Table of Contents

Why Fryer Oil Suddenly Matters to Jet Fuel

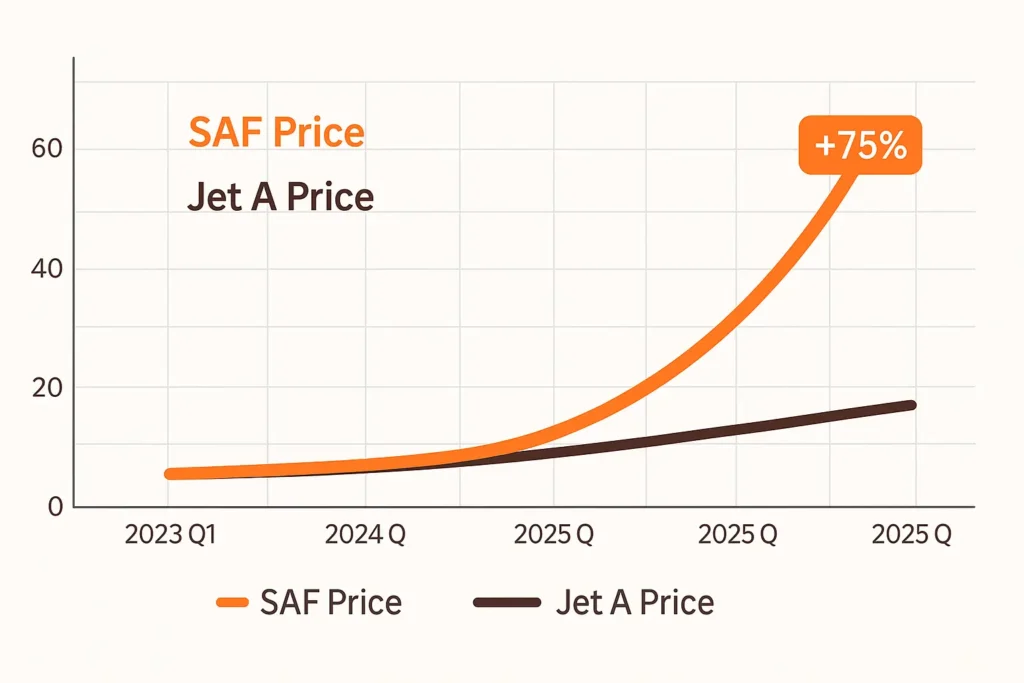

Used cooking oil (UCO) once priced like waste fat now fetches 48 ¢ /lb, up 22 % since January 2024, according to Fastmarkets June 2025 spot index. Airlines need low carbon fuel to hit net zero pledges and to meet the EU’s new ReFuelEU rule that starts at 2 % SAF in 2025 and rises to 20 % by 2035. Grease Connections tip: our drivers now see a live “SAF premium” ticker in the route app before every pickup; chefs get the same number on the e ticket printed at the dumpster, an upgrade we launched in January 2025 after kitchens asked to track oil like corn futures.

The result: a commodity once tossed in the alley is suddenly jet fuel’s newest feedstock.

From Kitchen to Cockpit: Steps We Take Every Day

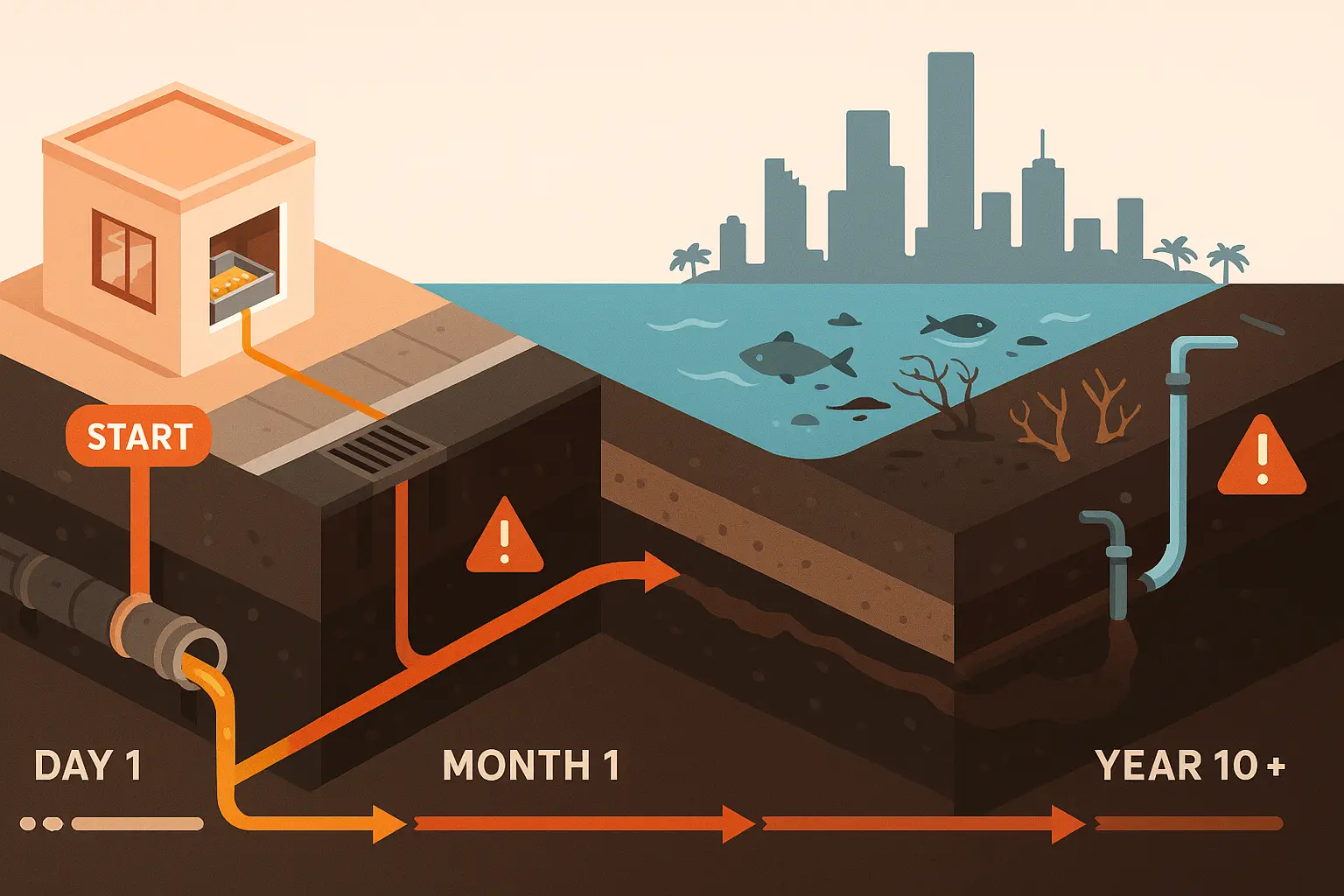

Restaurants empty fryers into sealed bins; we haul those to our depots; screens pull crumbs; heat strips water; filtered oil heads to refineries where hydrotreating turns lipids into HEFA that can be blended 50 50 under ASTM D7566. Each gallon of HEFA cuts life cycle CO₂ by up to 80 %, says Argus Biofuels’ March outlook. Grease Connections field note: in our Orlando depot, heated quick drain pads trimmed average moisture from 0.7 % to 0.48 %. When SAF refiners raised the penalty threshold to 0.5 % this spring, that tweak paid for itself in one quarter. Clean oil equals higher bids and faster truck turnarounds.

Price Snapshot: UCO by End Use (Week of 23 June 2025)

| End Use | Spot Price* | Typical Buyer |

|---|---|---|

| SAF Feedstock | $0.48 /lb | Jet fuel refiners |

| Biodiesel | $0.38 /lb | Midwest plants |

| Animal Feed | $0.27 /lb | Rendering mills |

Grease Connections rebates: eateries on our Miami route earned $0.34 to $0.40 /gal last month thanks to “jet grade” bonuses when loads pass moisture tests on the first scan.

Demand Rocket: Airline Pledges & Mandates

Public airline deals now total 9 billion gallons of neat SAF, triple last year, per ICAO’s offtake dashboard. U.S. jet fuel retails at about $2.85 /gal while SAF averages $6.69 /gal, Reuters reports. Grease Connections auction diary: in April five refiners outbid each other for a single 220,000 gallon lot we listed on Fastmarkets, our most competitive auction in years.

The Supply Squeeze Beyond Your Kitchen

Low carbon scores make UCO the prize feedstock under California’s LCFS, which values carbon intensity (CI) at roughly 15 g CO₂e/MJ for clean UCO loads. Renderers report 7 % less supply year on year as SAF contracts siphon barrels from animal feed. In Atlanta, a craft brewer who switched to our sealed tank system in May saw rival collectors offer cash within a week, proof the squeeze is real on the loading dock.

How Collection Deals Are Changing

Longer contracts, sample based quality clauses, and GPS stamps are now standard because refiners need traceability for tax credits under EPA’s 2025 RFS set rule. Legal front line: attorneys for a national fast casual chain asked us to add an annual “SAF escalator clause”, language we had seen only in jet fuel supply agreements. Expect it to spread by 2026.

Hotspots & Premiums Across the U.S.

California’s LCFS creates a 10 to 15 % price uplift over national averages, while new HEFA units on the Gulf Coast keep bids high near Houston. EIA data show U.S. biodiesel imports doubled between 2022 and 2023, filling Midwestern gaps but not coastal demand. Route intel: our late night Coral Gables truck hauls Florida’s cleanest oil, 97 % purity, earning the state’s top rebate tier every run.

Forward Look: 2030 Price Trajectory

IEA warns announced SAF capacity meets only ≈4 % of global jet fuel demand by 2030. Argus forecasts UCO premiums of $100 to $120 /MT above crude linked feedstocks through 2027. McKinsey expects refinery conversions to triple U.S. renewable diesel/SAF output by 2030, tightening feedstocks further.

Cap ex move: we ordered four new stainless 10k gallon trailers this spring because buyers now insist on food only equipment to avoid cross contamination, specs that did not exist three years ago.

What Kitchens Can Do Today

- Keep every drop: A $22 slotted insert at Hilton Miami Downtown cut crumb load and raised rebates 11 % in one billing cycle.

- Test & tag: Keep water below 0.5 %; loads above that face SAF penalties.

- Review contracts yearly: Add an SAF price escalator so you share in rising premiums.

- Stay compliant: Log volumes; LCFS or RFS credits can boost payouts.

Why Grease Connections Leads the Way

We publish live spot rebates every Friday at 4 p.m., the exact moment we lock our SAF hedges. Our East Coast fleet covers all 50 states and links each gallon to verified jet grade buyers. Book a free UCO revenue assessment today and see how much more your kitchen can earn this quarter.