Table of Contents

2025: The Year Waste Grease Goes Mainstream

Biodiesel made from used cooking oil (UCO) has shifted from dumpster sideline to policy darling. Federal and state regulators now separate “waste derived” fuel from virgin oil biodiesel, rewarding the lower carbon profile and landfill avoidance. The upshot: grease that restaurants once paid to discard now trades like an environmental commodity, complete with its own audit trail and credit premium. Growing demand from trucking, marine, and home heating sectors means recyclers face a seller’s market provided they can verify origin and quality.

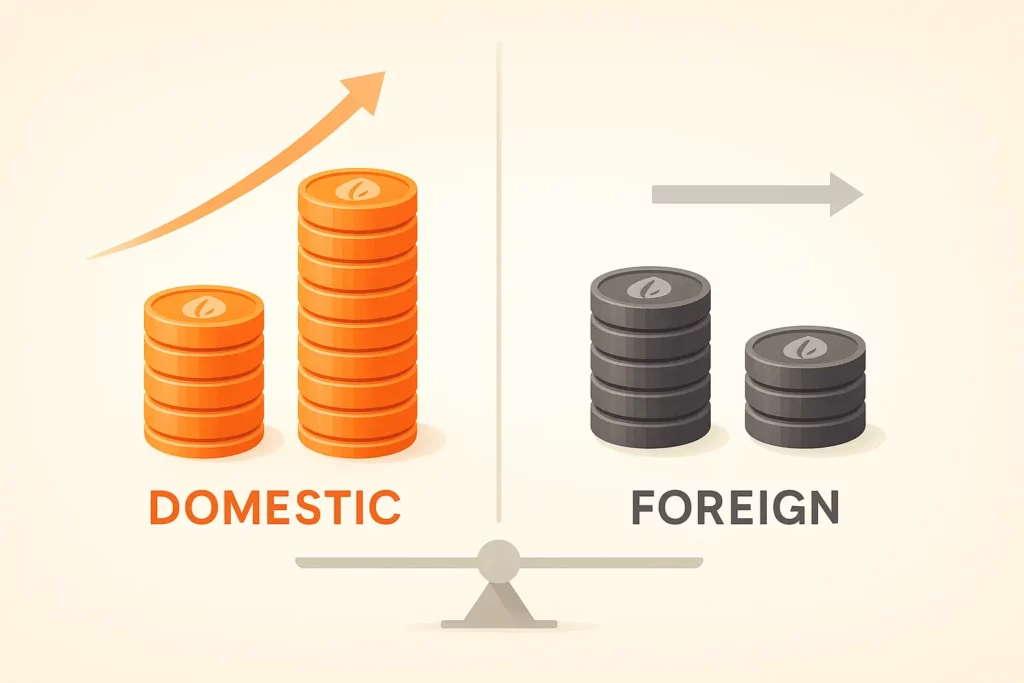

Federal Spotlight: EPA’s New RFS Dial Favors Domestic Waste Oils

On 13 June 2025 the EPA proposed record high renewable fuel volumes through 2027 and, for the first time, cut Renewable Identification Number (RIN) value in half for foreign feedstocks (according to Reuters). The rule effectively doubles the credit for UCO collected on U.S. soil, pushing refiners to secure local grease. Advanced biofuel volumes rise to 24.02 billion gallons in 2026, creating the largest federal pull yet for waste derived diesel. Because biomass based diesel RINs fall from 1.6 to roughly 1.28 per gallon, compliance now hinges on low carbon intensity rather than sheer volume an edge tailor made for recycled fats.

State Frontlines: New York’s B10 Bioheat & California’s Crop Oil Cap

New York will require 10 % biodiesel in every gallon of heating oil sold statewide by 1 July 2025 (according to the NY Senate). That jump from B5 to B10 could add 100 million gallons of demand each winter, much of it met with in state UCO. Out West, California’s 2024 25 Low Carbon Fuel Standard amendments move forward with a 20 % cap on biofuels made from crop oils, steering producers toward waste feedstocks (according to BioCycle). Together the coasts are tightening the vise on virgin oil diesel while handing recyclers an assured offtake.

Credit Math: Why Half Value Foreign RINs Matter

A RIN once fungible across borders now carries a domestic bonus: importers earn only 50 % credit for the same gallon (U.S. Department of the Treasury). The policy slashes arbitrage on cheap Southeast Asian UCO and makes local grease contracts king. Meanwhile, the California LCFS awards more credits per ton of CO₂ saved, so low carbon UCO diesel generates up to 1.3 × the value of higher CI crop oil diesel (CARB dashboard). The spread already shows up in spot markets where waste grease methyl ester trades at a premium of 12 18 ¢/gal over soybean biodiesel.

From Dumpsters to Dollars: Opportunities for UCO Collectors

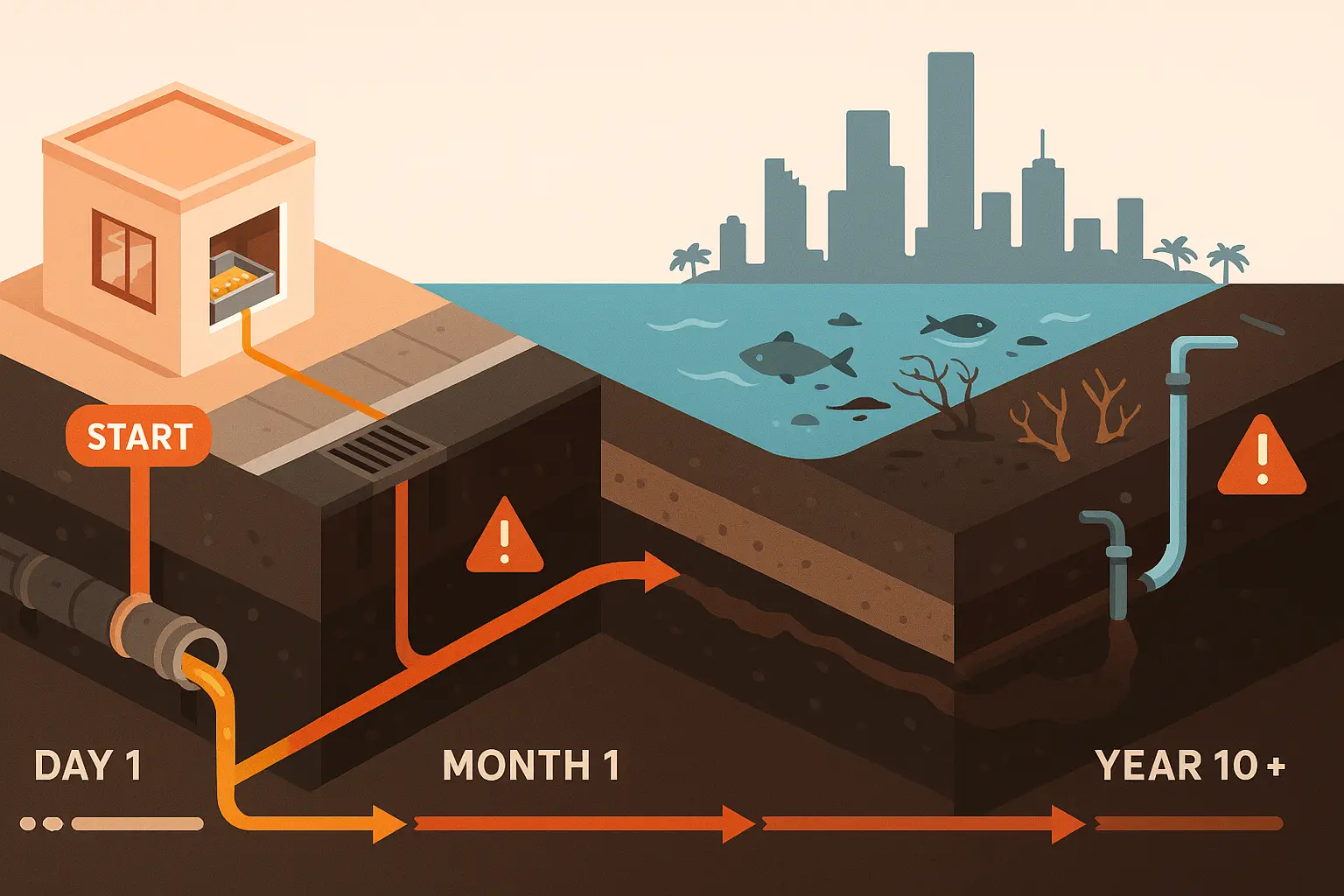

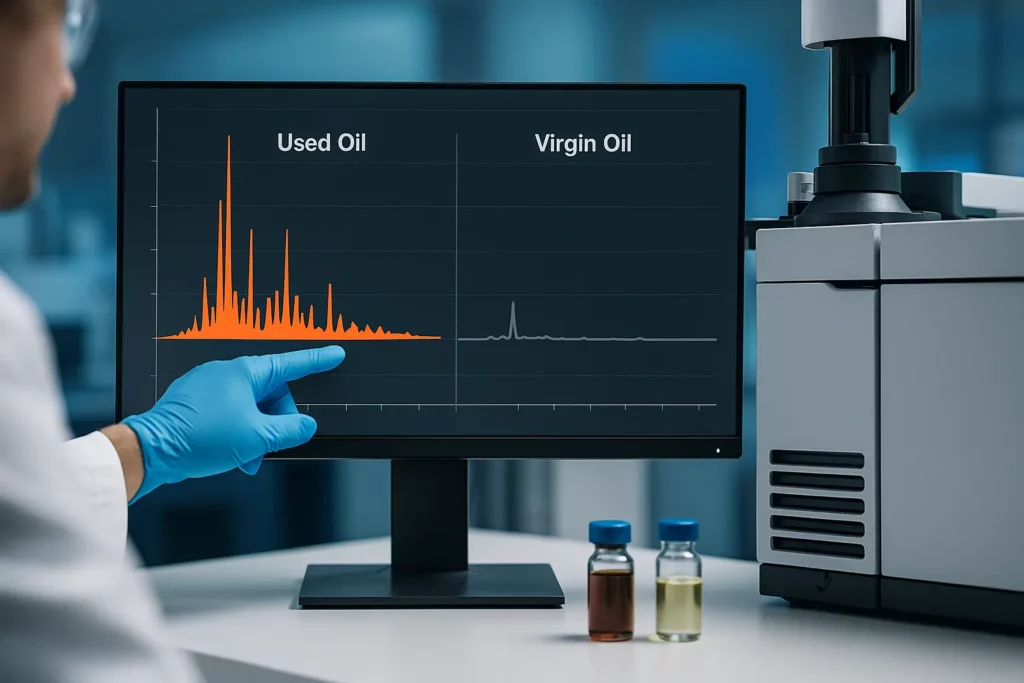

Restaurants and food processors can now negotiate revenue sharing instead of haul away fees. CME’s 2025 outlook notes escalating price volatility as refiners chase finite waste feedstocks (according to CME Group). Quality assurance is paramount: new “FAME fingerprinting” tests tie each batch to its feedstock origin, exposing fraud and protecting credit value (according to GCMD). Collectors that invest in sealed tank fleets, GPS tracked pickups, and chain of custody software can command long term offtake contracts from biodiesel and sustainable aviation fuel plants.

Compliance Blueprint for Food Service Operators

- Sign a recycling agreement that specifies grease volume, moisture limits, and test protocols.

- Install lockable grease bins to prevent theft that could void RIN traceability.

- Keep digital transfer records; upcoming attestation letter rules require every link from fryer to refinery to document feedstock custody (according to Christianson CPA).

- Request monthly lab reports summarizing free fatty acid and water content; premiums apply for cleaner feedstock.

- Following these steps turns a waste management cost center into a modest income stream while ensuring compliance with biofuel auditors.

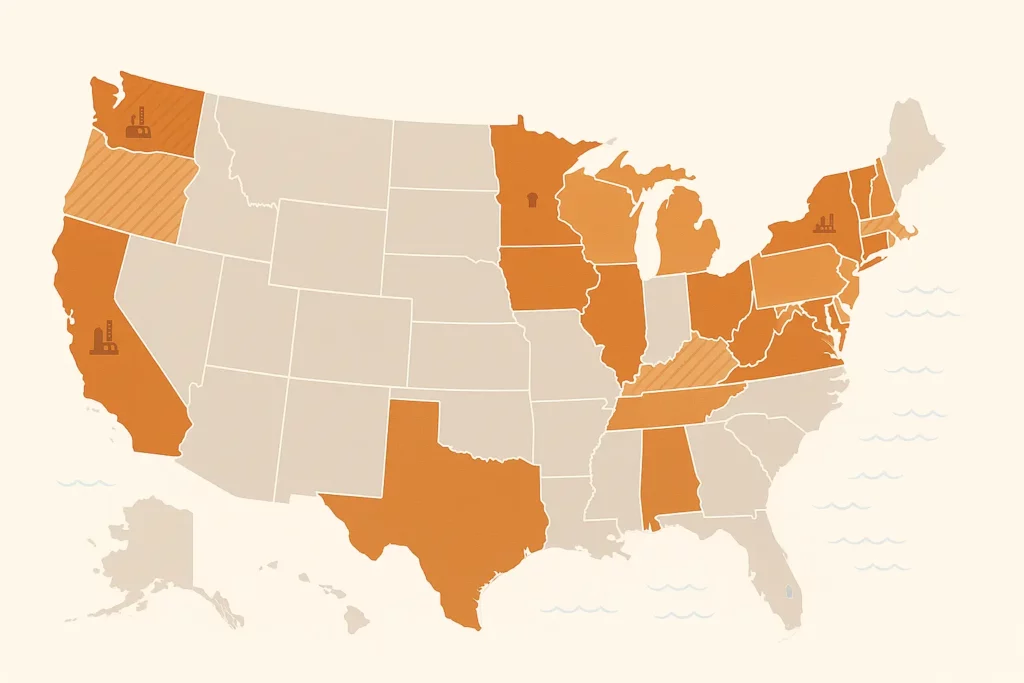

Key 2025 Policy Milestones for Waste Derived Biodiesel

| Policy | Jurisdiction | In force date | What it means for UCO |

|---|---|---|---|

| RFS “domestic RIN” rule | U.S. EPA | Final rule expected Dec 2025 | 2× credit for U.S. waste oils |

| Bioheat B10 mandate | New York State | 1 Jul 2025 | +100 M gal/yr UCO demand |

| LCFS crop oil cap | California | Retroactive to 1 Jan 2025 | Limits virgin oil to 20 % of pool |

| Attestation letter chain | CA, OR, WA (pending) | June 2025 | Signed proof for every UCO load |

| Fraud fingerprinting norm | IMO/GCMD pilot | Rolling 2025 | Lab ID of waste vs virgin feedstocks |

Closing Thoughts: Turning Fryers into Fuel Futures

Policy is finally catching up with physics: the lowest carbon gallon is the one born from waste. By elevating recycled grease in federal and state mandates, 2025 sets the stage for a cleaner, more circular fuel system. For restaurants, haulers, and refiners willing to invest in traceability, yesterday’s fryer oil is tomorrow’s margin driver and a tangible step toward net zero logistics.