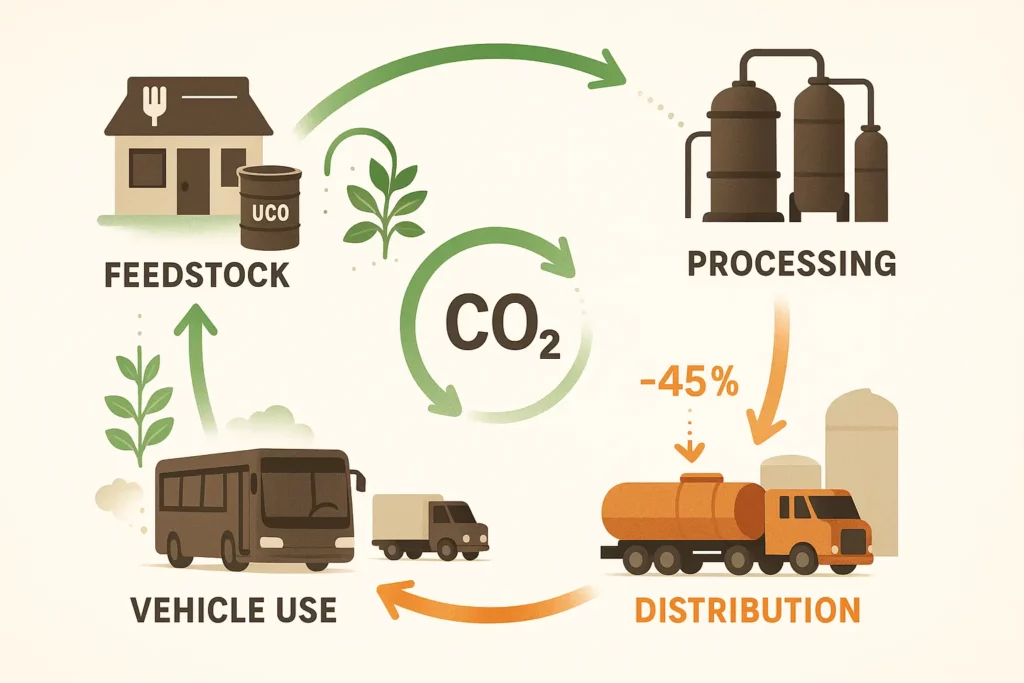

Fresh lifecycle data show a gallon of neat (B100) biodiesel can trim net greenhouse gas emissions by roughly three quarters compared with fossil diesel, chiefly because plants pull CO₂ from the air before the fuel is ever burned. If that biodiesel comes from used cooking oil the climate dividend is even bigger its carbon intensity falls to about one fifth of diesel’s. Below, we unpack how scientists calculate those savings, trace each tone of avoided carbon, explore caveats such as indirect land use change, and outline what the numbers mean for fleets and policymakers.

Table of Contents

Why Lifecycle Emissions Matter

Transportation still tops U.S. climate charts, and diesel freight is the hardest to electrify. According to Argonne National Laboratory’s GREET model, switching from conventional diesel to B100 biodiesel cuts well to wheels CO₂ by 74 %. Unlike tailpipe tests, lifecycle analysis counts every stage feedstock growth, fuel production, distribution and combustion giving a full picture of climate impact. That holistic lens increasingly underpins clean fuel credits under the U.S. Renewable Fuel Standard and California’s Low Carbon Fuel Standard, turning carbon intensity into real dollars for fleet managers.

How Lifecycle Analysis Works

Lifecycle (or “well to wheels”) accounting subtracts biogenic carbon uptake during crop growth from the CO₂ released in a vehicle, then adds emissions from farming, transport and refining. EPA’s biogenic carbon framework explains why the uptake is credited at the field, not the tailpipe, ensuring carbon isn’t double counted. Advanced models such as GREET layer in nitrous oxide soil fluxes, fertilizer manufacture and electricity grids, giving policymakers a granular emissions ledger that can be audited and updated each year.

The 74 % Advantage Where the Savings Come From

Three drivers underpin biodiesel’s large emissions gap:

- Biogenic CO₂ neutrality. Photosynthesis locks atmospheric carbon into soybean or canola oil; that carbon is simply recycled on combustion, not added anew.

- Lower energy refining. Transesterification of oils into fatty acid methyl esters uses far less heat and hydrogen than petroleum cracking and desulfurization.

- Cleaner distribution. Biodiesel is often produced regionally, shortening fuel miles. The result: a 74 % cut versus petrol diesel for typical soy based B100, verified by Argonne’s 2024 dataset.

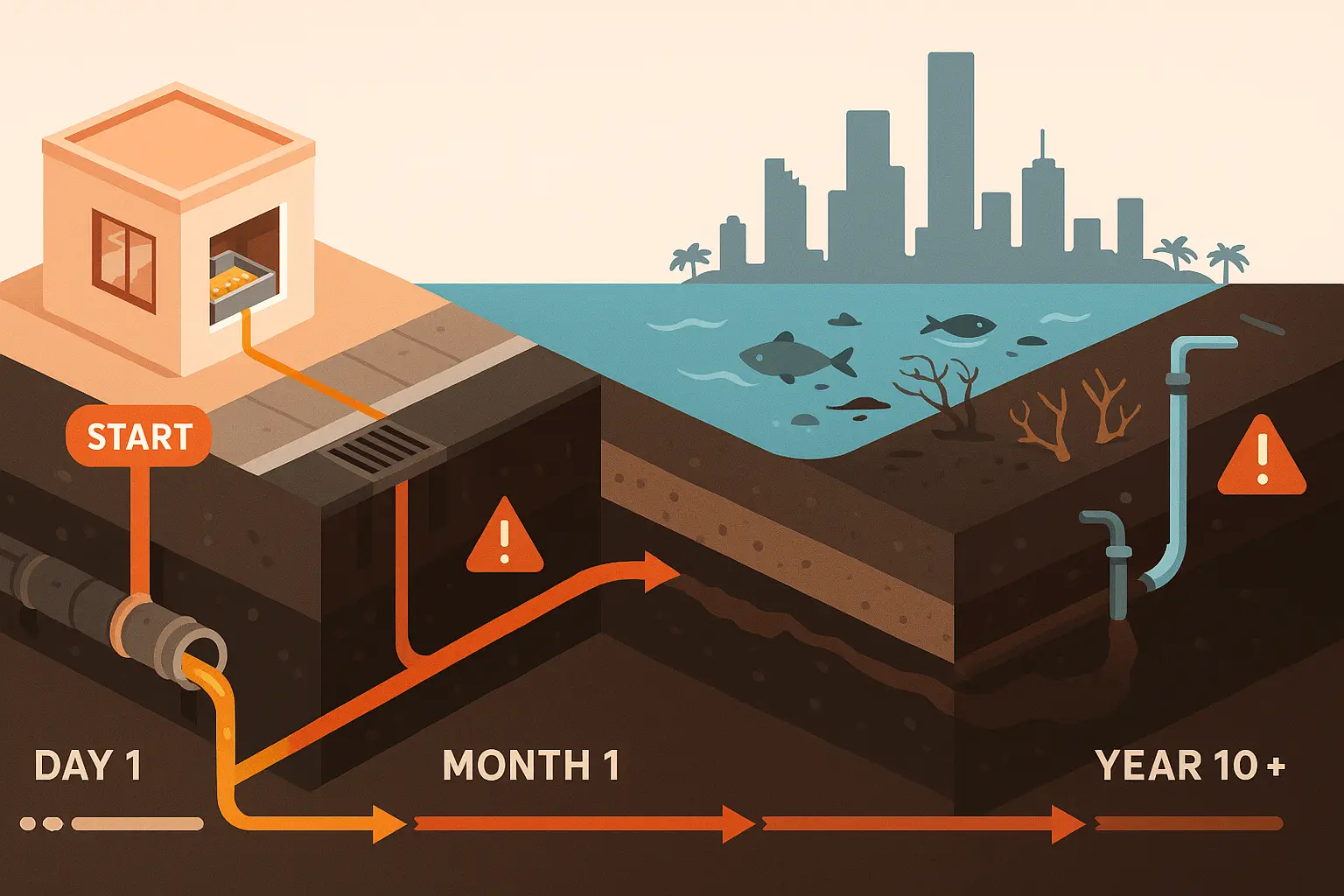

Waste to Wheels: Used Cooking Oil Biodiesel

Turning fryer grease into fuel adds another layer of climate benefit. Argonne researchers calculate 79 86 % lifecycle CO₂ savings for biodiesel made from used cooking oil (UCO) or tallow because no new land, fertilizer or irrigation is required. Carbon intensity falls to about 18 g CO₂ eq/MJ one fifth the 95 g figure for fossil diesel. Real world rollouts back the numbers: Oakland’s entire municipal fleet now runs on waste oil renewable diesel, while UAE retailer LuLu powers deliveries with UCO biodiesel collected in house.

Refining Energy: Transesterification vs. Oil Cracking

Diesel’s refining stage contributes about 22 g CO₂ eq/MJ, largely from hydrotreaters and catalytic crackers. In contrast, biodiesel’s transesterification reactors operate near 60 °C and atmospheric pressure, slashing process energy. According to the same Argonne study, energy demand for soy biodiesel production is roughly 50 % lower per unit of fuel than for fossil diesel hydrocracking. Less steam and hydrogen mean fewer upstream emissions from natural gas reformers and boilers.

Indirect Land Use Change (ILUC) Caveats

ILUC estimates attempt to capture global market ripple effects e.g., higher soy prices nudging pasture into cropland. A 2024 Sustainability analysis shows ILUC adds anywhere from 5 g to 25 g CO₂ eq/MJ depending on the economic model and soil carbon factors chosen. For soy biodiesel, that could erode roughly one sixth of its climate gain, whereas UCO pathways remain virtually unaffected. Policymakers therefore reward waste and residue based fuels with stronger credits under EU RED III and U.S. Section 45Z.

The Numbers at a Glance

| Pathway (B100) | Carbon Intensity (g CO₂ eq/MJ) | Net Saving vs. Diesel | Note |

|---|---|---|---|

| Fossil diesel | 95 | baseline | Average U.S. refinery slate |

| Soy biodiesel | 21 | 78 % | Drops to 30 g when ILUC is added |

| Used cooking oil biodiesel | 18 | 81 % | Waste feedstock, no ILUC penalty |

| Soy + ILUC | 30 | 68 % | High end of ILUC range |

Policy & Feedstock Outlook

Europe cut average road fuel carbon intensity 5.6 % from 2010 2022, driven mainly by biodiesel blends. Demand for low CI feedstocks is soaring; the IEA warns of a potential waste oil supply crunch by 2027 if collection doesn’t keep pace with new refining capacity. U.S. Section 45Z will tighten CI targets from 2027 onward, amplifying premiums for sub 30 g fuels like UCO biodiesel.

What Fleets and Cities Can Do Now

Because biodiesel is a “drop in” fuel up to B20 and B100 with minor modifications fleets can decarbonize immediately without buying new trucks. Federal law even grants alternative fuel credits for fleets using B20 or higher. Operators should audit local waste oil supplies, negotiate offtake with grease recyclers, and monitor CI scores annually using GREET or similar tools. Early adopters report no downtime penalties and modest fuel filter adjustments, yet enjoy double digit emissions cuts and reputational gains.