Updated 6/30/2025

Table of Contents

From Fryer to Flight Deck: Why This Topic Matters

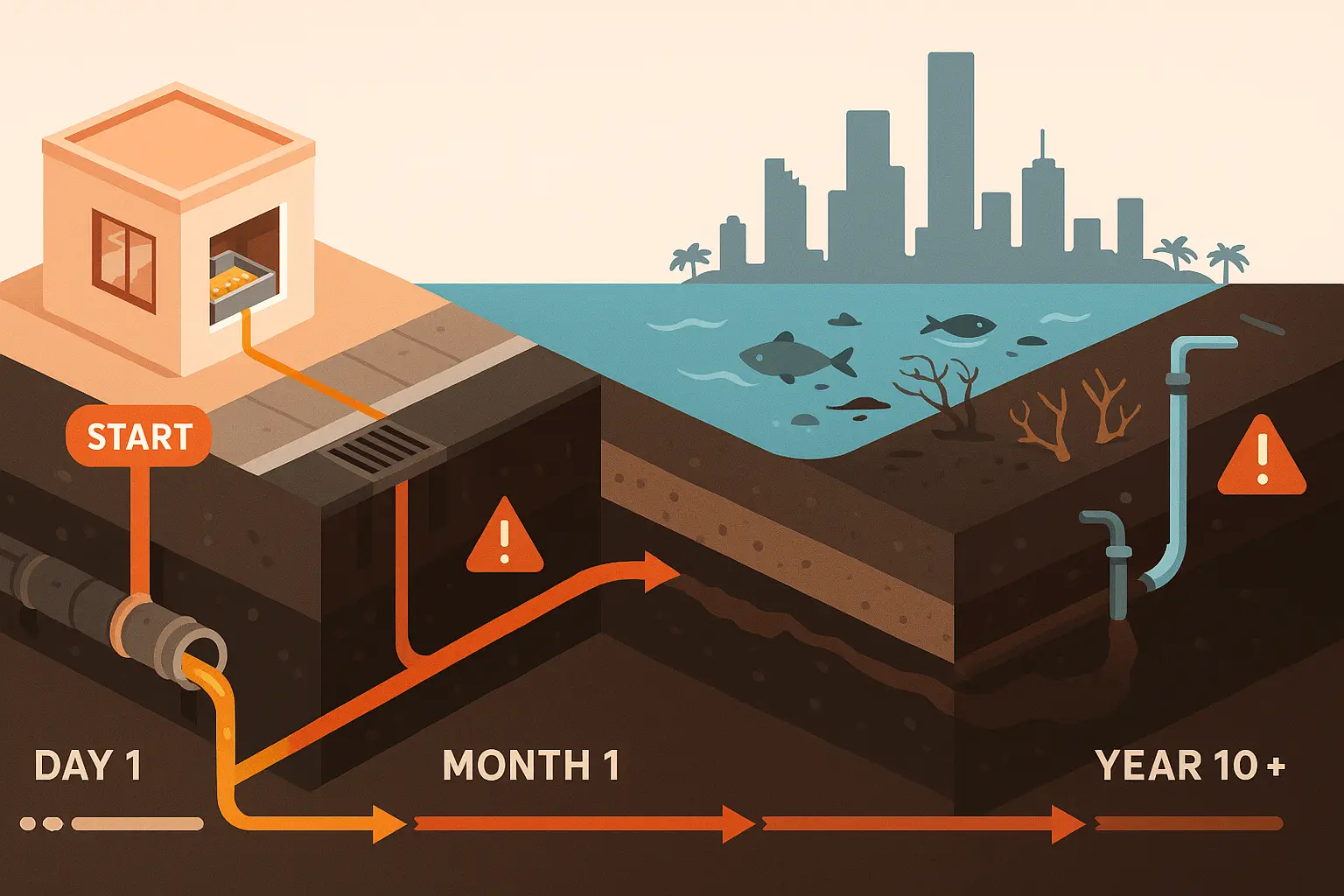

Airlines are under pressure to curb carbon yet keep fares affordable. Waste oil biodiesel grease that once crisped restaurant fries looks tempting because it avoids the “food versus fuel” debate and slots into existing refinery streams. But turbine engines live or die by physics, not good intentions. Density controls payload calculations, viscosity dictates spray quality, and freezing point decides whether fuel turns waxy at 38 000 feet. This article dissects those properties from a used cooking oil (UCO) recycler’s vantage point, showing restaurateurs, refiners and carriers whether the grease in last night’s fryer basket can responsibly power tomorrow’s jets.

Physical Properties: The Gatekeepers of Turbine Reliability

Jet engines demand kerosene that stays pumpable at -47 °C, atomizes into a fine mist, and delivers at least 43 MJ of energy per kilogram. According to the U.S. Department of Energy’s Alternative Fuels Data Center, every alternative fuel must match or outperform those benchmarks before ASTM will even consider it. Biodiesel molecules are heavier, more polar and oxygen rich than Jet A 1 hydrocarbons, altering density, viscosity and cold flow traits. Some of these shifts are fatal, others manageable through hydrotreating. Understanding which is which separates viable sustainable aviation fuel (SAF) from an expensive laboratory curiosity.

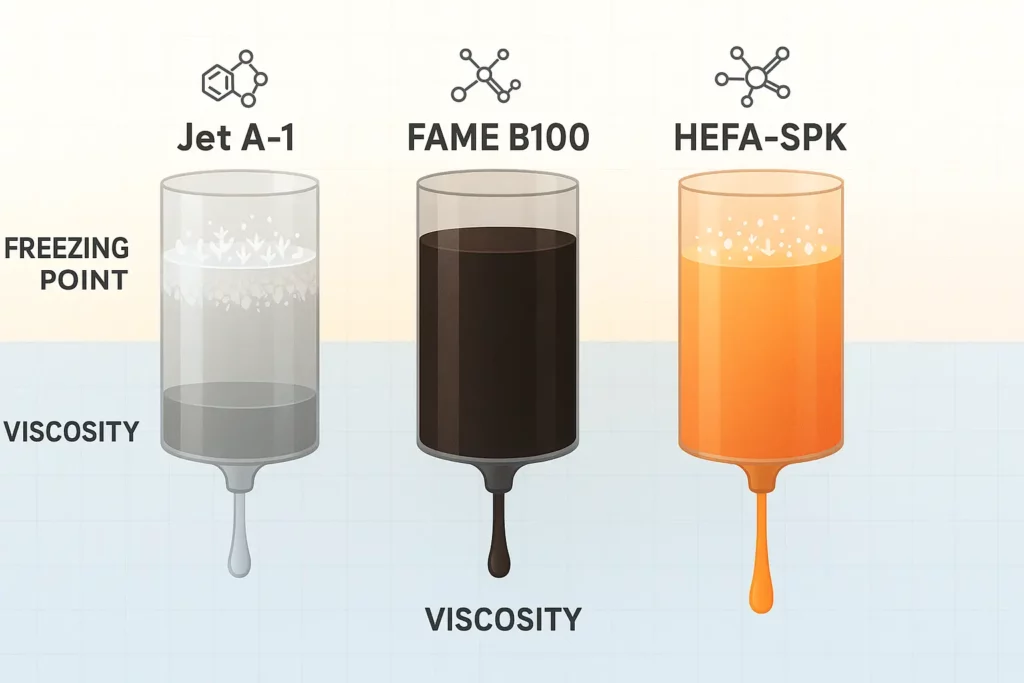

Snapshot Table: Jet A 1 vs UCO FAME vs UCO Derived HEFA

| Property | Jet A 1 (spec) | UCO FAME B100 | UCO HEFA SPK* |

|---|---|---|---|

| Density @15 °C (kg /L) | 0.775 0.840 | 0.88 | 0.76 |

| Viscosity @ -20 °C (mm²/s) | ≤8.0 | 12 15 | 6 8 |

| Freezing point (°C) | ≤ -47 | ≈ -3 | ≤ -54 |

| Net heating value (MJ/kg) | ≈43 | ≈38 | ≈43 |

| ASTM blend limit | 100 % | ≤50 ppm (contamination) | Up to 50 % |

Energy Density: Range and Revenue

Every kilogram of mass lifted reduces either passengers or cargo. Jet A 1 and HEFA SPK deliver roughly identical 43 MJ/kg; FAME biodiesel sacrifices about 12 % of that punch. According to Wikipedia’s compiled jet fuel data, a drop to 38 MJ/kg translates into shorter routes or additional tankage. Airlines chasing trans continental stage lengths simply cannot afford that penalty, which is why neat biodiesel remains a no fly zone while HEFA earns flight test slots.

Viscosity: Spray Science in the Combustor

Atomizers inside a CFM56 injector expect kerosene thin fluids. UCO FAME runs four to five times thicker at 40 °C, stressing pumps and widening droplet size outcomes linked to higher soot and ignition delays, according to academic viscosity studies. Hydrotreating breaks those ester chains, producing HEFA with a viscosity envelope almost identical to conventional jet fuel, so no hardware changes are required. The recycler’s job is clear: push waste lipids through a hydrotreater, not a blending manifold.

Cold Flow Behavior: Surviving -50 °C

Crystals form when esters reach their cloud point, blocking filters and starving engines. Laboratory work shows FAME wax precipitation starting near -3 °C. In contrast, HEFA’s straight chain paraffins freeze below -54 °C better than Jet A 1 and well inside ASTM D1655 margins. That cold flow edge offers airlines flexibility on polar or high cruise altitude routes while satisfying airport hydrant operators worried about filter icing. For a UCO collector, this property is the golden ticket that unlocks premium SAF contracts.

Safety Benchmarks: Flash Point & Elastomer Compatibility

Ground crews need a flash point above 38 °C to minimize tarmac vapors. Jet A 1 and HEFA meet that easily; biodiesel’s flash point is actually higher (>101 °C), posing no risk. The hidden issue is material swell: biodiesel’s polar molecules attack certain nitrile seals. HEFA, stripped of oxygen, behaves like kerosene and passes OEM elastomer tests, according to FAA fire safety data. That compatibility keeps retrofit costs at zero.

Certification Pathway: Reading ASTM Fine Print

ASTM D7566 Annex A2 lets refiners blend HEFA SPK up to 50 % with Jet A 1 once 19 separate property tests are met, from lubricity to thermal stability. The same committee strictly caps FAME contamination at 50 ppm effectively banning purposeful blending. For UCO recyclers, that difference dictates business models: transesterification alone supplies road diesel fleets, while aviation customers require an extra hydrotreating train plus peroxide stability analytics. Certification costs rise, but so does price per gallon.

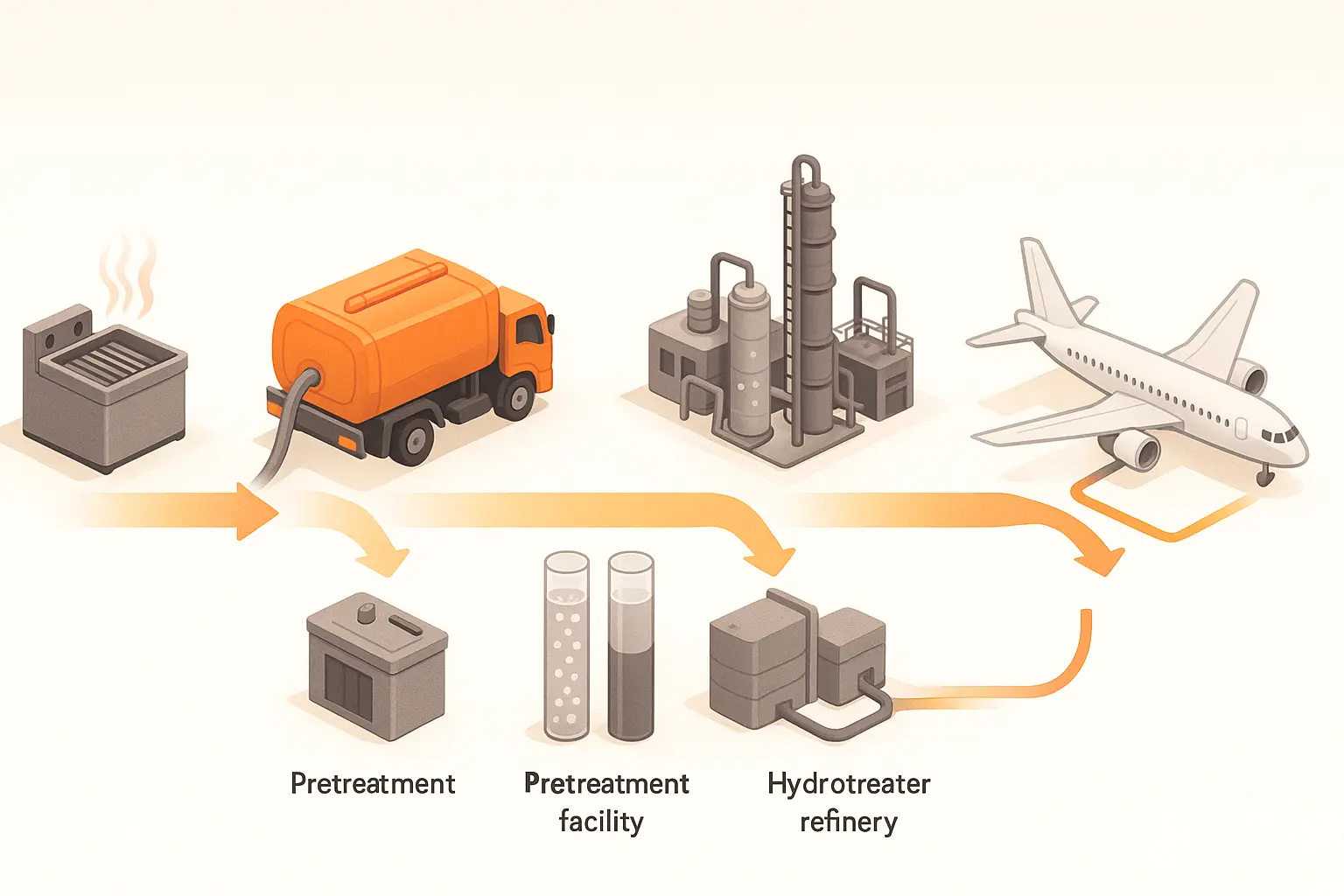

Supply Chain Lens: Closing the Grease Loop

Waste cooking oil volumes in North America top 3 billion liters per year enough feedstock for roughly 1 % of global jet demand. Chinese investors are already spending US $1 billion to convert UCO into HEFA ahead of a 2 5 % national SAF mandate, Reuters reports. Our own collection network locks in fryer contracts, tests free fatty acid levels on site, and pretreats loads before shipping them to partner refineries. That gives airlines the provenance data they need for ESG audits while paying restaurants a premium above tallow buyers.

Operational Roadmap: Blending, Testing, Scaling

- Step 1: certify each pretreatment batch against ASTM D1655 trace metals to protect hydrotreater catalysts.

- Step 2: co process in a mild hydrocracker with a nickel molybdenum bed, targeting n paraffins C10 C15.

- Step 3: run the neat HEFA through a full D7566 test slate density, freeze, smoke point.

- Step 4: blend 10 %, 30 %, then 50 % with Jet A 1 and perform engine test cell runs, tracking specific fuel consumption; studies at Rzeszow University show up to 2 % thrust gains at B50.

- Step 5: submit data to FAA and airline purchasers for route proving flights.

Bottom Line: Property Data Favors HEFA

Physics decides fuel fate. FAME biodiesel fails on viscosity and freeze point, relegating it to ground fleets. Hydrotreating used cooking oil into HEFA SPK restores jet grade density, preserves energy content and even betters cold soak margins. Airlines get drop in performance; restaurants monetize waste; the climate wins a double dividend. The sooner waste oil recyclers pivot to HEFA, the sooner that circular supply chain can climb above 35 000 feet.