Table of Contents

Key takeaway: Turning waste fryer oil into hydro processed esters and fatty acids (HEFA) sustainable aviation fuel (SAF) slashes life cycle CO₂ by roughly three quarters, almost eliminates sulfur and soot, and can even curb contrail forming ice crystals while matching conventional Jet A’s energy punch. Scaling supply, however, hinges on policy sticks, price carrots and tighter fraud checks for feedstock origin.

Why Compare Used Cooking Oil Fuel with Jet A?

Aviation pumps out 2 to 3% of global CO₂ and a disproportionate share of warming contrails. Traditional Jet A sits near the top of every emissions league table, so any credible drop in alternative must prove its climate edge without sacrificing safety or performance. Waste oil derived HEFA ticks those boxes and is already ASTM approved, making it the most “here and now” SAF pathway.

From Fryer to Flight: How HEFA SAF Is Made

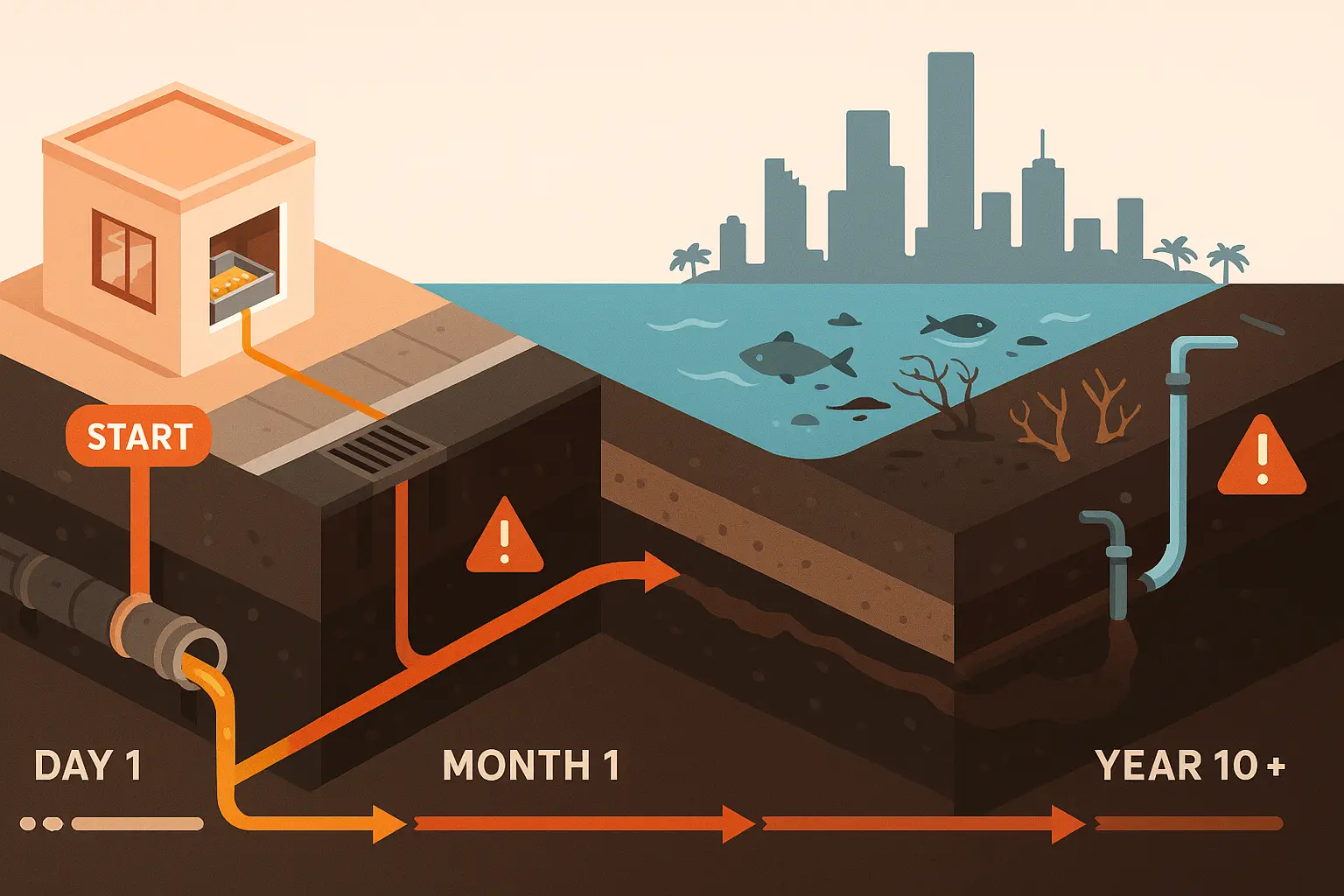

Restaurants empty their used cooking oil (UCO) into sealed drums; licensed collectors refine the greasy mix, filter water and free fatty acids, and ship it to a hydro processing unit. There, hydrogen removes oxygen, cracking triglycerides into straight chain paraffins almost identical to Jet A. According to the U.S. DOE GREET 2024 manual, the process creates a fungible fuel with minimal aromatics and <0.001% sulfur. Smooth blending at up to 50% is routine today, and 100% flights are now on the test card.

Greenhouse Gas Footprint

HEFA’s biggest win is carbon intensity. DOE’s latest GREET run shows 20 to 30 g CO₂e/MJ versus Jet A’s 89 g CO₂e/MJ, a 68 to 78% saving. Meta analysis of dozens of LCAs broadens the range to 60 to 90% depending on collection distance and hydrogen source.

| Environmental Metric | Jet A 1 (Baseline) | UCO HEFA SAF | Relative Change |

|---|---|---|---|

| Life cycle CO₂e (g/MJ) | 89 | 20 to 30 | ↓ ≈75% |

| Sulfur (wt%) | ≤0.3 | <0.001 | ~100% cut |

| Soot/PM Number Index | 1.0 | 0.15 | ↓ 85% |

| Energy Density (MJ/kg) | 43.1 | 43.7 | Parity |

Beyond CO₂: Non CO₂ Emissions

Lower sulfur and aromatic content mean fewer black carbon nuclei, translating to up to 85% less soot and dramatically smaller ice crystals in contrails, Airbus’ 2024 in flight study confirms. Cleaner burn also cuts particulate bound metals and polycyclic aromatics that degrade air quality around airports. The result is a double dividend: cooler skies and healthier lungs.

Energy Density and Engine Compatibility

HEFA’s 43 to 44 MJ/kg mirrors Jet A, so aircraft range, thrust and fuel mass calculations stay unchanged. Engine testing shows equal freeze and flash points, while reduced density slightly improves gravimetric efficiency. No hardware modifications are required; airlines simply load the blend and fly.

Feedstock Availability & Scalability

Global UCO supply is about 14 million tons today and may reach 31 million t by 2030, driven largely by Asian restaurant chains and new collection mandates. Even at that level it could meet ~3 to 5% of projected 2030 jet fuel demand, so HEFA is vital but not the sole answer. Authenticity audits are rising after EU fraud concerns on mislabeled imports, underscoring the need for traceable chains of custody.

Policy Signals and Market Economics

ReFuelEU sets a 2% SAF mandate in 2025 climbing to 70% by 2050, with UCO HEFA expected to do early heavy lifting. ICAO’s CORSIA allows full LCA credit for waste oil HEFA, and U.S. 40BSAF tax credits can shave up to $1.75 / gal off costs. Yet a Financial Times report notes airlines and refiners remain locked in a price stalemate, with HEFA costing roughly 2 to 3× Jet A. Market analysts still forecast a $25 bn SAF sector by 2030 as mandates tighten.

Caveats, Co Benefits & Next Steps

UCO is truly “waste,” so indirect land use change is minimal, but wide adoption must avoid crowding out other biodiesel markets. Lifecycle savings plunge if hydrogen comes from fossil SMR; renewable H₂ is the next frontier. Airlines can unlock extra climate benefit by pairing HEFA with smart contrail avoidance routing, already shown to halve short term warming at modest cost.