Table of Contents

The State of Aviation Carbon

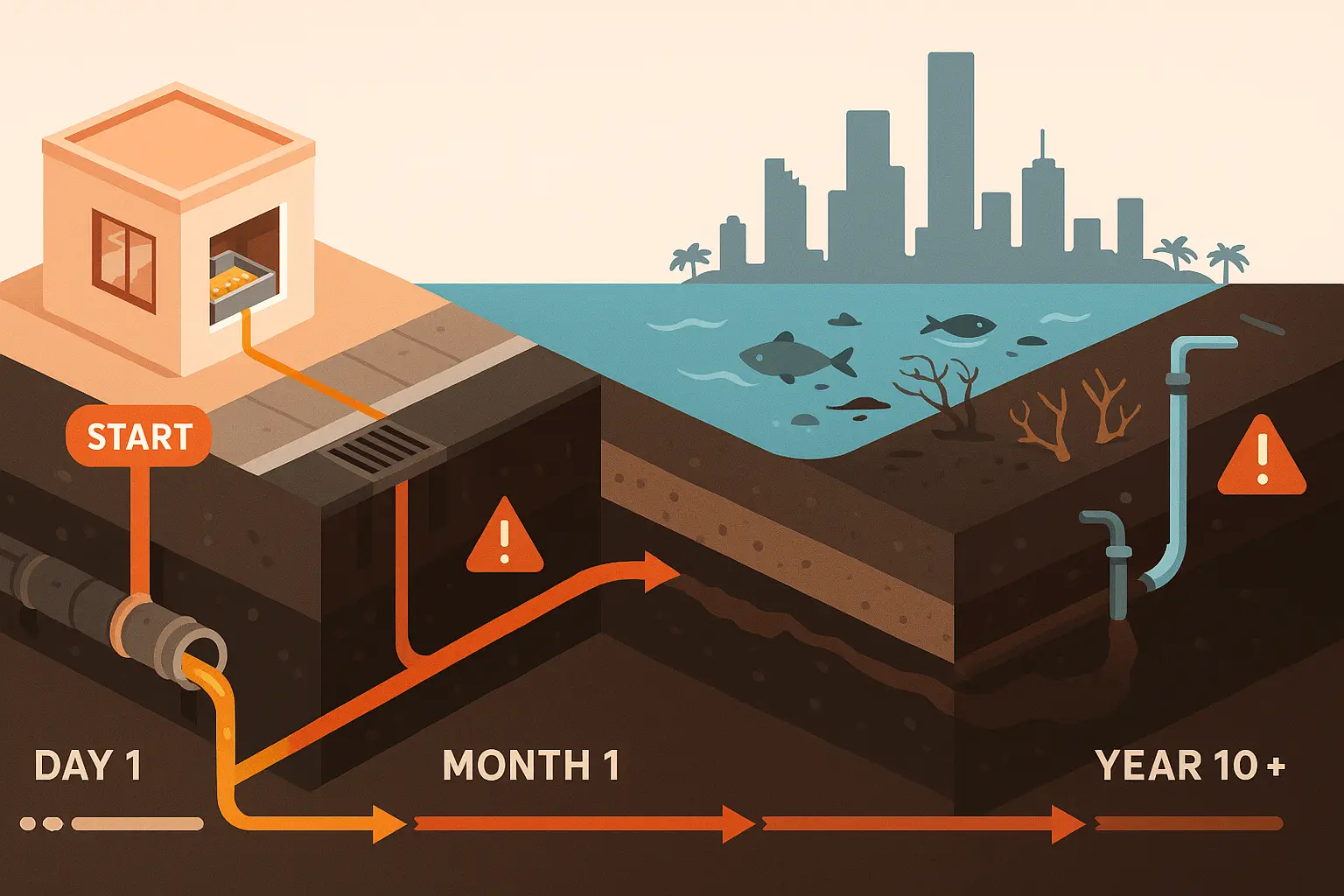

Jet fuel drives about 2.5 % of global CO₂, but contrails and NOx push its climate impact closer to 3.5 %. Demand is still climbing post pandemic, which means efficiency gains alone can’t hit net zero aviation goals.

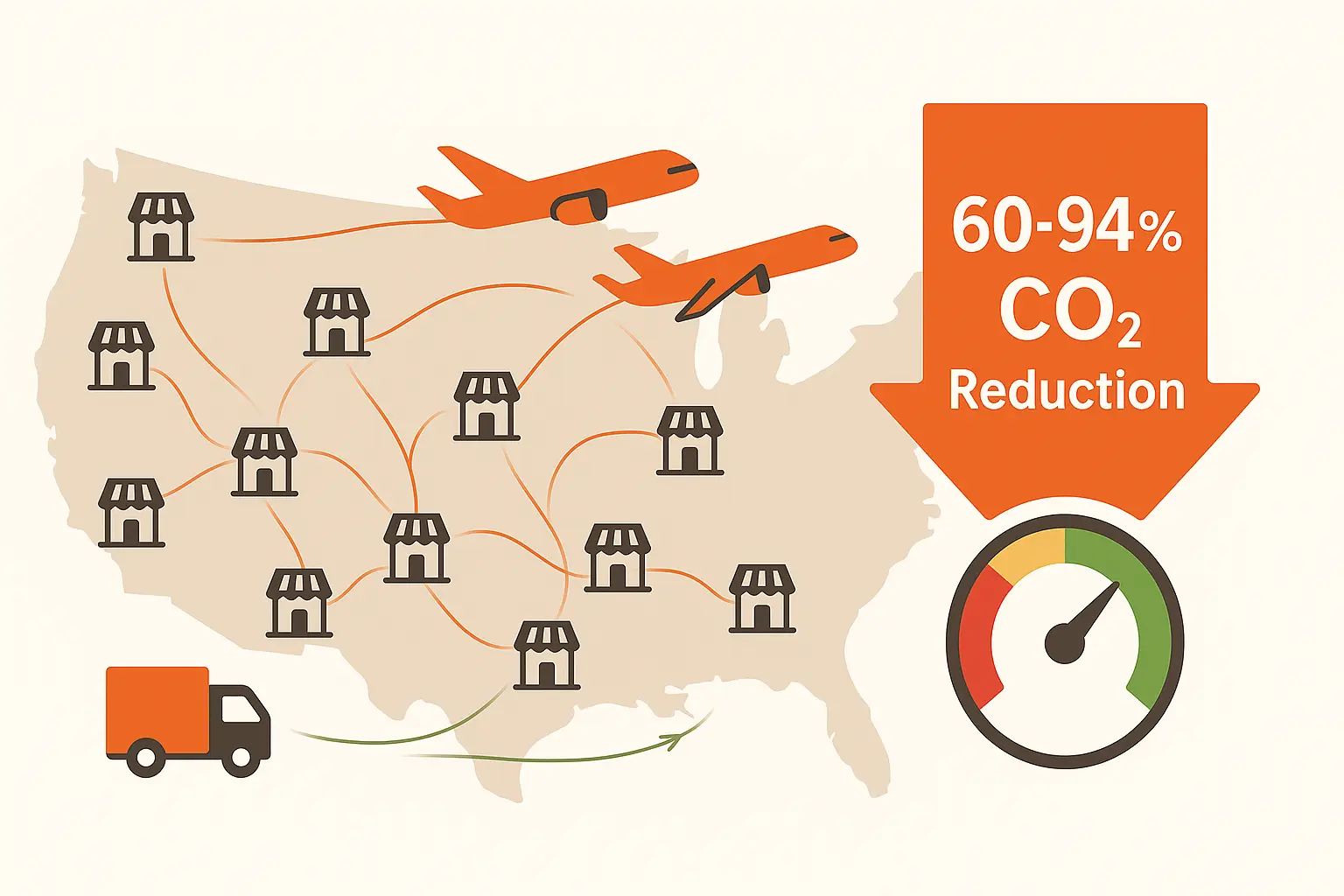

The White House SAF Grand Challenge calls for three billion gallons of low carbon aviation fuel by 2030, each gallon delivering at least a 50 % greenhouse gas (GHG) cut. That mandate unlocks a new revenue stream for every U.S. restaurant that sends its grease to a certified used oil collection company instead of the landfill.

SAF 101: A Drop In, Low Carbon Aviation Fuel

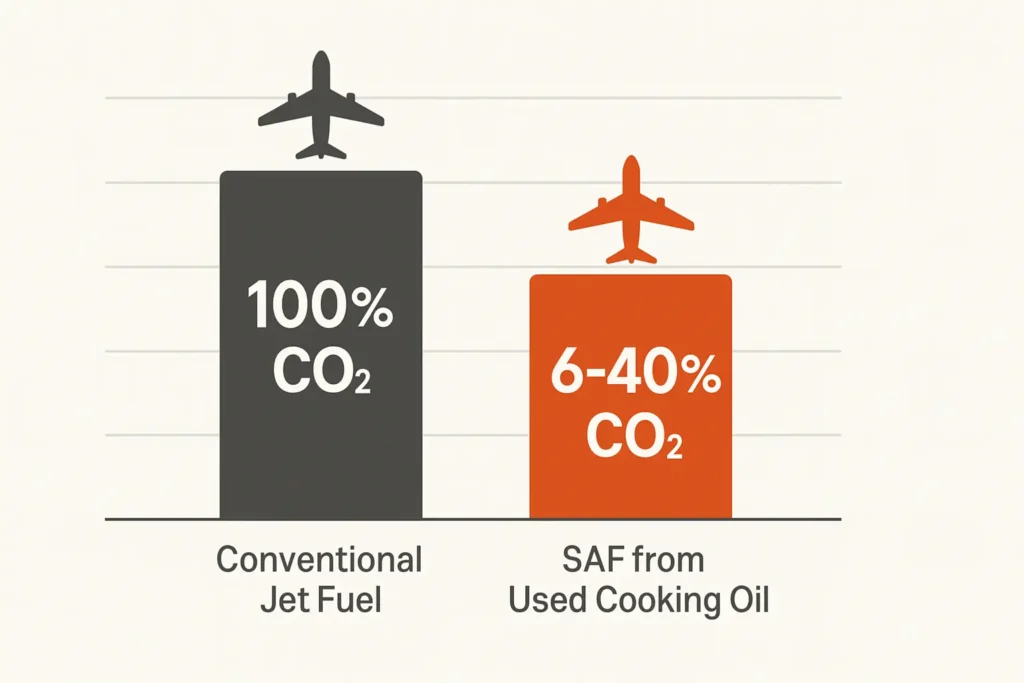

SAF is “drop in,” meaning it blends seamlessly with Jet A and uses existing pipelines and wings. The U.S. Alternative Fuels Data Center lists feedstocks from animal fats to municipal waste and reports up to 94 % GHG reduction at 100 % SAF, depending on pathway. Industry bodies such as IATA quote a more conservative “up to 80 %” to account for real world blends. Either way, SAF beats offsets because the carbon never reaches the air in the first place.

How Lifecycle Emissions Are Counted

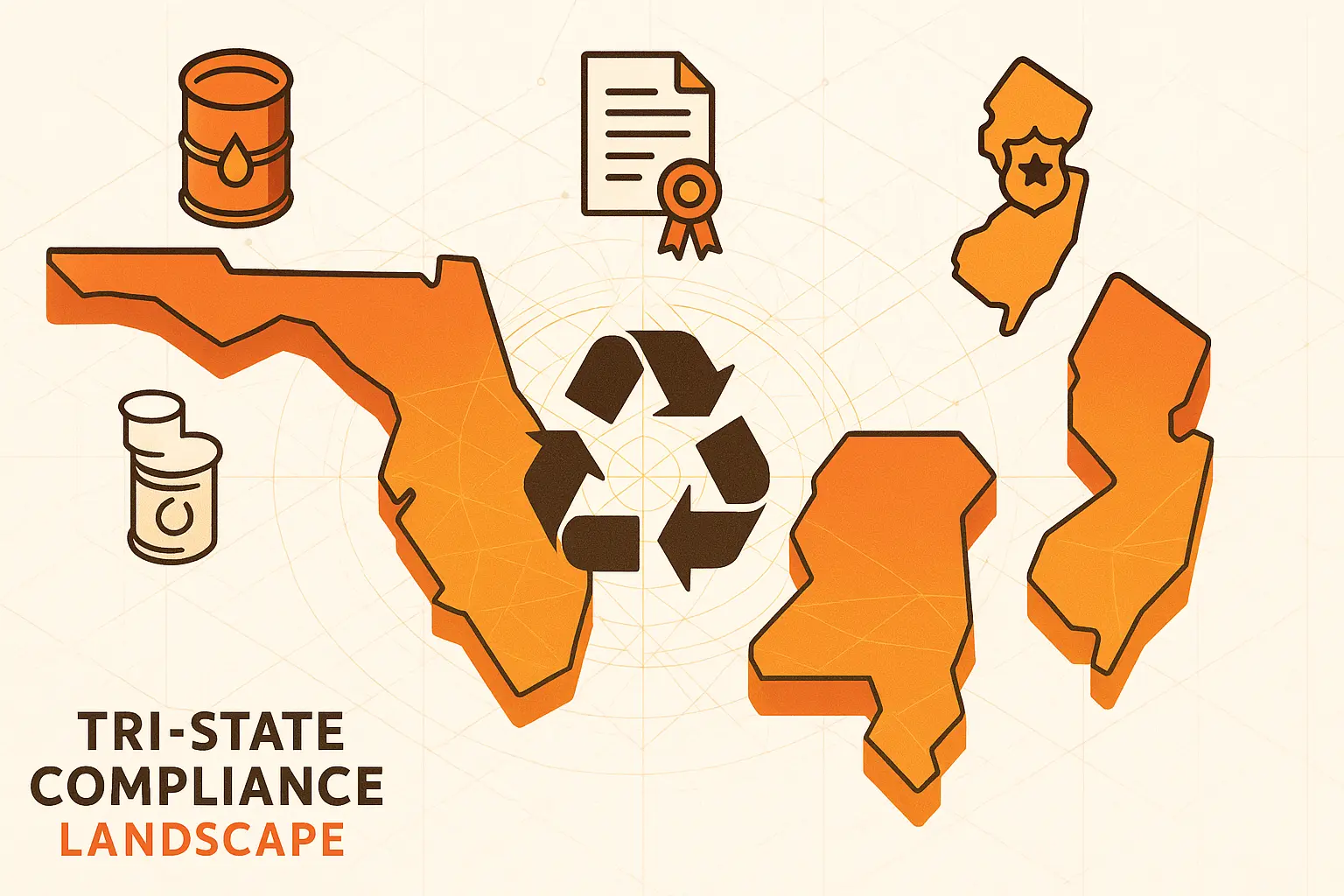

Regulators use well to wake (or cradle to contrail) accounting. The ICAO CORSIA method tracks every gram of CO₂ from feedstock collection, refining, distribution, and combustion. Models such as Argonne’s GREET crunch thousands of variables: energy mix, transport distance, coproduct credits, to produce an official carbon intensity (CI) score in g CO₂e/MJ. Blenders then compare that CI to the fossil jet baseline (89.9 g CO₂e/MJ). The delta is the certified reduction airlines can claim and restaurants can sell.

Pathways and Their Carbon Scorecard

| SAF Pathway | Typical Feedstock | Avg. CI (g CO₂e/MJ) | % Cut vs. Jet A* | Key Source |

|---|---|---|---|---|

| HEFA | Used cooking oil | 22 to 36 | 60 to 76 % | ICAO defaults |

| FT SPK | Municipal solid waste | 10 to 25 | 70 to 89 % | RMI |

| Alcohol to Jet | Corn stover ethanol | 30 to 45 | 50 to 66 % | Argonne 2025 LCA |

| Power to Liquid | Green H₂ + captured CO₂ | <10 | 90 to 100 % | Boeing report |

*Ranges reflect existing commercial plants and GREET default baselines.

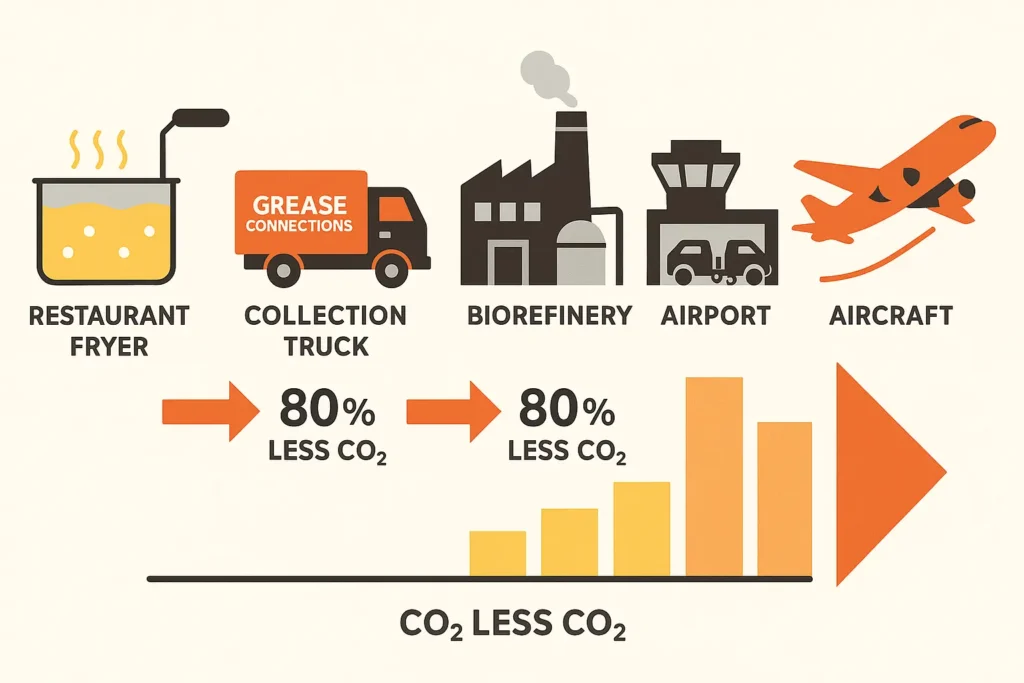

Spotlight on HEFA: Turning Restaurant Oil into Jet Fuel

HEFA (hydroprocessed esters and fatty acids) dominates today’s SAF supply because it repurposes waste oils like UCO. Delta’s March 2025 deal in Japan will power flights with SAF made entirely from domestic restaurant grease. Because UCO counts as a waste product, lifecycle math starts at the collection truck, not the soybean field, giving an immediate 60 to 80 % GHG edge. Restaurants can lock in higher rebates when their oil meets HEFA specs: low free fatty acid content and no water, so simple maintenance of fryers pays climate dividends.

Proof It Flies: ASTM D7566 & CORSIA

No airline buys fuel on trust alone. ASTM D7566 sets chemical limits for synthetic jet components, and Annex A2 covers HEFA blends up to 50 %. Once a batch meets ASTM, CORSIA auditors apply the LCA workbook to verify the claimed reduction before airlines can log credits. The same GREET datasets support U.S. tax credits under §45Z, aligning global rules and giving restaurants a nationwide market for compliant grease.

Certified Numbers: How Big Is the Cut?

According to AFDC, a pure SAF flight made from top performing feedstocks can hit a 94 % CO₂ cut, while the average commercial blend today sits near 70 %. The World Resources Institute pegs HEFA UCO’s sweet spot at 60 to 80 %, depending on haul distance and refinery efficiency. Compare that to the 15 to 25 % slice efficiency upgrades deliver, and it’s clear why SAF leads every decarbonizing aviation forecast.

How SAF Stacks Up Against Other Tools

Hydrogen aircraft may one day offer zero in flight CO₂, but Airbus now targets 2040 for entry into service. Direct air capture credits remove carbon after the fact. SAF, by contrast, cuts emissions today and drops into existing engines. That immediacy is why IATA calls it “the largest single lever” for net zero aviation in 2050 roadmaps.

Grease to Jet Deals You Can Touch

United Airlines burned more than three million gallons of HEFA SAF in 2024 and targets 10 % of total fuel by 2030. Boeing just locked in a 9.4 million gallon purchase that will eliminate up to 85 % lifecycle CO₂. Every gallon begins with feedstock contracts, often UCO, from cities like Miami and Atlanta. (If you operate in either city, see our service area guide to maximize value.)

Dollars and Sense for Restaurants

California’s LCFS credits reached $85 per metric ton of CO₂e in early 2025. A single fast casual kitchen can produce 15 tons of avoided CO₂ yearly by sending 20 tons of clean UCO to an SAF refinery, worth over $1,200 in side income plus avoided disposal fees. With national §45Z credits kicking in January 2025, those figures could double for kitchens that document chain of custody.

Quick Fire FAQs

- Does fryer oil from animal fat qualify? Yes, as “waste tallow” under HEFA rules, though CI scores differ.

- What blend can aircraft use today? Up to 50 % HEFA or ATJ; ASTM tests for 100 % drop in are underway.

- Is the carbon math audited? CORSIA and GREET scores are verified by accredited auditors before credits issue.