is now treated as liquid revenue. After each shift, crews pump the still‑warm fryer oil into sealed indoor tanks and run it through a mesh screen that catches crumbs and breading flakes. Collectors pick up that filtered oil and sell it to Gulf Coast refiners, who turn it into biodiesel, renewable diesel, and other low‑carbon biofuels. Because biodiesel and renewable diesel can be poured straight into a truck’s existing diesel fuel tank, every clean gallon of fryer oil lowers carbon emissions without any engine upgrades.

The Cooking Oil Market and Fuel Demand

Behind the fryer stories is a booming cooking oil market driven by new fuel vectors. Refiners eye yellow grease not only for road diesel but also for sustainable aviation fuel, a sector racing to slash carbon emissions on busy routes out of Miami International and Orlando. The surge in demand for yellow grease and UCO in biofuel production is causing significant changes in global vegetable oil markets. As airlines seek low‑CI blends, fryer oil’s value rises right alongside its climate benefit. The surge in demand for byproduct oils including used cooking oil influences crop oil prices, creating ripple effects across agricultural markets.

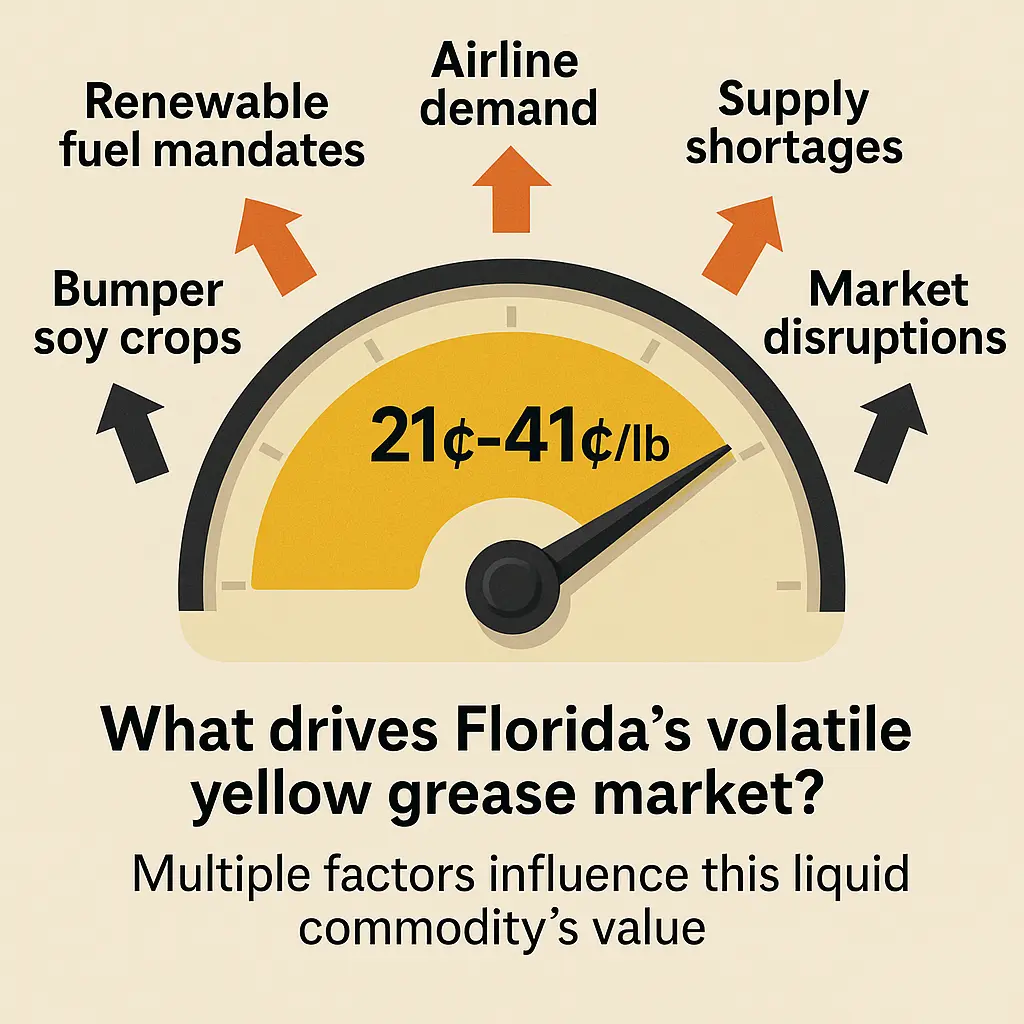

Yellow grease trades like oranges or sugar. Its value obeys three levers; supply, demand, and policy; plus the daily swings in UCO prices posted by brokers. A recent USDA report pegs the statewide spot between 21¢ and 41¢ per pound. The same survey notes that yellow grease represents roughly one fifth of the 24 billion pounds of renewable animal feed produced in the United States, proving its reach into various industries well beyond fuel.

Market Factors Shaping Florida Prices

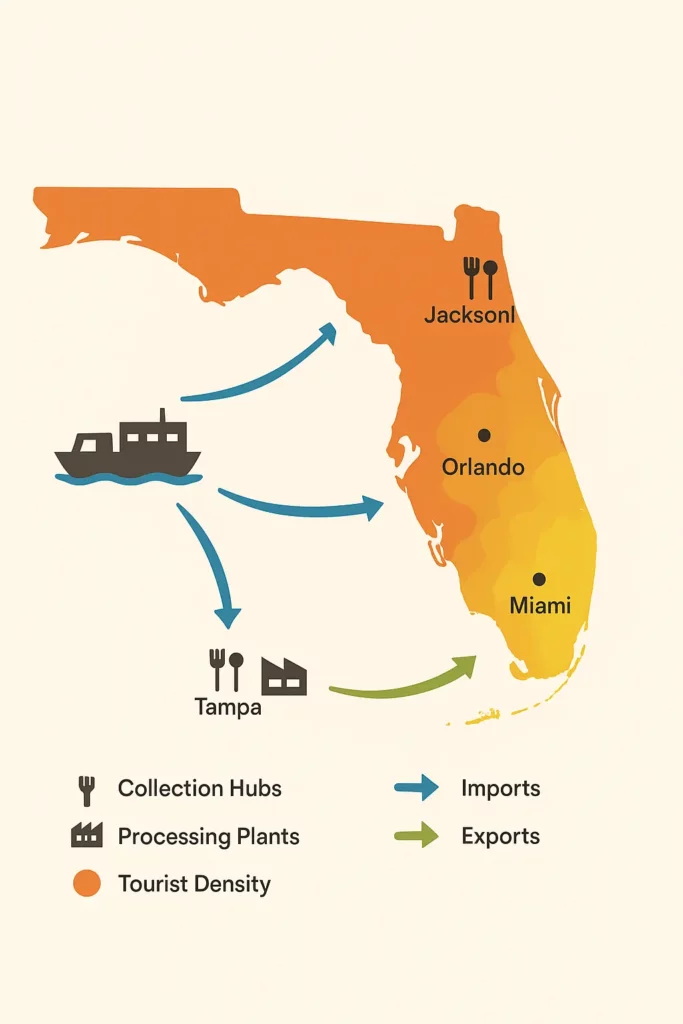

Tourism keeps Florida’s fryers humming, yet the state’s checks still rise and fall with the wider yellow grease market. When Midwest crushers reroute more soybean oil and corn oil into feed mills, East Coast refiners scramble for substitute feedstocks and push higher bids through the Port of Tampa and Port of Miami. A bumper soy or canola oil crop can add fresh vegetable oils to Gulf pipelines, putting downward pressure on fryer oil. Tight links among soy, palm, and fryer oil mean each contract affects the others. The United States even flipped to net importer status on soybean oil exports after a record crush to feed the renewable diesel boom, marking the first time the U.S. has become a net importer of soybean oil due to high domestic demand. The production of renewable diesel has outpaced that of biodiesel, affecting the demand for soybean oil and leading to a decrease in U.S. soybean oil exports.

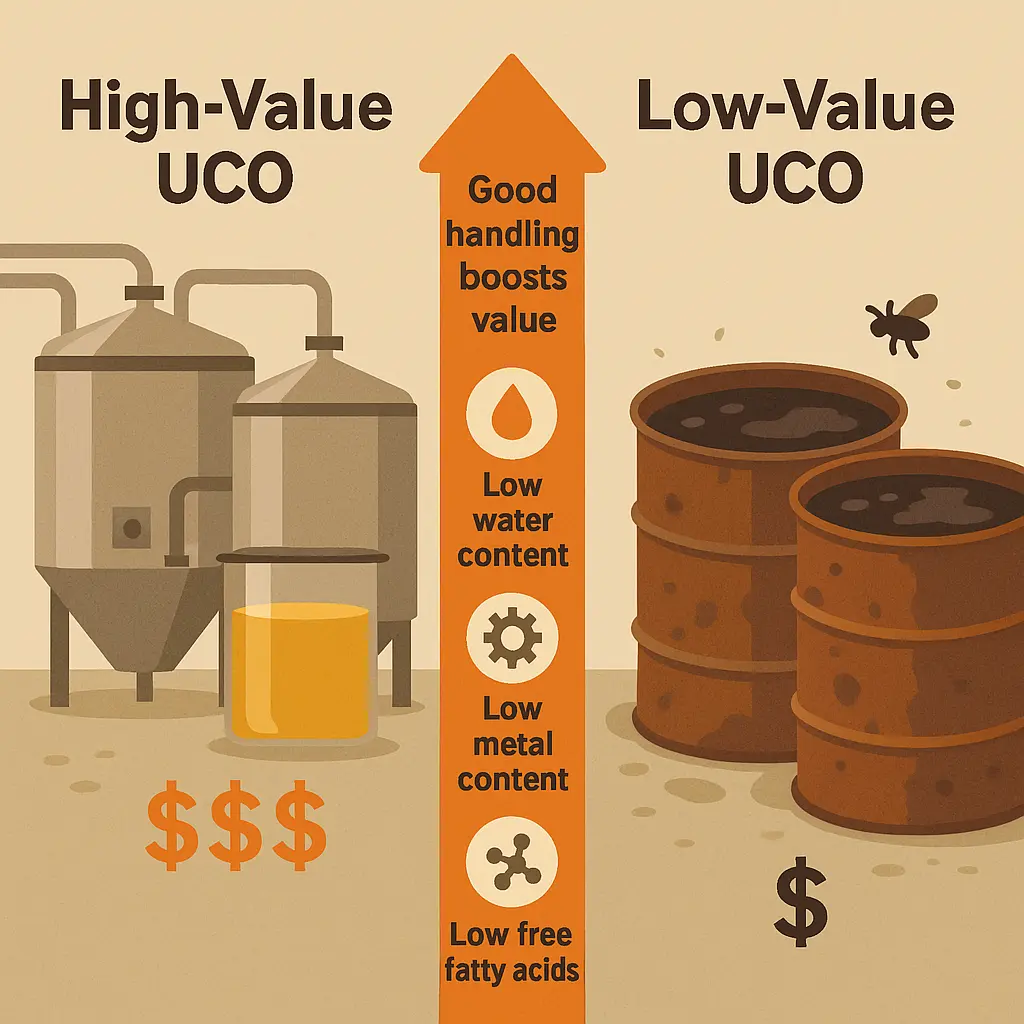

Quality sweetens the deal. Grease with low water, metals, and free fatty acids draws price premiums because it yields more gallons. Collectors urge restaurants to keep lids closed, service grease traps, and schedule prompt pickups. Theft adds another wrinkle: organized crews siphon high‑value oil, upsetting local oil prices and supply metrics. Training staff on tank locks and cameras helps protect revenue.

Trade Routes and Imports

Florida no longer sits at the margin of edible oil trade. Refiners tug in palm oil and Canadian canola through Tampa Bay and Jacksonville to balance the slate. Each tanker tweaks pricing. Hurricane closures, canal logjams, or a new tariff on Indonesian palm can shake fryer‑oil bids within a day. Government data show imports of animal fats and waste oil more than doubling from 2020 to 2023. These collective imports have surged due to renewable diesel production, reflecting major shifts in the market. U.S. imports of animal fats and vegetable oils have significantly increased due to the expansion of renewable diesel production, further altering the dynamics of the edible-oil trade.

Renewable Diesel Production in the Southeast

While California’s LCFS grabs headlines for high California consumption of credits, Florida leans on federal RINs. New renewable diesel plants on the Gulf Coast, coupled with expansion units along the Mississippi, siphon Florida’s supply. Analysts see national renewable diesel production topping eight billion gallons by 2030. To stretch feedstock pools, blenders sometimes mix fryer oil with cheaper brown grease or palm, a practice that raises purity flags and undercuts claimed carbon scores. The California Low Carbon Fuel Standard (LCFS) has driven significant growth in U.S. renewable diesel consumption, particularly from waste-based feedstocks, highlighting the role of policy in shaping the market.

Factors Affecting Prices

Prices ride three familiar rails—supply, demand, and credits—but each rail hides extra factors affecting the final check. A dry summer can drop Mississippi barge drafts and lift rail cost; a wet harvest can spike moisture and dock value; a new government blending target can pull bids up overnight. Traders reading these market dynamics watch soy‑crush margins, credit screens, freight spreads, and weather maps more than they watch yesterday’s bid sheet. U.S. soybean crush is forecast at a record high due to increased demand for soybean oil from renewable diesel production, further influencing market trends.

Managing Used Cooking Oil for Top Dollar

Restaurants practice proactive oil recycling. Indoor tanks, automated pump‑outs, and disciplined cooking oil recycling keep water and metals at bay, lifting yellow grease to white grease grade. Utilizing cooking oil management services can reduce operational costs for restaurants, making it a financially savvy choice. Collectors such as Grease Connections a Florida based independent used cooking oil collection company, post current rates online and issue weighted e‑tickets so a chef in Fort Lauderdale sees real‑time value. Kitchens hitting 200‑gallon routes often share in rebates, selling instead of paying for haul‑off. Clean fuel policies provide incentives for using byproduct oils in renewable fuel production, further encouraging sustainable practices in the industry.

Conclusion and Outlook

Florida sits where tourism, freight, and agricultural trade meet. Those streams keep demand for low‑carbon fuel climbing, even as weather, crops, and freight tweak fryer‑oil checks. Watching soy‑crush reports, hurricane tracks, RIN boards, and import dockets will let producers sign when the spread favors the Sunshine State and shield them when the next decline rolls through.