Table of Contents

More airlines are asking for sustainable aviation fuel (SAF), but only a handful of refineries can make it at scale. Below you’ll find who those players are, how their technology works, and where restaurants fit in the loop that turns fryer oil into jet power.

Why SAF Matters Right Now

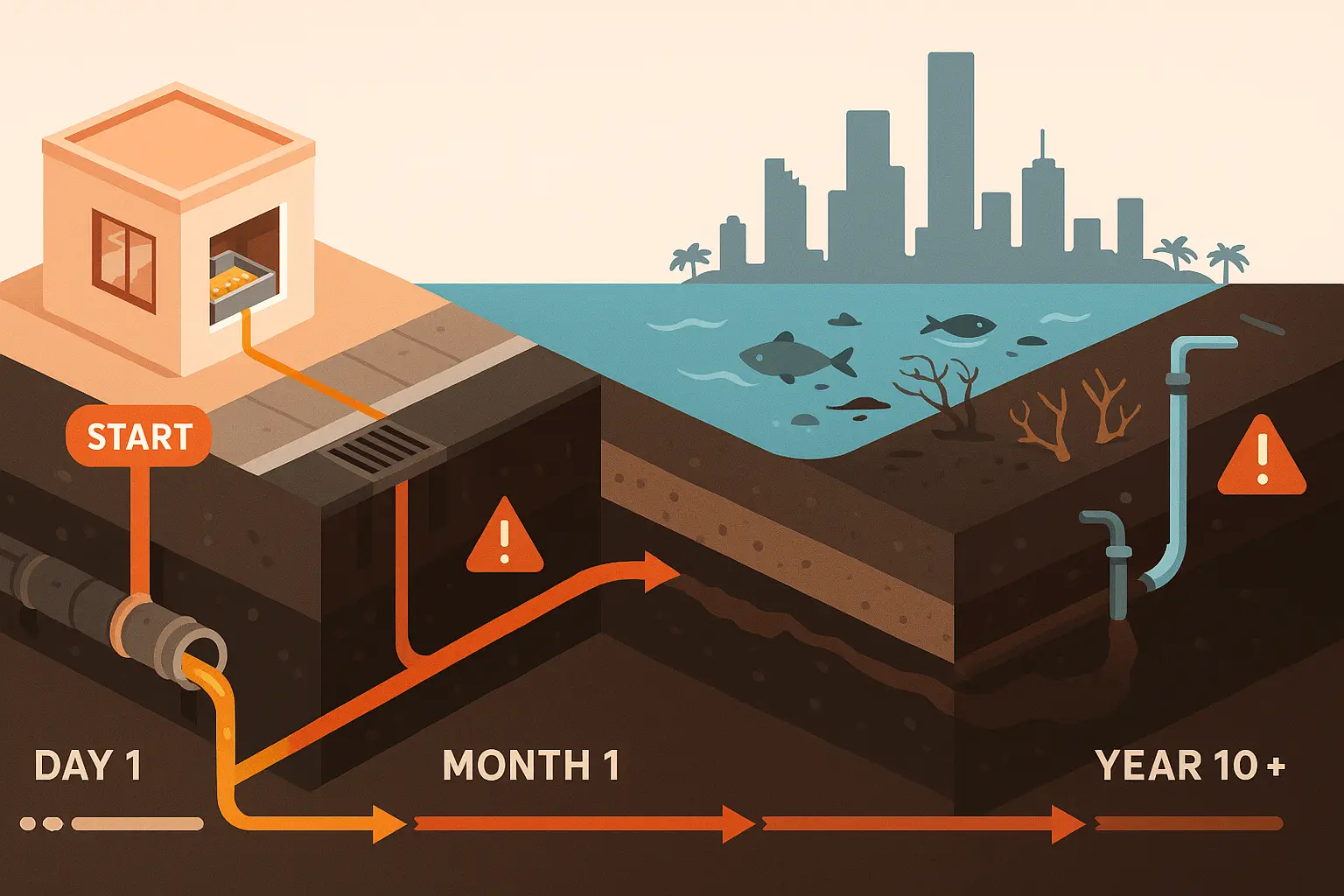

Commercial aviation burns roughly 100 billion gallons of jet fuel a year; only 1 million tonnes of SAF were produced in 2024, doubling to a projected 2 Mt in 2025. The White House backed SAF Grand Challenge calls for 3 billion gallons by 2030, creating a supply gap and an investment opportunity. For restaurant owners and facility managers, that demand means every gallon of used cooking oil (UCO) has new value. Grease Connections advises kitchens to treat UCO not as waste but as “liquid gold” feeding the SAF boom, generating new revenue streams while cutting landfill costs.

U.S. SAF Production Facilities

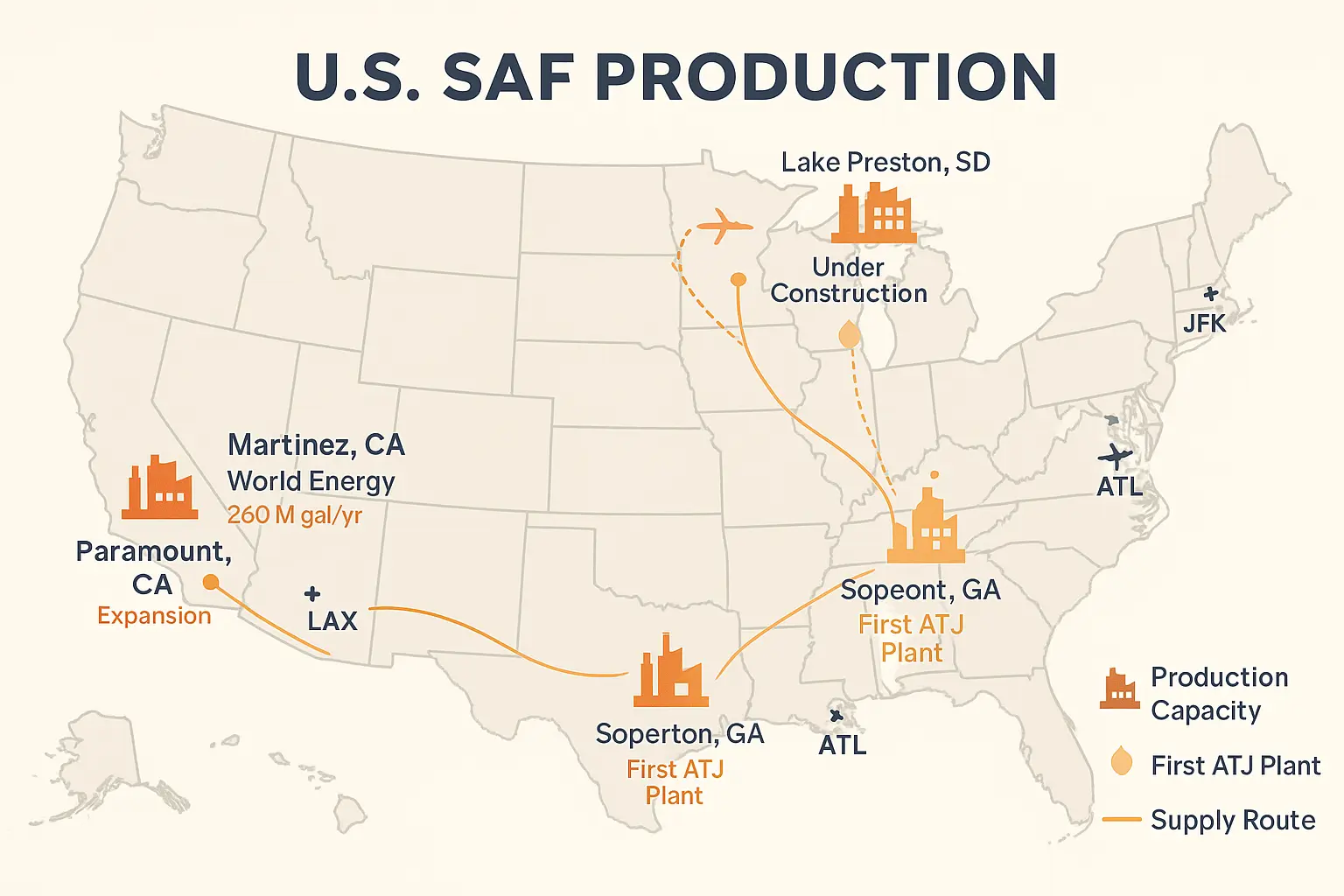

Interactive map of Sustainable Aviation Fuel production locations

From Fryer to Flight: The SAF Supply Chain

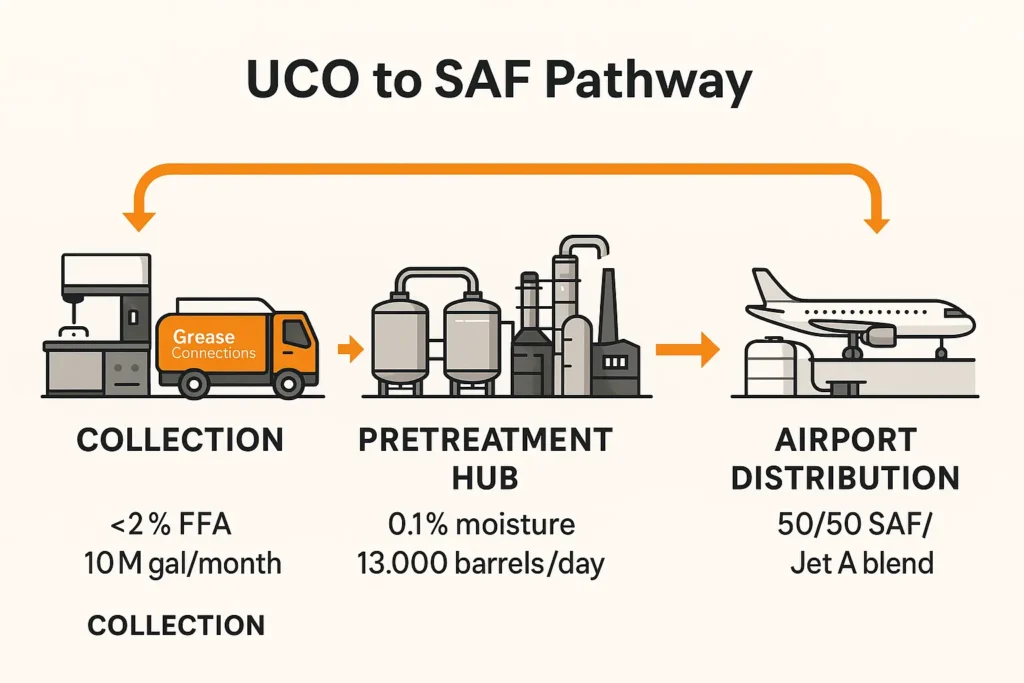

A gallon of fryer oil leaves a restaurant on a Grease Connections truck, is pre treated at a regional hub, then shipped to a HEFA biorefinery where hydrogen removes oxygen to create a clear, drop in jet fuel. Final blending and testing happen at the airport; FedEx, for instance, now uplifts 3 million gallons of Neste SAF at LAX. Because HEFA SAF cuts lifecycle CO₂ by up to 80 percent, airlines can meet both corporate climate targets and emerging state mandates without changing engines.

Meet the Market Leaders

| Company | Primary U.S. Site | 2025 SAF Capacity (gal/yr) | Certified Pathway | Note |

|---|---|---|---|---|

| Neste Renewable Fuels | Martinez, CA (JV with Marathon) | 260 M | HEFA | Largest U.S. HEFA run rate |

| World Energy Paramount | Paramount, CA | 150 M (expanding to 340 M) | HEFA | First dedicated U.S. SAF plant |

| Diamond Green Diesel (Valero/Darling) | Norco, LA | 150 M, SAF line starts Q4 2025 | HEFA | Uses waste fats & UCO |

| LanzaJet Freedom Pines | Soperton, GA | 10 M ramping to 30 M | Alcohol to Jet | World’s first ATJ plant |

| Gevo NETZERO 1 | Lake Preston, SD (under contr.) | 60 M planned | ATJ | Renewable power + corn ethanol |

These SAF producers dominate today’s U.S. output, giving them first mover pricing power. For restaurants, placing stable UCO supply contracts with Grease Connections ensures access to these refineries’ premium feedstock pools.

Inside the Refineries

Neste Marathon’s Martinez complex repurposed a 74 year old crude unit, switching out desulfurizers for hydrotreaters that run entirely on renewable feed. At World Energy Paramount, a parallel expansion adds cryogenic hydrogen recovery to lift yields to 340 million gallons a year.

Diamond Green Diesel leans on Honeywell Ecofining™, squeezing 3 to 5 percent more SAF from the same feedstock while lowering costs by 20 percent. Such plant upgrades show why biorefinery companies with proven hydroprocessing know how have become hot investment targets.

Technology Spotlight: Topsoe, LanzaJet, Gevo

Topsoe’s HydroFlex™ line retrofits fossil refineries in as little as 12 months and is licensed at more than 10 U.S. sites. LanzaJet’s Freedom Pines turns low grade ethanol into jet fuel in one pass, a breakthrough for Midwest distilleries seeking higher margins.

Gevo pairs alcohol to jet synthesis with onsite wind power, chasing zero emission scope 2 energy. These platforms (Topsoe SAF technology, LanzaJet alcohol to jet, and Gevo SAF) are the frontier that could push SAF costs below $2.50 per gallon by 2030.

| Tech Provider | Pathway | Typical Feed | Notable U.S. Deployments |

|---|---|---|---|

| Topsoe HydroFlex™ | HEFA | UCO, tallow | Martinez (CA), St. Bernard (LA) |

| Honeywell UOP Ecofining | HEFA | FOG, distillers corn oil | Diamond Green Diesel (LA) |

| LanzaJet ATJ | Alcohol to Jet | Ethanol | Freedom Pines (GA) |

Closing the Loop: Used Cooking Oil as Premium Feed

EPA lists UCO as an approved RFS pathway with a D code of 7, giving producers tradable credits that can offset more than 40 percent of refining cost. With each gallon of fryer oil now worth up to $3 in credits, kitchens that partner with Grease Connections lock in monthly rebates and verified chain of custody records, critical for airline ESG audits. FedEx’s LAX deal shows that even logistics giants trace feedstock back to the fryer.

Partnership Playbook

Airlines need long term contracts to unlock financing for new plants, says Bayer’s sustainability chief. Restaurants and facility managers can ride that wave by signing multi year UCO supply agreements, ensuring refinery offtake and price stability. Grease Connections’ East Coast network links kitchens in every U.S. metro with SAF manufacturers USA, smoothing logistics hiccups and simplifying LCFS and RFS paperwork. (See our Miami service hub page for local program details.)

Market Outlook & Next Steps

IATA projects that even after doubling, SAF will cover just 0.7 percent of jet fuel use in 2025. Honeywell counters with a pipeline of 50 licensed SAF facilities worldwide, many slated for U.S. Gulf Coast ports. The opportunity: secure feedstock now, before demand outpaces supply. Start by auditing kitchen oil volumes, then schedule a call with Grease Connections to map a collection to refinery route that turns yesterday’s fries into tomorrow’s flight.

Key Takeaway

The leaders (Neste, World Energy Paramount, Diamond Green Diesel, LanzaJet, and Gevo) are building capacity fast, but they can’t scale without a steady stream of high quality waste oils. Restaurants that lock in supply deals today become essential partners in the clean flight economy.

Questions? Our experts are ready to walk you through site specific collection plans, incentives, and refinery connections that keep your kitchen compliant and profitable.