Table of Contents

Why this comparison matters

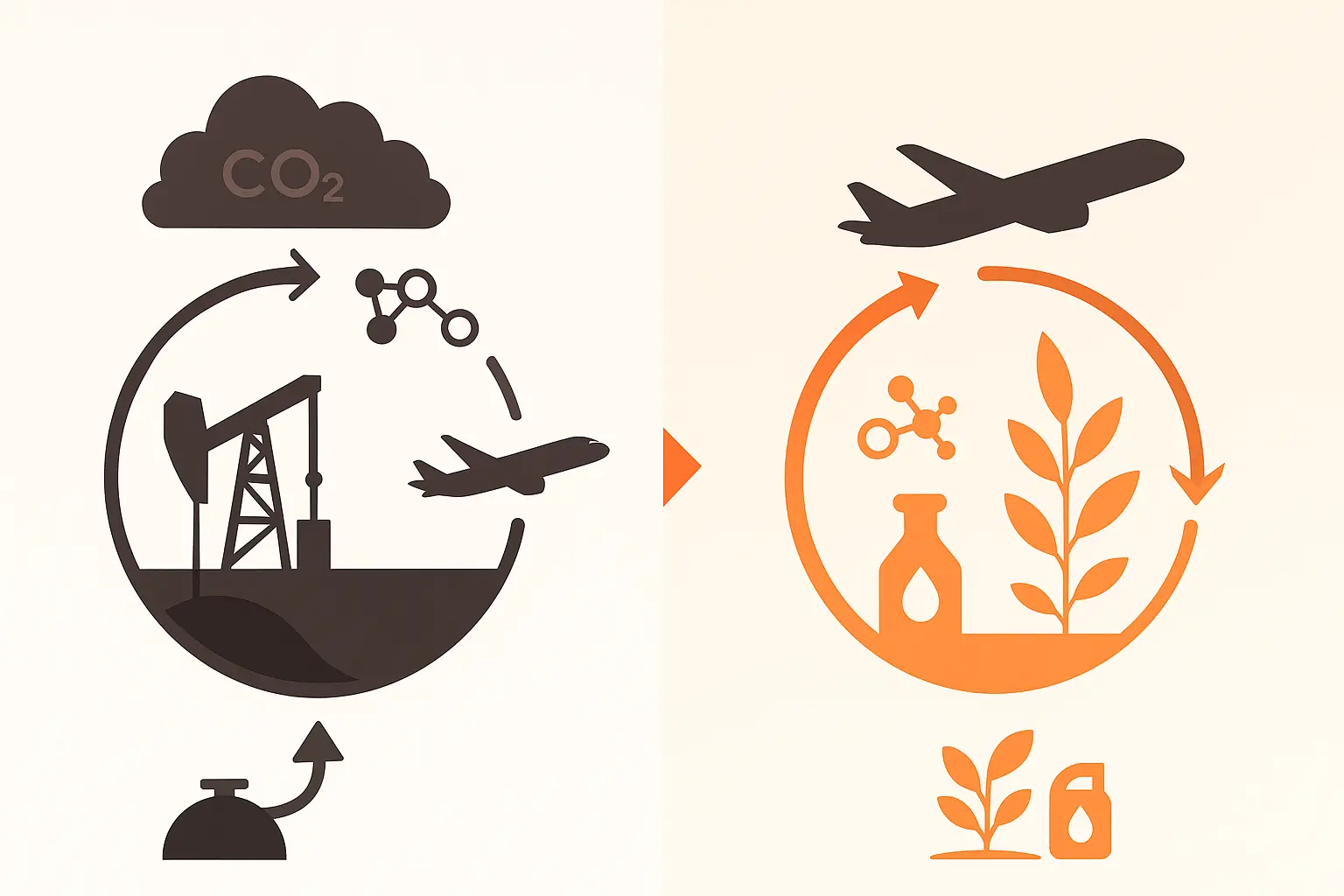

Aviation faces mounting pressure to cut climate and air quality impacts while keeping passengers and cargo moving on time. Biodiesel derived sustainable aviation fuel (SAF) is touted as a “drop in” fix, yet its chemistry differs markedly from kerosene. Understanding those differences in thrust, range, emissions and day to day operability determines whether airlines can scale bio blends without compromising safety, schedules or margins.

From fryer oil to flight deck: what counts as “biodiesel” up there?

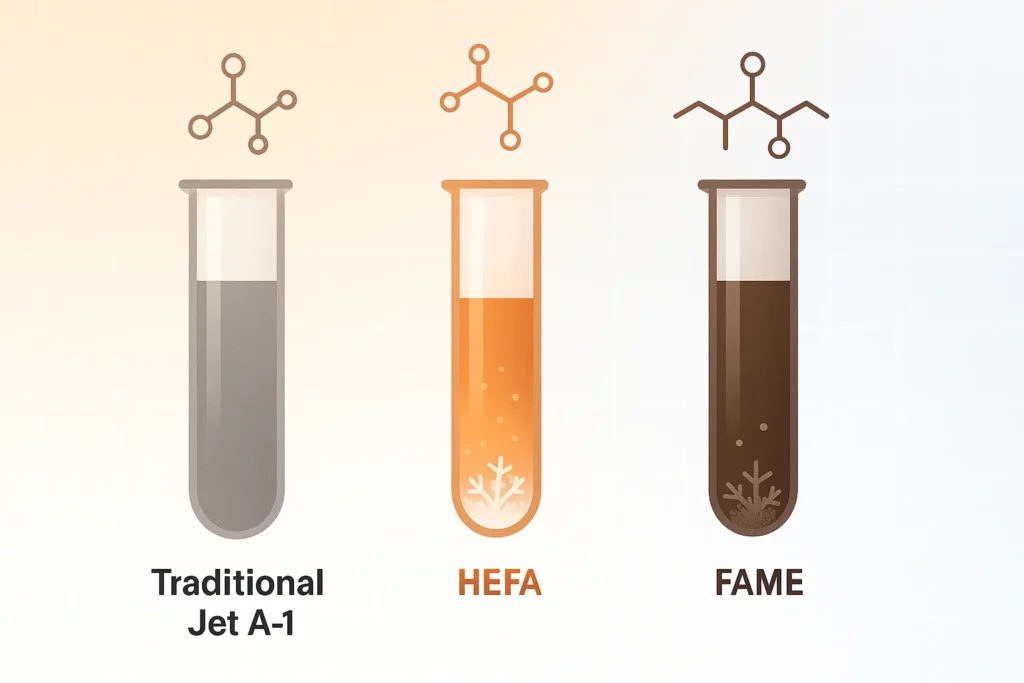

“Biodiesel” for road diesels is usually fatty acid methyl ester (FAME). FAME gels near freezing, so aviation instead relies on hydroprocessed esters and fatty acids (HEFA SPK) and similar bio kerosenes certified under ASTM D7566 Annexes A1 A9. These fuels retain the carbon skeleton of jet fuel but strip out sulfur and aromatics, allowing up to 50 % blend in today’s engines and pipelines without hardware changes, according to ICAO’s conversion process registry.

Core performance properties (at 15 °C, sea level)

| Property | Jet A / A 1 | Biodiesel (B100) | HEFA SPK (SAF) | Take away |

|---|---|---|---|---|

| Energy density (MJ kg⁻¹) | ≈ 43 | ≈ 37.8 | ≈ 43.5 | Pure biodiesel carries 10 15 % less energy; HEFA matches kerosene. |

| Freeze point (°C) | ≤ -40 (Jet A) / -47 (A 1) | -3 to 0 | ≈ -54 | FAME fails at cruise temperatures; HEFA exceeds spec. |

| Sulfur (ppm) | up to 600 | ≈ 0 | ≈ 0 | Lower sulfur cuts SOₓ and soot. |

Specific fuel burn and range

Lower gravimetric energy means engines must flow more biodiesel to make the same thrust. A 2024 turbojet test found specific fuel consumption climbed 14.34 % on neat biofuel, shrinking range or payload unless extra tanks are carried. Blends under 50 % mitigate but do not erase this penalty, which is why most commercial demonstrations fly on 30 50 % SAF rather than 100 %.

Lifecycle greenhouse gas scorecard

Because plants absorb CO₂ while growing, certified SAF pathways must show at least 50 % lower cradle to wingtip emissions than fossil Jet A; some waste oil HEFA routes achieve up to 94 % reduction, reports the U.S. DOE’s SAF Grand Challenge. Tail pipe CO₂ in flight is similar for both fuels the climate win comes from the feedstock’s biogenic carbon and renewable hydrogen.

Beyond CO₂: soot, contrails and local air quality

SAF contains virtually no sulfur or naphthalene aromatics, yielding 50 70 % fewer soot particles. NASA’s 2023 contrail campaign showed that cleaner exhaust nucleates less ice, potentially slashing climate forcing contrail cirrus. NOx trends are mixed: the extra oxygen in biodiesel can raise peak flame temperature slightly, offsetting some gains, though advanced combustor designs are narrowing that gap.

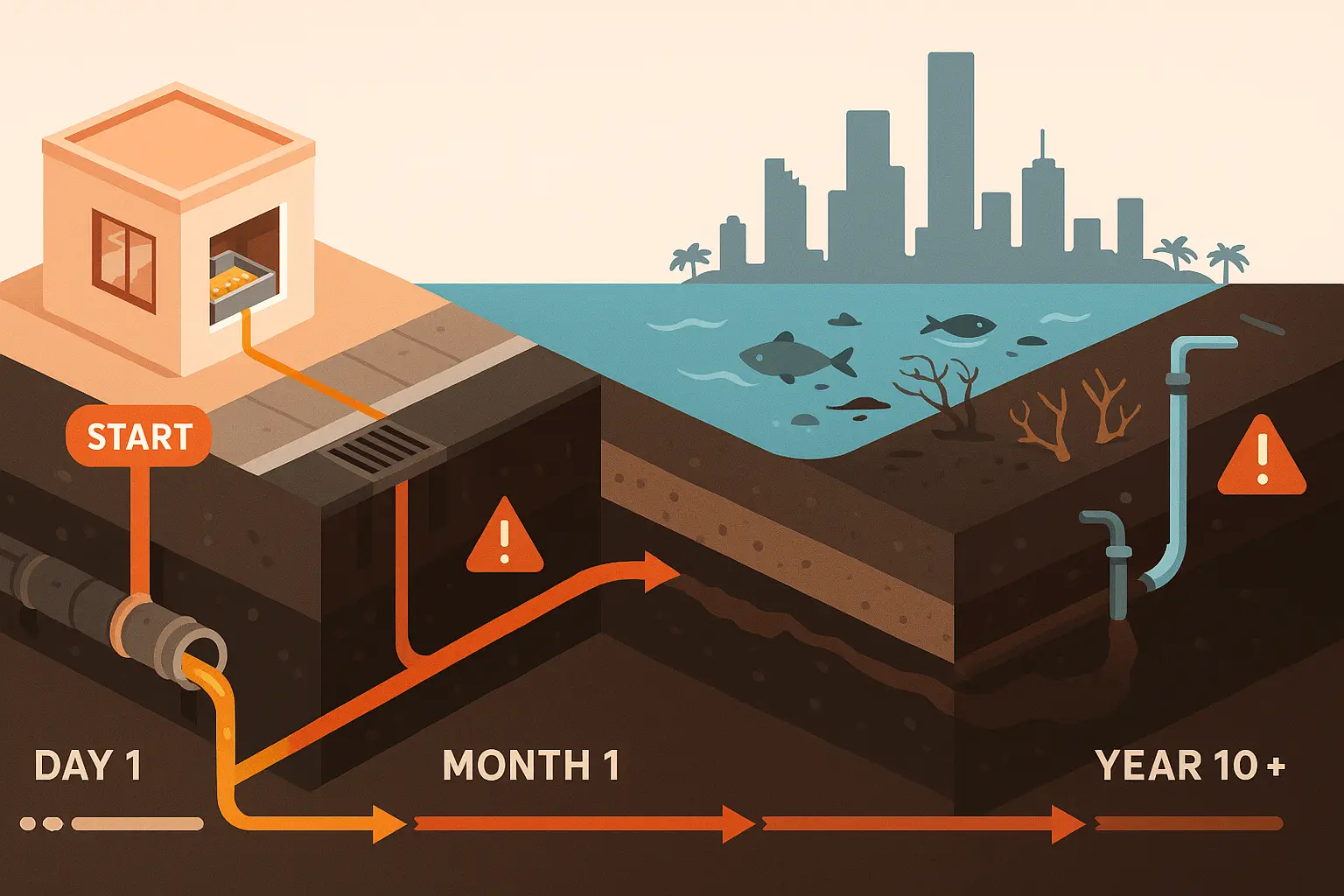

Cold flow, storage and maintenance realities

FAME biodiesel’s high cloud point makes it unsuitable above 25,000 ft without heavy kerosene dilution or costly heaters; even B5 blends struggled to meet Jet A 1 freeze specs in lab tests. HEFA based SAF, by contrast, comfortably surpasses the -47 °C requirement and shows improved thermal stability an unexpected benefit that may extend engine oil life. Seals and O rings see lower swell with low aromatic SAF, so operators monitor elastomer compatibility during long term trials.

Economics, policy and the road to scale

SAF still costs two to five times more than Jet A, chiefly because feedstock fats and oils are scarce and split across road fuels and chemicals. Government targets 3 billion gal yr⁻¹ of U.S. SAF by 2030 and 35 billion gal by 2050 aim to unlock economies of scale, carbon credits and power to liquid e fuel routes that decouple supply from farmland. Airlines that hedge early with long term offtake contracts are already reaping brand and regulatory advantages.

Key takeaways

- Pure FAME biodiesel cannot fly at altitude; hydroprocessed bio kerosenes can.

- Energy penalty drives 5 15 % higher fuel burn unless blends stay below 50 %.

- Certified SAF delivers ≥50 % lifecycle CO₂ cuts and dramatically less soot.

- Freeze point and seal compatibility remain the operational swing factors.

- Policy backed scale up is critical to close today’s stubborn cost gap.