Table of Contents

Why Oil Shocks Hit Airlines First

When global conflicts tighten the Strait of Hormuz, jet fuel prices can jump 45 percent in a single week, as seen after the April 2025 Gulf escalation. Every uptick funnels straight into ticket prices because aviation lacks quick substitutes. U.S. carriers still burn about 1.65 million barrels a day of petroleum based jet fuel, according to the Energy Information Administration. That dependence on foreign oil exposes airlines, and the economy, to supply interruptions they cannot control. Reducing fossil fuel dependence is therefore not just a climate goal; it is an energy security imperative.

Cooking Oil to Jet Fuel: America’s Shortcut

Used cooking oil (UCO) from restaurants can be hydro processed into Sustainable Aviation Fuel that meets ASTM D7566 specifications. Because the feedstock is collected inside the United States, it bypasses international crude routes entirely. Clean Fuels Alliance data show the nation already captures 850 million gallons of UCO each year, enough to produce roughly 700 million gallons of SAF after processing losses.

The technology reuses a waste product, qualifies for federal SAF tax credits, and slots into existing jet engines with no hardware changes. In short, the fryer oil your kitchen discards today can power a flight tomorrow, strengthening domestic energy production and diversifying energy sources in one move.

Cutting the Cord to Imported Oil

Imports of jet fuel fell by 210,000 barrels per day in 2024, thanks partly to rising biofuel blends. Yet the United States still spends billions on foreign kerosene each year. The SAF Grand Challenge Roadmap targets 3 billion domestic gallons by 2030, displacing about one tenth of current jet fuel demand and directly reducing oil imports. Each gallon refined from UCO is one less gallon subject to OPEC pricing or geopolitical risk. For airlines, that translates to steadier budgets; for the nation, it builds energy independence.

Price Stability From Homegrown Waste

Jet fuel spot prices swing wildly: in 2023 they climbed nearly 150 percent year over year. UCO based SAF, by contrast, is often sold under multi year offtake contracts linked to feedstock indices rather than Brent crude. Restaurants sign fixed rate agreements with a used collection company, and airlines lock in long term SAF supply, smoothing cost curves across the aviation fuel supply chain. The result: better cash flow forecasts for carriers and lower fare volatility for travelers.

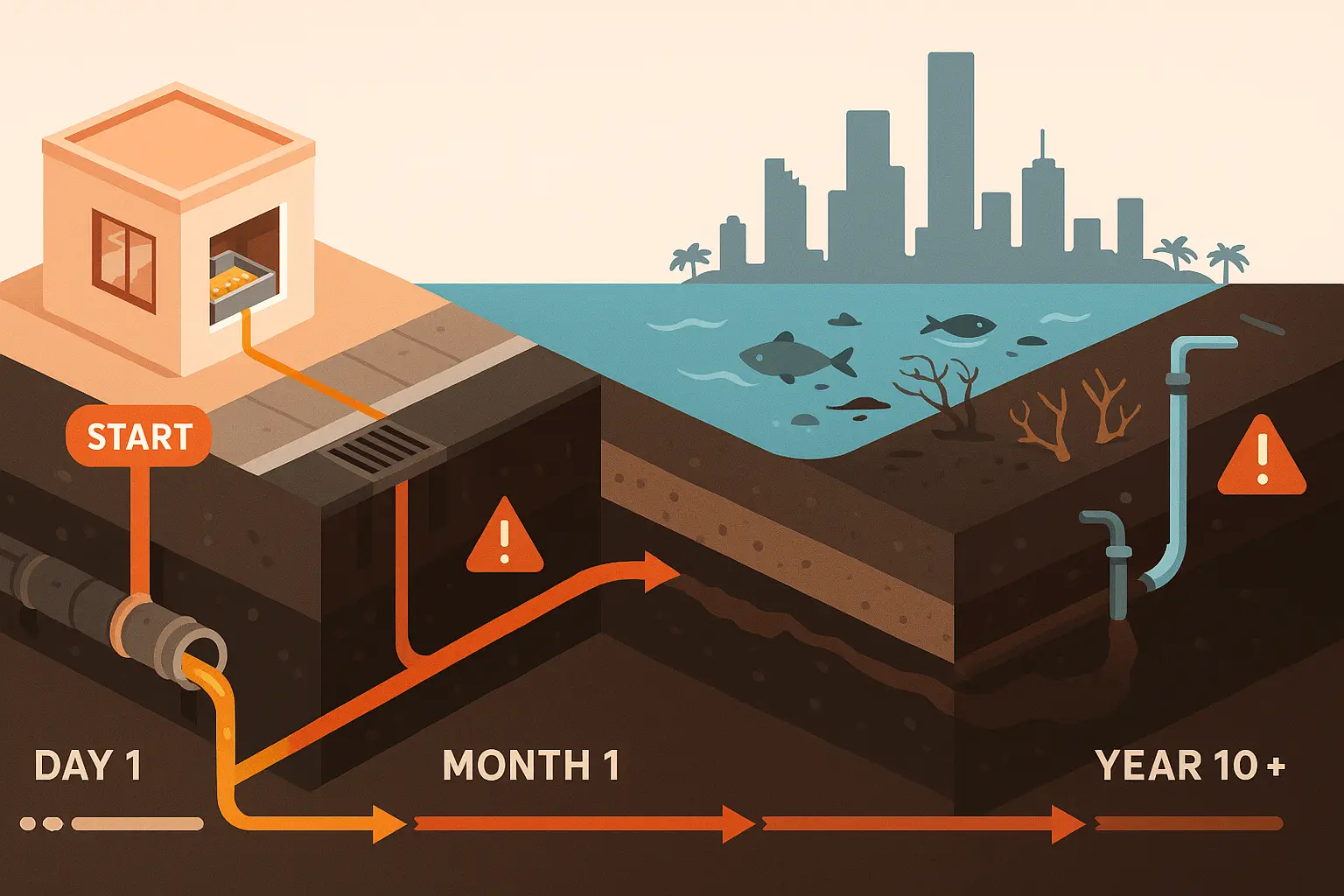

A Supply Chain That Stays at Home

Traditional jet fuel travels thousands of miles, from foreign wells to U.S. terminals, through chokepoints vulnerable to disruption. UCO SAF shrinks that chain to a domestic loop: kitchen → collection → refinery → airport. USDA data show rising UCO imports from Asia are already under scrutiny for fraud and quality concerns; relying on local waste sidesteps that risk. With announced projects, domestic SAF capacity could exceed 3 billion gallons by 2030, creating 70,000 U.S. jobs and fortifying national infrastructure.

| Metric (2024) | Imported Jet Fuel | UCO Based SAF |

|---|---|---|

| Source Region | Middle East & Caribbean | All 50 U.S. states |

| Price Driver | Brent crude spot | UCO feedstock index |

| Transit Risk | High: sea lanes | Low: domestic trucking |

| GHG Cut | 0 % | ≥ 50 % lifecycle reduction |

Geopolitics Without the Drama

Oil is famously entangled with international diplomacy. Airlines faced sudden rerouting costs when Russian airspace closed in 2022, largely because fuel burn increased on longer paths. By embracing alternative aviation fuels made at home, the industry insulates itself from power plays abroad and reinforces U.S. energy security. As IATA notes, scaling SAF “provides geopolitical resilience as well as carbon savings.”

What It Means for Restaurants and Collection Partners

Every gallon of fryer oil you hand over is a strategic fuel resource. Restaurants already generate millions of gallons of recyclable oil annually. When a used collection company routes that waste to an SAF refinery, the value chain rewards every link: eateries earn rebates; refiners secure feedstock; airlines receive renewable fuel sources; the nation gains energy security. Participation is straightforward: keep oil segregated, schedule pickups, and request proof of recycling certificates for ESG reports.

Next Steps: Scaling Up Quickly and Safely

Federal incentives under the Inflation Reduction Act offer up to $1.75 per gallon for SAF that cuts 50 percent of lifecycle emissions. DOE tracking shows production and imports have already climbed from 5 million gallons in 2021 to 93 million by September 2024. With UCO supply able to reach 1.1 billion gallons through better collection, the feedstock exists; what’s needed is more refining capacity and firm long term purchase agreements. Airlines, restaurateurs, and investors who act now position themselves at the front of a market designed to meet a mandatory 35 billion gallon SAF demand by 2050.