Table of Contents

Summary

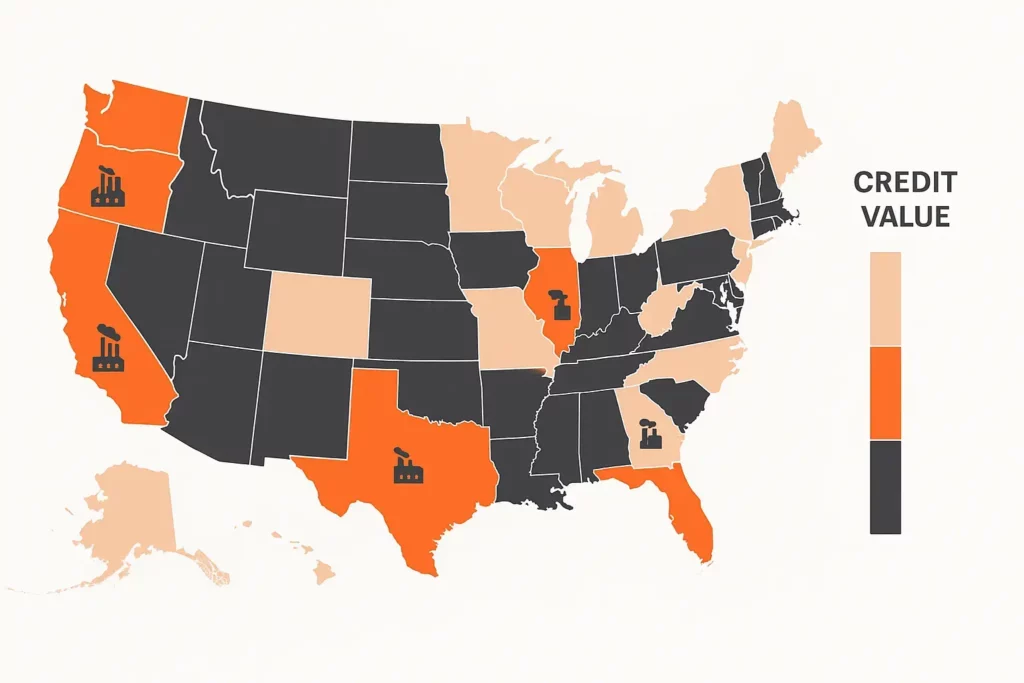

Kitchen grease has quietly become a climate finance asset. Under the Inflation Reduction Act’s §45Z Clean Fuel Production Credit, every gallon of low carbon biodiesel refined from recycled cooking oil can earn up to $0.70 in federal tax credits when prevailing wage rules are met. Using per capita grease generation data and Census populations, Grease Connections estimates that California alone could unlock roughly $32 million in annual credit value, with Texas and Florida close behind. Finance desks covering carbon markets, municipal waste, or restaurant M&A now have a fresh dataset and a three year window to follow the money.

Why Kitchen Grease Is Suddenly Worth Modelling

Congress replaced the blender’s credit with §45Z to reward fuels that actually cut lifecycle emissions instead of simply meeting a bio percentage target. Grease derived biodiesel scores extremely low on Argonne’s 45Z GREET model because the feedstock is a waste stream, not a purpose grown crop, giving it one of the best carbon intensity (CI) discounts in the table published by Treasury in January 2025. That discount boosts each tax credit dollar and makes yellow grease contracts attractive to renderers, refiners, and private equity roll ups of mom and pop haulers.

§45Z in Plain English (2025 27 Window)

Who qualifies? U.S. producers that sell transportation fuel with lifecycle GHG ≤ 50 kg CO₂e/mmBTU.

Credit size:

- Base $0.20/gal for renewable diesel or biodiesel; $1.00/gal if prevailing wage & apprenticeship (PWA) rules are met.

- Applies to fuel sold 1 Jan 2025 to 31 Dec 2027.

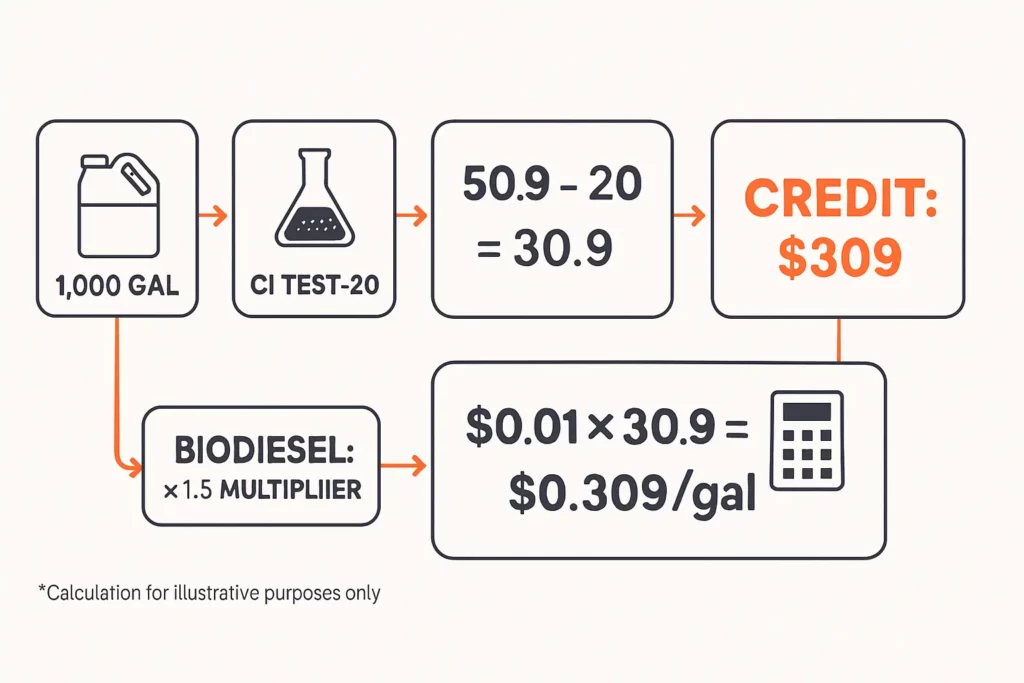

- Emissions factor: (50 minus fuel CI) ÷ 50, rounded to the nearest 0.1.

How the Math Turns Grease into Dollars

- Calculate emissions factor. Low CI yellow grease biodiesel typically tests around 15 kg CO₂e/mmBTU in California LCFS filings, yielding an emissions factor of 0.7.

- Multiply by applicable amount. With PWA, $1.00 × 0.7 = $0.70 per gallon; without PWA, $0.20 × 0.7 = $0.14.

- Scale by gallons refined. One gallon requires ~7.7 lb of filtered grease.

Finance teams can slot these three inputs into any spreadsheet to model project cash flow alongside LCFS and RFS credits.

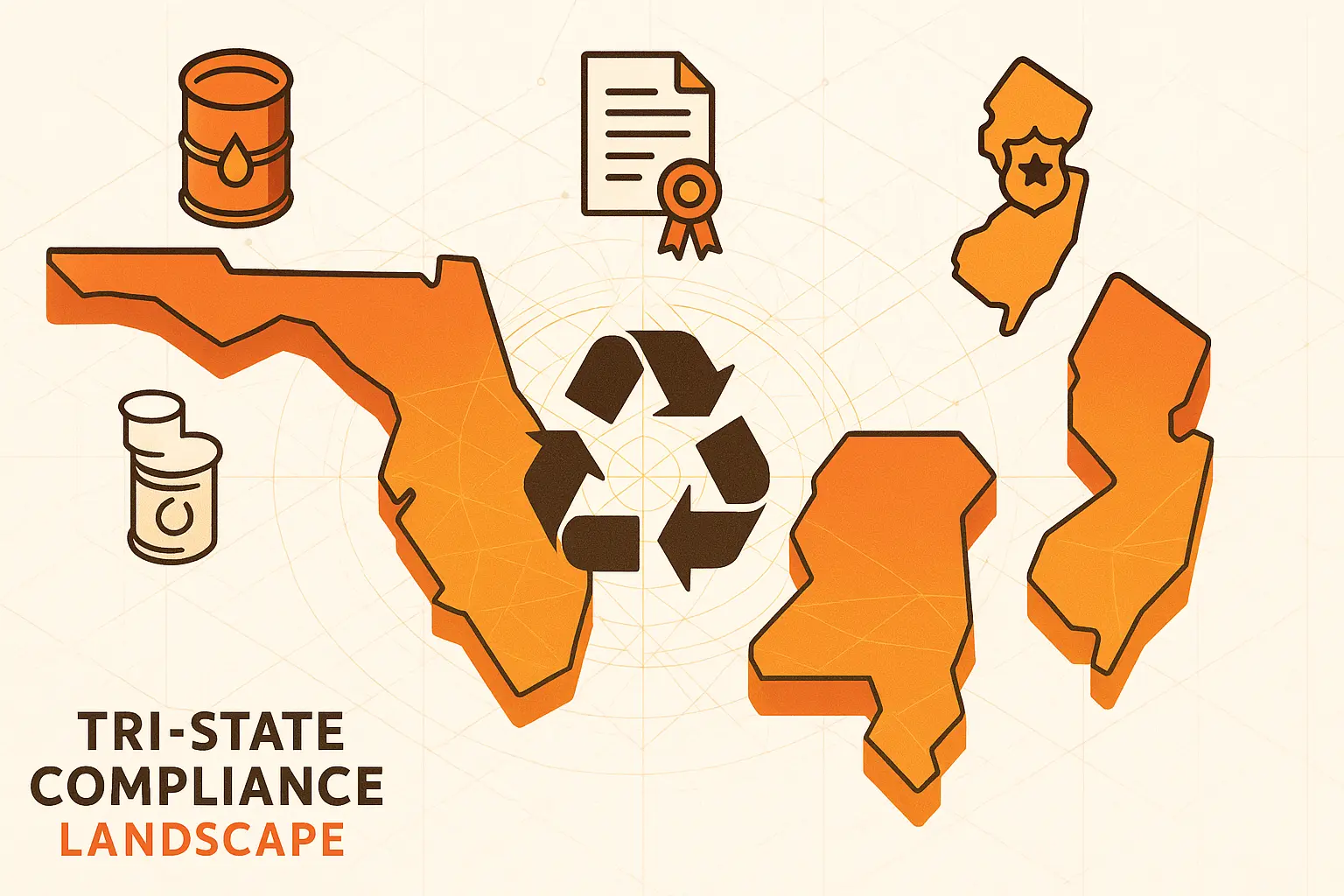

State Level Grease Supply: What We Know

- NREL’s national survey found urban restaurants generate 3 to 21 lb of collectable used cooking oil per capita annually, clustering near 9 lb.

- USDA’s February 2025 Oil Crops Outlook confirms 850 million gallons of UCO and yellow grease were available in the U.S. in 2024.

- EIA feedstock tables show yellow grease usage jumped to 5 billion lb in 2022, a five fold rise in five years.

Applying the 9 lb midpoint to 2024 Census populations yields the rough gallon volumes below:

| State | Est. Grease Gallons/yr | 45Z Credit Range (Low $0.14) | 45Z Credit Range (High $0.70) |

|---|---|---|---|

| California | 45.6 m | $6.4 m | $31.9 m |

| Texas | 35.1 m | $4.9 m | $24.5 m |

| Florida | 25.7 m | $3.6 m | $18.0 m |

| New York | 23.4 m | $3.3 m | $16.4 m |

| Illinois | 15.2 m | $2.1 m | $10.6 m |

Market Signals Editors Should Watch

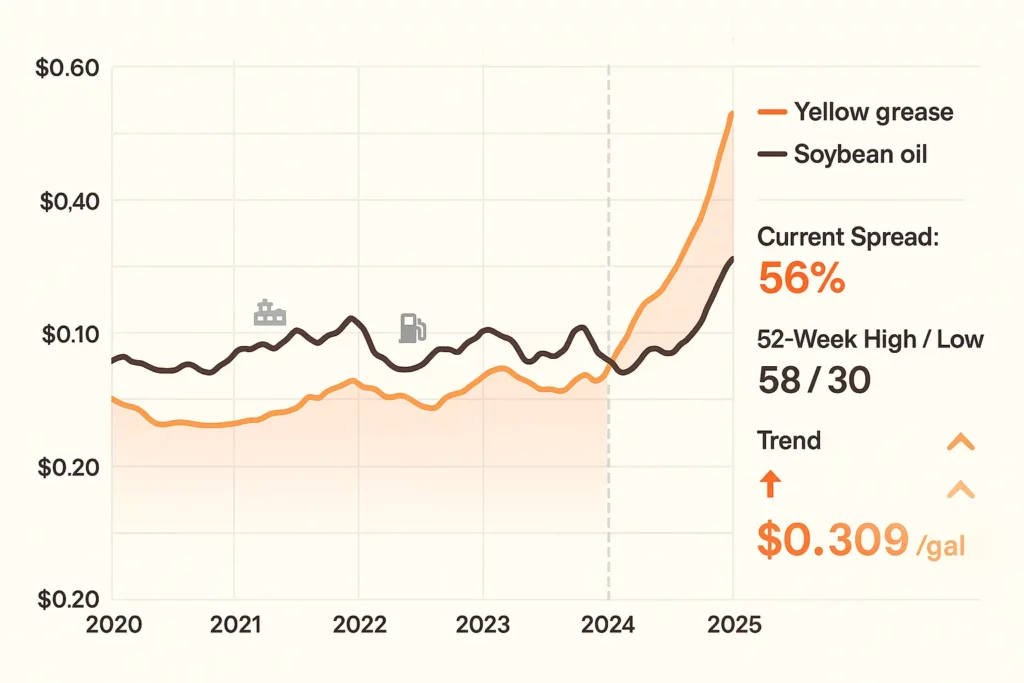

- Spot Price Spread: USDA reports yellow grease bids at 33 to 45 ¢/lb in California roughly $2.80 to $3.50/gal well below soybean oil, preserving a healthy margin once the 45Z credit is layered in. ams.usda.gov

- Import Pressure: U.S. grease imports from China topped 1 million t in Sept 2024, sparking farmer lawsuits and possible fraud probes.

- EPA RFS Volumes: The 2023 25 RFS “set rule” locks in biomass based diesel growth, guaranteeing demand for UCO feedstock.

Steps to Capture the Credit (Restaurant to Refinery)

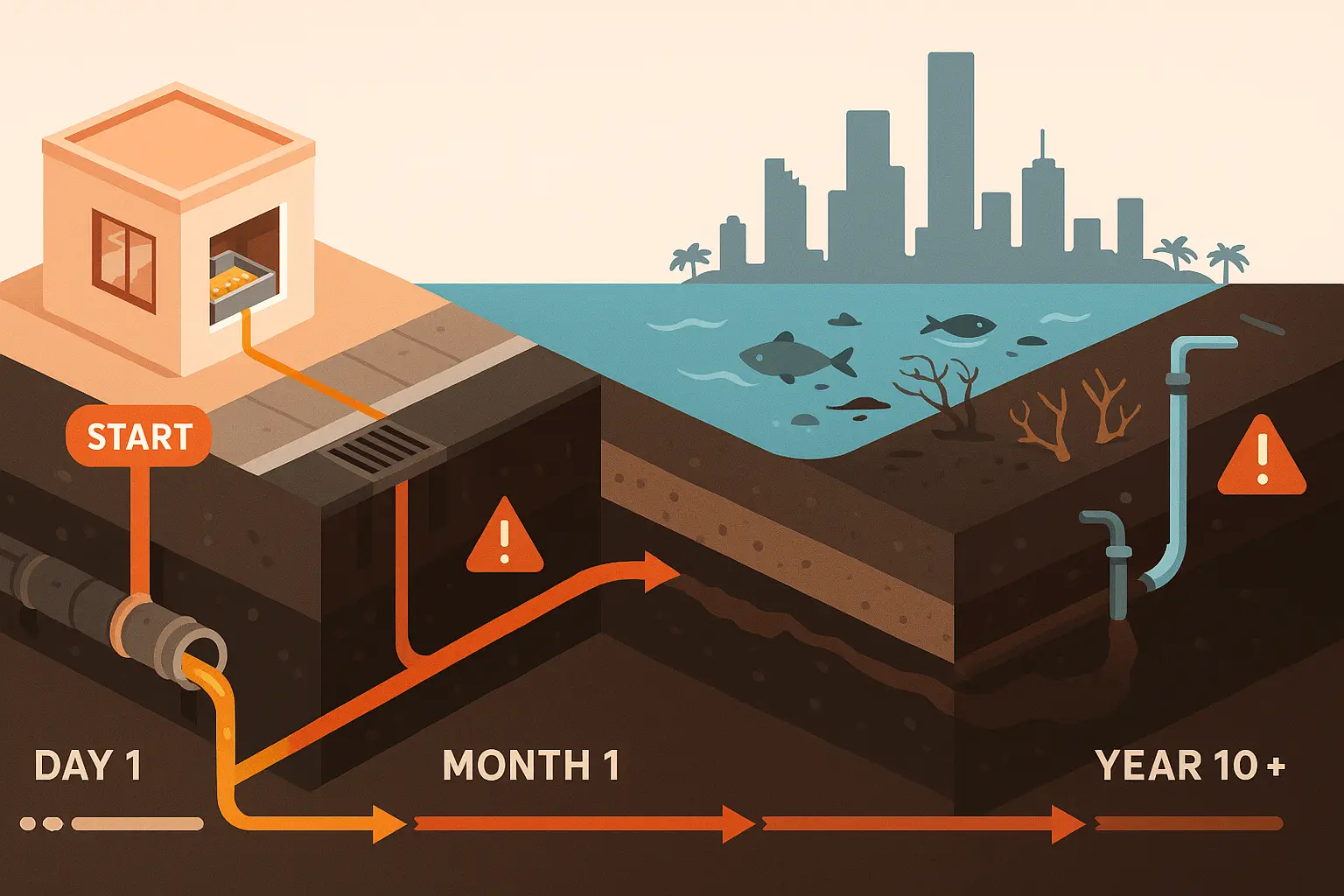

- Secure documented chain of custody from restaurant to render plant to refiner; missing links jeopardize the low CI score.

- Register the production facility under IRS §4101 before first sale.

- Run CI through the 45Z GREET model or use the published emissions rate table if available.

- File Form 7218 with credit calculations and third party CI verification.

The Bigger Picture

Yellow grease is no longer a back alley commodity. For the next three years it carries a federally backed floor price, tilting project finance toward renderers and biodiesel plants that can lock up supply early. After 2027 the credit sunsets but the data gathered now will shape whatever follows. Grease, in other words, just got a ticker symbol.