Table of Contents

Summary

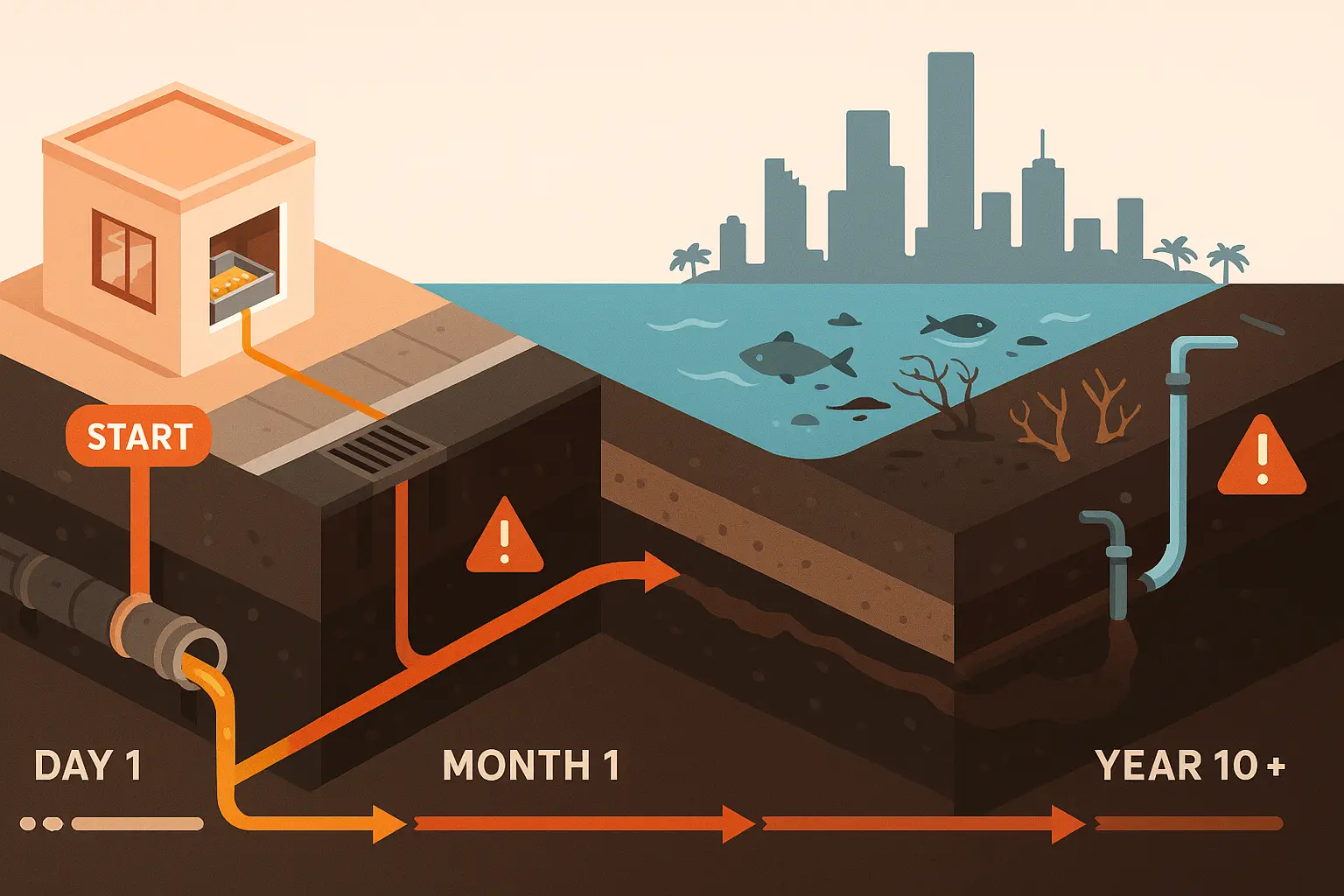

Quick service restaurants pour away an overlooked profit center: waste frying oil. At today’s yellow grease spot range of US $2.50 to $3.50 per gallon, even a modest 35 lb/day operation can turn spent oil into a four figure annual credit. Industry fact sheets show tens of thousands of limited service outlets in Florida, Georgia and New Jersey alone enough volume to power new biodiesel mandates and fatten bottom lines for operators who lock in transparent rebates. The case study below proves the math, explains why prices keep climbing.

Cash in the Fryer

A typical quick service kitchen drains about 35 pounds of oil each day, equal to roughly 4.5 gallons once filtered. At the current Jacobsen tracked spot band of $2.50 to $3.50 per gallon, those drippings are worth $4,100 to $5,700 a year before accounting tricks or menu price hikes. Leaving grease in the waste bin is like refusing the day’s cash drawer.

Yellow Grease Is a Commodity, Not Garbage

USDA’s weekly Ag Energy report shows yellow grease bids clustering around $33 to $38 per cwt in major hubs mirroring the gallon prices above once density is converted. Renewable fuel demand is the driver: the EPA locked in biomass based diesel quotas of 3.35 billion gallons for 2025 and is proposing 5.6 billion by 2027. More gallons blended means fiercer bidding for every fry line drop.

How Much Oil Does a QSR Produce?

Multiple equipment audits peg output at 150 to 250 lb per week (≈ 19 to 32 gal). rti inc.com Multiply by 52 weeks and a single drive thru storefront quietly generates 1,000 to 1,600 gallons a year enough to offset a month of fryer oil purchases when rebates hit the high end of today’s range.

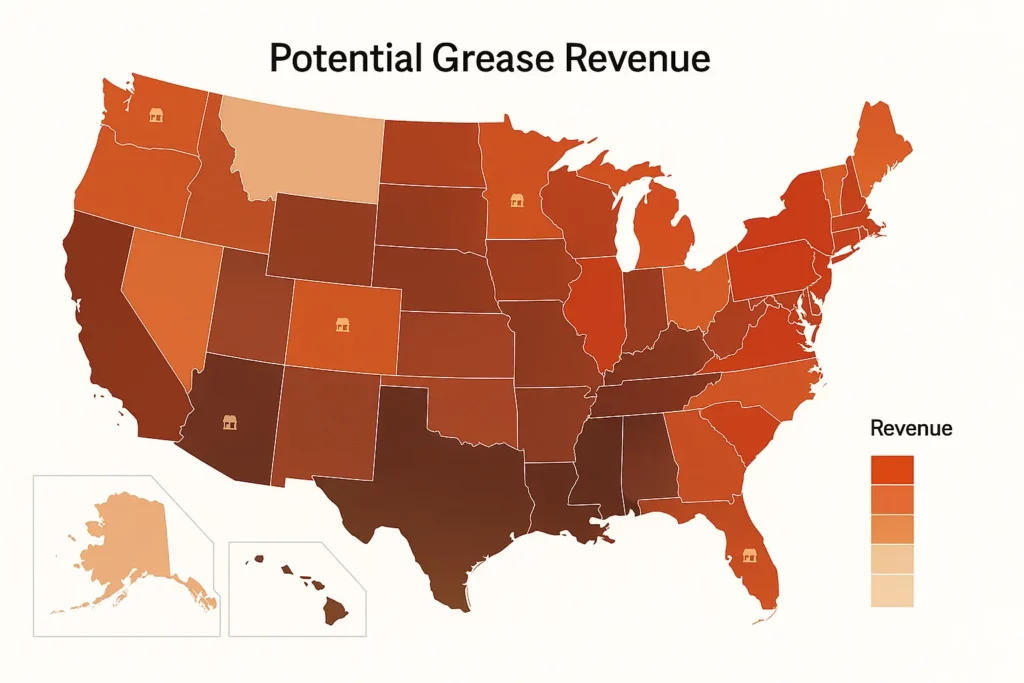

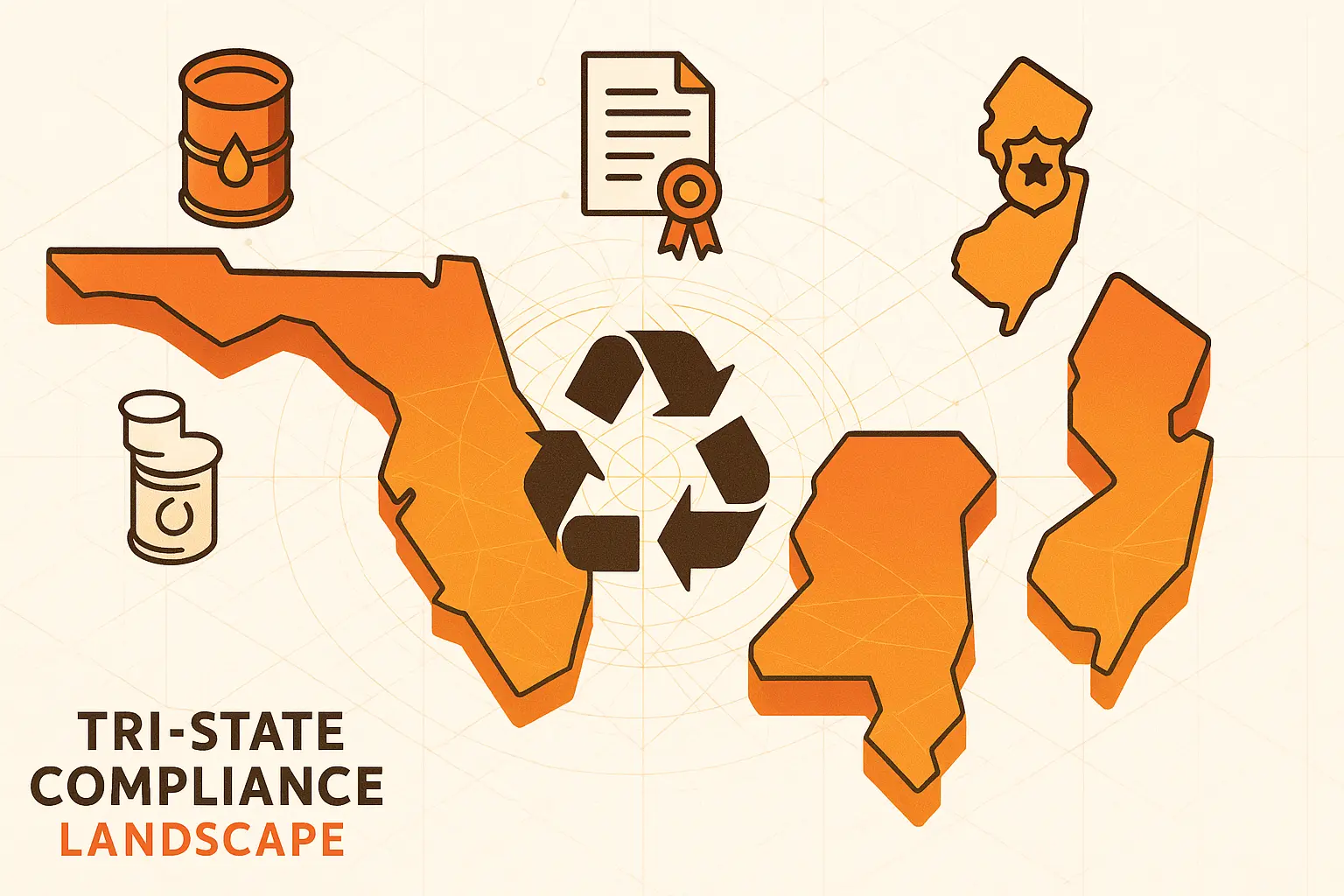

State By State Opportunity

Below are 2024 restaurant location counts from National Restaurant Association fact sheets and the annual grease revenue those outlets leave “on the table” if they recycle at $3.00/gal and generate 1,200 gal each.

| State | QSR / Restaurant Locations | Potential Grease Revenue (US$ millions) |

|---|---|---|

| Florida | 48,516 locations | $174.7 M |

| Georgia | 23,310 locations | $83.9 M |

| New Jersey | 20,433 locations | $73.6 M |

That’s a quarter billion dollars in three states and it scales nationwide with 213,000+ fast food businesses.

Proof of Concept: Hilton Miami Downtown

A Grease Connections project flipped a hotel kitchen from a hauling expense to a revenue line by securing rebates of $0.40 to $0.55 per gallon, paying for new filtration gear in six months. greaseconnections.com The same logistics (sealed tanks, IoT fill sensors, 48 hour payouts) apply to counter service chains, minus the linen tablecloths.

Why Prices Keep Rising

Airlines, truck fleets and chemical blenders all chase low carbon feedstock, and the RFS “set rule” guarantees upward volume curves through 2025. Analysts at Touch Bistro note margin compression from wage and produce inflation; grease sales are one of the few pure upside levers left. Escoffier’s state by state density map hints at where competition for gallons will be fiercest.

Four Steps to Capture Your Share

- Meter your output. Two weeks of weigh backs beats guesswork.

- Lock containers. Theft spikes when yellow grease trades near diesel parity.

- Demand transparent pricing. Rebate tiers should reference public indexes such as Jacobsen or USDA.

- Automate manifests. Digital bills satisfy health inspectors and ESG auditors alike.

According to Can You Sell Grease for Money?, operators in GA, FL and NJ are already netting up to $0.44/lb when they follow these steps.