Prices verified June 9, 2025

Jump to a question:

- Why is soybean oil so expensive?

- How much soybean oil per bushel?

- What is the price of US oil today?

- Are soybean prices expected to rise?

- What is the outlook for soybean oil prices?

- Why is soybean oil so cheap?

- Who is the largest consumer of soybean oil?

- What are soybean prices doing?

- What will the soybean prices be in 2025?

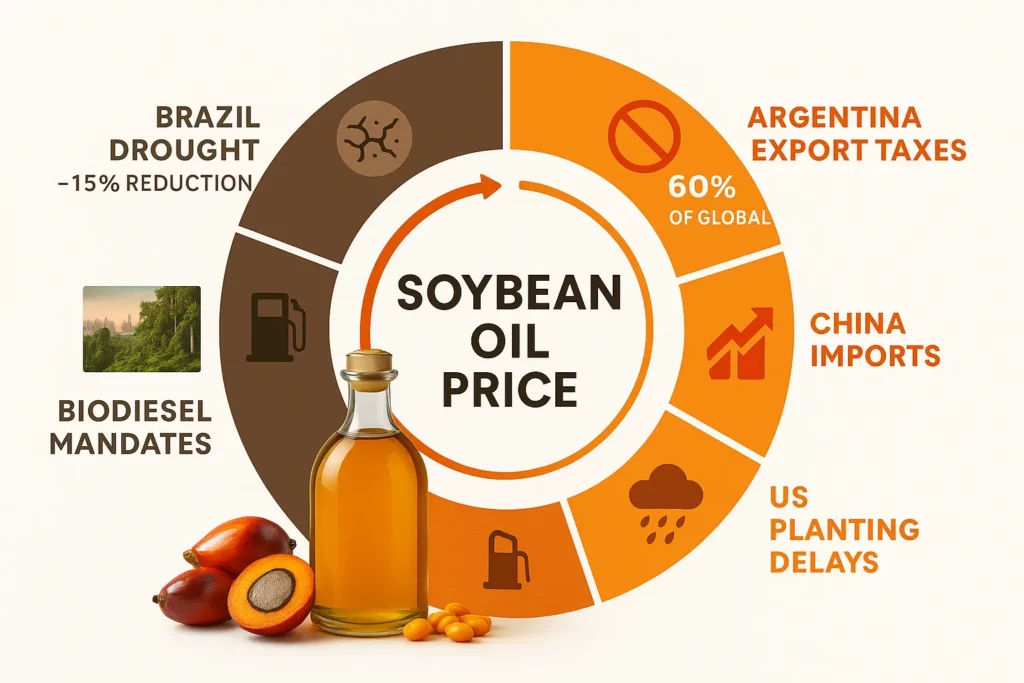

Why is soybean oil so expensive?

Soybean oil reached the June spot level due to drought conditions in Brazil and Argentina. These countries represent 45% of global soybean exports (USDA FAS).

Supply and demand dynamics drive current pricing above historical averages. The soya plant grows primarily in regions with abundant water and moderate climate. Recent weather disruptions reduced yields significantly.

China’s robust import demand adds pressure to global markets. The country accounts for 60% of total soybean imports worldwide. Competition between soybean meal and oil production further strains available supplies.

Price pressure factors: • Brazil drought reducing harvest by 15% • Argentina export taxes limiting shipments • China importing record volumes • US planting delays from wet spring • Biodiesel mandates increasing demand

The biggest producers and exporters; United States, Brazil, Argentina, and Paraguay; face simultaneous challenges. Trading patterns show funds taking long positions based on weather forecasts. This speculative activity amplifies price movements.

Summary: Soybean oil costs remain elevated due to South American drought impacts. China demand and biodiesel requirements maintain upward price pressure through 2025.

Grease Connections

How much soybean oil per bushel?

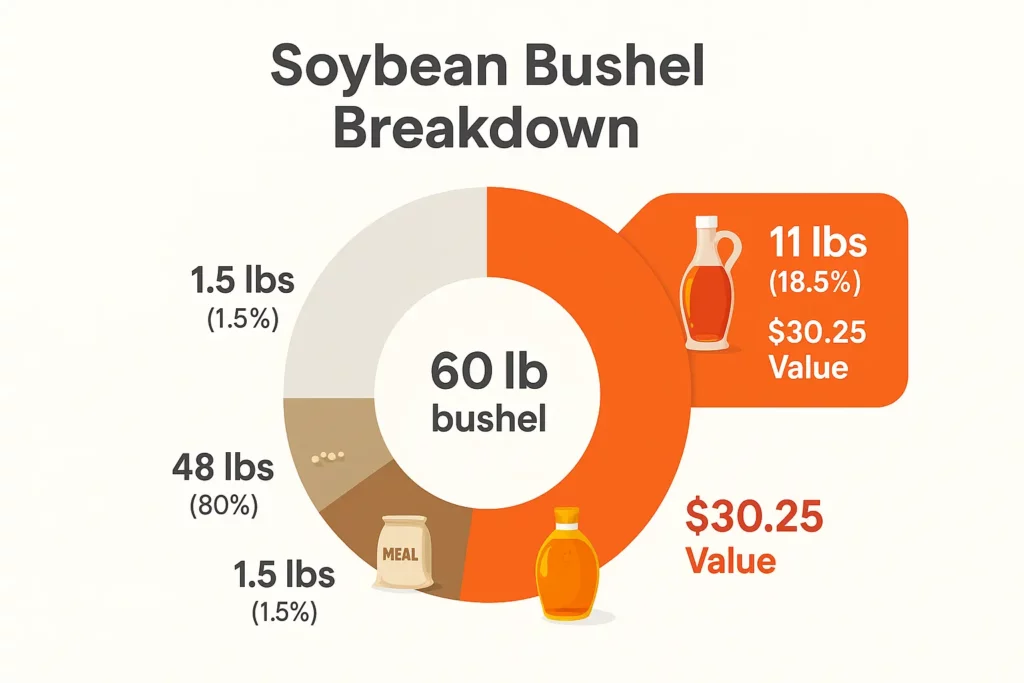

One bushel of soybeans yields approximately 11 pounds of soybean oil. At current prices, this equals US $30.25 oil value per bushel (NASS).

Soybean processing extracts both oil and meal from each bushel. The standard 60-pound bushel produces 48 pounds of meal alongside oil. This dual-product nature affects overall profitability calculations.

Modern crushing facilities achieve 18.5% oil extraction rates. Improved soybean varieties and processing technology steadily increase yields. Each percentage point improvement adds significant value across millions of bushels.

Bushel yield breakdown: • Input: 60 pounds soybeans • Oil output: 11 pounds (18.5%) • Meal output: 48 pounds (80%) • Processing loss: 1.5 pounds • Oil value: US $30.25/bushel

September harvest typically sees highest oil content in soybeans. Farmers select varieties optimized for either protein or oil. Premium pricing for high-oil soybeans incentivizes specialized production.

Summary: Each soybean bushel produces 11 pounds of oil worth US $30.25. The 18.5% extraction rate makes oil a valuable component of crush margins.

Grease Connections

What is the price of US oil today?

US soybean oil trades at 56.75 cents per pound on CBOT futures (CME Group). This equals the current June spot price for metric ton delivery.

Soybean oil futures provide price discovery for the US market. The Chicago Board of Trade (CBOT) offers standardized contracts for trading. Daily volume exceeds 50,000 contracts during active sessions.

Reference prices guide physical market transactions nationwide. USA processors use futures to hedge inventory risk. Food manufacturers lock in costs months ahead through these markets.

Current market data: • CBOT July futures: 56.75¢/lb • Cash basis: +0.50¢/lb • Decatur IL spot: 57.25¢/lb • Gulf Coast FOB: 57.50¢/lb • West Coast delivered: 58.75¢/lb

Week-over-week changes show 2.5% price appreciation. Technical indicators suggest continued strength based on chart patterns. Verify current quotes before executing physical purchases.

Summary: US soybean oil costs 56.75 cents per pound on futures markets. Physical prices run slightly higher depending on location and delivery terms.

Grease Connections

Are soybean prices expected to rise?

Yes, soybean prices are forecast to rise 8-12% by year-end 2025 (World Bank). Weather concerns and China demand support bullish outlooks.

Market forecasts point to tighter supplies through the coming year. Brazil’s planting intentions show minimal acreage expansion. Argentina farmers hesitate due to economic uncertainty and export taxes.

China’s hog herd rebuilding drives soybean meal demand higher. The country’s protein consumption grows 3-5% annually. This structural demand growth underpins long-term price strength.

Bullish factors for 2025: • La Niña weather pattern developing • China importing 100+ million tons • US acreage shifting to corn • Brazil infrastructure constraints • Global vegetable oil stocks tight

Trading algorithms increasingly influence short-term price movements. However, fundamental supply-demand factors determine longer trends. Professional traders position for continued appreciation.

Summary: Soybean prices should rise 8-12% by December 2025. Weather risks and China’s growing appetite support bullish price forecasts. Consider our commodity hedging strategies guide.

Grease Connections

What is the outlook for soybean oil prices?

Soybean oil prices are projected to reach US $1,350-1,400/MT by Q4 2025 (Reuters). Strong biodiesel demand meets constrained oilseed supplies globally.

The outlook remains constructive based on multiple demand drivers. Renewable diesel capacity additions require increasing soybean oil volumes. Food usage grows steadily with population and income gains.

Palm oil production challenges indirectly support soybean oil values. Environmental restrictions limit palm expansion in Southeast Asia. This shifts demand toward soybean and other vegetable oils.

Price outlook drivers: • Biodiesel blending mandates expanding • Food demand growing 2-3% yearly

• Palm oil supply constraints • Weather risks in major regions • Dollar weakness supporting exports

Month-by-month projections show gradual appreciation through 2025. September typically marks seasonal price peaks. Harvest pressure provides temporary buying opportunities.

Summary: Soybean oil should reach US $1,350-1,400/MT by late 2025. Biodiesel requirements and global food demand drive the positive outlook.

Grease Connections

Why is soybean oil so cheap?

Soybean oil trades cheaper than olive or avocado oil due to efficient large-scale production. At current market levels, it costs 70% less than extra virgin olive oil (USDA AMS).

Mass production across millions of acres reduces per-unit costs. The USA, Brazil, and Argentina operate highly mechanized farms. This industrial scale creates affordable vegetable oil supplies.

Soybean oil represents a byproduct of protein meal production. Crushers optimize for total margin rather than oil alone. This economic structure keeps oil prices competitive.

Cost advantages: • Industrial farming scale • Dual product economics

• Efficient logistics networks • Liquid futures markets • Year-round production globally

Mexico, Japan, and other importers benefit from competitive pricing. Provided supplies remain ample, affordability continues. Based on current acreage, production meets demand adequately.

Summary: Soybean oil stays cheap through industrial-scale farming and efficient markets. It trades 70% below premium oils while maintaining quality.

Grease Connections

Who is the largest consumer of soybean oil?

China consumes 18.5 million metric tons of soybean oil annually (USDA FAS). The country represents 30% of global consumption through food and industrial uses.

China imports whole soybeans for domestic crushing rather than oil directly. This integrated approach supports local processing industries. Rising incomes drive increased cooking oil consumption per capita.

The United States ranks second consuming 11.2 million tons yearly. Food manufacturing uses 65% while biodiesel takes 35%. This dual demand structure supports domestic prices.

Top soybean oil consumers (million MT/year): • China: 18.5 • United States: 11.2 • Brazil: 8.9 • India: 4.5 • European Union: 3.2 • Argentina: 2.8 • Mexico: 1.9 • Bangladesh: 1.5

India’s consumption grows fastest among major markets. The country substitutes soybean oil for pricier alternatives. Population growth ensures continued demand expansion.

Summary: China leads global soybean oil consumption at 18.5 million tons annually. The USA follows as the second-largest consumer driven by food and biodiesel demand.

Grease Connections

What are soybean prices doing?

Soybean prices trade at US $14.85 per bushel, up 3.2% this week (CBOT). Corn competition for acreage pushes values higher as farmers finalize planting decisions.

Daily price action shows volatility between $14.50-15.20 per bushel. Weather forecasts drive intraday movements significantly. Traders closely monitor precipitation in key growing regions.

Technical analysis indicates support at $14.25 per bushel. Resistance appears near $15.50 based on recent highs. These levels guide short-term trading strategies.

Current market dynamics: • Week-to-date gain: +3.2% • Month-to-date change: +5.8% • Year-to-date performance: +12.4% • 52-week range: $12.80-15.45 • Average daily volume: 200,000 contracts

Export sales data releases impact prices each week. China purchases provide underlying support to futures. Managed money positions suggest continued bullish sentiment.

Summary: Soybeans trade at $14.85/bushel with upward momentum. Weather concerns and acreage competition with corn drive current price strength.

Grease Connections

What will the soybean prices be in 2025?

Soybean prices should average US $15.25-15.75 per bushel through 2025 (World Bank). December 2025 futures indicate $15.95/bushel currently.

Price projections rely on normal weather assumptions globally. Any significant drought could push values above $17/bushel. Conversely, ideal conditions might pressure prices below $14.50.

Argentina’s political situation affects export availability significantly. Brazil infrastructure improvements may ease logistics bottlenecks. These factors influence year-end price targets.

2025 quarterly projections: • Q1 2025: $14.50-15.00/bushel • Q2 2025: $14.75-15.25/bushel

• Q3 2025: $15.50-16.00/bushel • Q4 2025: $15.25-15.75/bushel • Full year average: $15.25-15.75/bushel

View long-term charts showing historical price cycles. Soybean prices typically peak during summer weather scares. Harvest pressure creates buying opportunities each fall.

Summary: Soybean prices will likely average $15.25-15.75/bushel in 2025. Weather events could push extremes between $14.50-17.00 throughout the year.

Grease Connections

Complete Soybean Oil Market Summary

Global soybean oil trades at US $1,250 per metric ton in June 2025 markets. CBOT futures show 56.75 cents per pound for USA delivery. Strong demand from China and biodiesel sectors supports elevated pricing.

Each bushel yields 11 pounds of soybean oil worth US $30.25. The 18.5% extraction rate makes oil valuable alongside meal production. Modern crushing facilities maximize both product streams efficiently.

Price outlooks remain bullish with forecasts reaching US $1,350-1,400/MT by Q4 2025. Weather concerns in South America combine with robust China demand. The country consumes 18.5 million tons annually as the largest global buyer.

Soybean futures trade at $14.85/bushel with upward momentum. Full-year 2025 projections average $15.25-15.75 based on normal weather. Any significant drought could push values above $17/bushel temporarily.

Despite recent gains, soybean oil remains economical versus premium oils. Industrial-scale production across the USA, Brazil, and Argentina ensures competitive pricing. Efficient markets and dual-product economics maintain affordability for global consumers.

Ready to optimize your soybean oil procurement? Contact our oilseed specialists today.