Prices updated June 2025

Jump to a question:

What is the price of sunflower oil per ton today?

Sunflower oil trades at US $1,262.95 per metric ton as of June 2025, based on over the counter (OTC) and contract for difference (CFD) financial instruments according to commodity market data (IMF).

US importers face these wholesale prices when sourcing sunflower oil for distribution. The price reflects global market conditions since the largest exporters determine international pricing. Ukraine and Russia traditionally dominate exports, though US buyers increasingly source from Argentina.

Import cost breakdown per metric ton:

- Origin price (FOB): Current spot level

- Ocean freight: US $75 to 100 (Baltic Exchange)

- Port handling: US $25 to 35

- Inland transport: US $50 to 65

- Total landed cost: US $1,413 to 1,463

Daily price fluctuations affect purchasing decisions for US food manufacturers. Companies watching commodity charts see volatility ranging 2 to 5% within a single month. This impacts planning for businesses using sunflower oil in commercial baking and frying applications.

Key takeaways: • Monitor daily price movements on commodity trading platforms • Lock in forward contracts when prices dip below US $1,200/MT • Calculate landed costs adding US $50 to 75/MT for shipping to US ports

The International Monetary Fund provides period average prices in nominal US dollars for reference. These benchmarks help US buyers evaluate current market conditions against long term trends.

Summary: Today’s sunflower oil trades at historically elevated levels for US importers. OTC and CFD instruments provide real time pricing data for strategic purchasing decisions. Learn more about used cooking oil recycling to offset oil costs.

Grease Connections

What is the price of sunflower oil in the US?

US retail sunflower oil prices range from US $4.50 to 6.00 per liter (US $17 to 23 per gallon) in June 2025 (USDA Retail Monitor), with high oleic varieties commanding 15 to 20% premiums over standard options.

American consumers find sunflower oil pricing varies significantly by brand and retailer. Great value brands offer standard sunflower oil around US $4.50/liter while premium high oleic versions reach US $6.00/liter. Bulk purchases in 35 oz or larger containers reduce per unit costs.

Store brands help budget conscious shoppers save 20 to 30% versus national brands. Customers appreciate sunflower oil’s light texture and subtle taste for various cooking applications. The oil performs excellently for high heat cooking without burning on pans.

Action steps for smart shopping: • Download store apps for weekly sale notifications • Buy 1 gallon containers to save US $2 to 3 per liter • Join warehouse clubs if using over 2 gallons monthly • Stock up during Memorial Day and July 4th promotions

Product quality receives consistently positive feedback from US consumers. Reviews highlight sunflower oil as not super oily compared to alternatives. Many use it as a good substitute for olive oil in specific cooking applications.

Summary: US sunflower oil retails between US $4.50 to 6.00 per liter depending on type and brand. High oleic varieties cost more but offer superior heat stability and health benefits. Check our guide on grease trap maintenance for commercial kitchen tips.

Grease Connections

What is the price of fresh sunflower oil?

Fresh sunflower oil commands US $5.00 to 7.00 per liter at US farmers markets and specialty stores, reflecting small batch production and immediate post pressing bottling without extended storage.

Premium fresh pressed sunflower oil offers distinct advantages for health conscious consumers. The minimal processing preserves vitamin E content and natural antioxidants. US artisanal producers typically bottle within 48 hours of pressing sunflower seeds.

Small scale production limits availability and increases costs versus commodity oils. Fresh sunflower oil provides cardiovascular benefits similar to olive and canola oils. The unrefined product retains more nutrients but has shorter shelf life requiring refrigeration.

Where to find fresh pressed oil: • Visit local farmers markets May through October • Search “cold pressed sunflower oil near me” for artisan producers • Order direct from small farms for bulk discounts • Check natural food co ops for regional options

Customers particularly value fresh sunflower oil for refrigerated dressings. The oil component doesn’t solidify like some alternatives, maintaining smooth consistency. Light sautéing applications showcase the subtle nutty flavor profile. Consider bulk oil procurement consultation for commercial kitchen needs.

Summary: Fresh sunflower oil costs US $5.00 to 7.00 per liter at specialty US retailers. The premium reflects small batch processing and superior nutritional content versus refined versions.

Grease Connections

Why is sunflower oil so expensive?

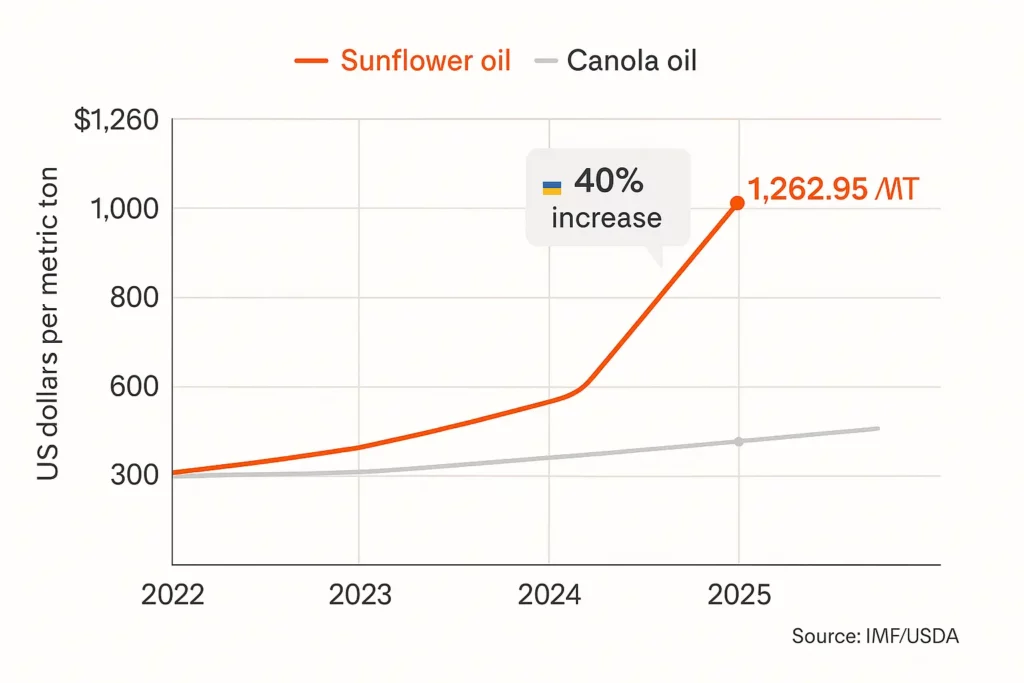

Sunflower oil remains expensive due to Ukraine Russia conflict disrupting 60% of global exports (USDA FAS), causing US import prices to stay elevated despite partial market recovery in 2025.

Historical data indicates sunflower oil remains more expensive than other high oleic oils like canola. The commodity traditionally traded at small premiums over competing oils. Current geopolitical disruptions created unprecedented price gaps that pushed the June spot well above historical norms.

US dependency on imports magnifies price impacts. Domestic sunflower production covers only 35% of national demand (NASS). Food manufacturers compete with biodiesel producers for limited supplies, adding upward price pressure beyond that level.

Cost reduction strategies: • Negotiate annual contracts during harvest season (September to October) • Blend with canola oil for 20% cost savings on some applications • Join buying cooperatives for volume discounts • Implement oil filtration systems to extend usage 40%

Supply chain complexity adds costs throughout distribution. Ocean freight, port handling, and domestic transportation contribute US $150 to 200 per metric ton above origin prices. These logistics expenses compound the already elevated commodity values.

Summary: Sunflower oil stays expensive due to 60% supply disruption from major exporters and US import dependency. Prices remain 40% above historical averages despite some market stabilization.

Grease Connections

Is sunflower oil price going up?

Yes, sunflower oil prices are projected to rise to US $1,308.63 per metric ton within 12 months (World Bank). This represents a 3.6% increase from current June 2025 levels.

Market fundamentals support continued price increases for US buyers. Growing global demand for high oleic varieties outpaces production expansion. Climate challenges in major growing regions limit yield improvements, keeping values above the June spot.

US food manufacturers should prepare for higher costs. Companies watching commodity charts see upward trends continuing through 2026. Forward contracts help manage budget risk from anticipated price escalation beyond current levels.

Key takeaways: • Lock in 2025 prices through forward purchasing agreements • Budget for 5 to 10% annual price increases in planning • Explore oil blend formulations to manage costs

Quarter end projections show sunflower oil maintaining elevated trading levels. The steady march upward reflects structural supply constraints. US buyers face limited options for avoiding these increases given import dependency.

Summary: Sunflower oil prices will rise to US $1,308.63/MT by mid 2026, adding 3.6% to costs. US importers should use forward contracts to manage inevitable price increases.

Grease Connections

What is the price of crude sunflower oil?

Crude sunflower oil trades at US $1,150 to 1,200 per metric ton for US industrial buyers (Oil World), approximately US $60 to 100/MT below refined oil prices due to additional processing requirements.

Unrefined crude sunflower oil serves specific industrial applications in the US market. Food manufacturers requiring custom refining specifications purchase crude oil for in house processing. The lower price reflects costs for degumming, bleaching, and deodorizing needed to reach refined quality.

Crude oil quality varies significantly by origin and extraction method. US buyers must carefully evaluate free fatty acid levels and moisture content. These factors determine refining yields and final product quality when processing from this base level.

Key takeaways: • Verify crude oil specifications match refining capabilities • Calculate total costs including refining before comparing to refined prices • Establish quality testing protocols with suppliers

Small US processors find crude oil purchases uneconomical due to refining complexity. Minimum order quantities typically start at 20 metric tons. Storage requirements and processing equipment represent significant capital investments. Explore our oil recycling solutions for cost recovery options.

Summary: Crude sunflower oil costs US $1,150 to 1,200/MT for industrial US buyers. The discount versus refined oil reflects additional processing requirements.

Grease Connections

What is the market price for sunflowers?

US sunflower seed prices range from US $400 to 500 per metric ton at farm gates in June 2025 (NASS), with oil type varieties commanding US $50 to 75/MT premiums over confectionery seeds.

American sunflower growers face volatile market conditions. Oil content determines pricing with high oleic varieties earning best returns. North Dakota and South Dakota produce 75% of US sunflower crops.

Farmers calculate profitability based on oil yield potential. Standard varieties yield 40 to 45% oil content while improved hybrids reach 50%. Each percentage point of oil content adds approximately US $10/MT to seed value.

Key takeaways: • Oil sunflowers earn US $450 to 500/MT at current market prices • Confectionery types bring US $400 to 425/MT for snack food use • Contract growing provides price stability for farmers

Direct relationships between oil processors and growers strengthen US supply chains. Domestic production reduces import dependency but requires continued acreage expansion. Climate adapted varieties help stabilize yields despite weather variability.

Summary: US sunflower seeds trade at US $400 to 500 per metric ton depending on type. Oil varieties command premium prices reflecting their 40 to 50% oil extraction rates.

Grease Connections

Complete Sunflower Oil Market Summary

US sunflower oil prices reflect complex global dynamics. The June spot sits at US $1,262.95/MT (IMF). Retail costs range US $4.50 to 6.00/liter with high oleic varieties commanding premiums for superior cooking performance and health benefits. Ukraine Russia conflict continues disrupting 60% of global supply, keeping prices 40% above historical averages despite partial recovery.

Market projections show prices rising to US $1,308.63/MT within 12 months based on structural supply constraints and growing demand. US import dependency magnifies price impacts since domestic production covers only 35% of national needs. Fresh pressed artisanal oils command US $5.00 to 7.00/liter reflecting small batch quality and preserved vitamin E content.

Strategic buyers use multiple approaches to manage costs. Forward contracts lock in current prices before anticipated increases. Bulk purchasing in gallon or larger containers reduces per unit expenses. Store brands offer 20 to 30% savings while maintaining quality for frying and baking applications. Industrial users can access crude oil at US $1,150 to 1,200/MT but must factor refining costs. US sunflower growers receive US $400 to 500/MT for seeds with oil varieties earning premiums based on 40 to 50% extraction yields.

Ready to optimize your sunflower oil procurement? Request a custom pricing analysis today.