June 2025 U.S. average rebate: $0.34 per gallon

Miami-Dade kitchens report up to $0.40 Rates update daily.

Restaurant operators from Trenton, New Jersey, to Miami, Florida, and up through Atlanta, Georgia, keep asking the same question: How much is used cooking oil worth? In 2025 the answer sits at the center of a rapidly expanding cooking oil market whose market size now tops $7 billion, according to analysts tracking the used cooking oil market and broader cooking oil industry. Selling fryer drippings no longer just offsets disposal fees; it can trim food‑cost volatility, support sustainability efforts, and connect kitchens to the wider renewable energy sector.

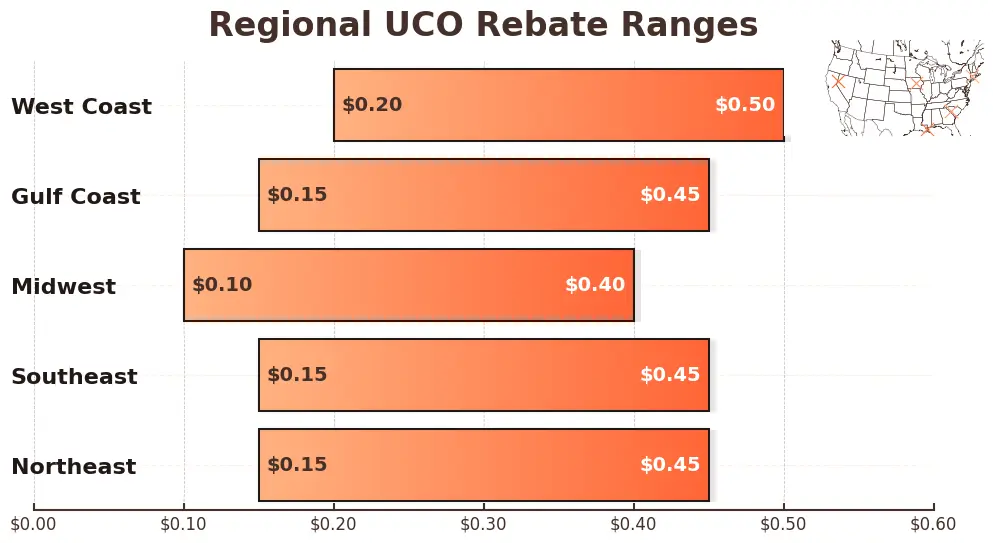

This guide outlines current prices, explains what drives them, and shows the real‑world math any chef or GM can use to forecast a realistic monthly rebate. For most restaurants in 2025, this translates to rebates of $0.10‑$0.50 per gallon of used cooking oil depending on quality, volume, and location. Participating in a cooking oil recycling program has become standard practice for many commercial kitchens, turning what was once a disposal headache into a modest, predictable revenue stream.

We made an even more in depth guide on used cooking oil cost, pricing etc.

Find out if we can Pickup

Looking to Sell Your Grease?

First, skim our step-by-step guide on how to sell used grease for money, then check if our trucks cover your ZIP.

Global Market Prices at a Glance

Right below this introduction you’ll find a live widget that tracks used cooking oil market prices across United States. The tool pulls from Google Finance Commodities and other trackers of market trends in the oil market, refreshing daily so operators can monitor increasing demand and gauge market stability.

📊 Current UCO Market Price

- Location

- US Gulf Coast

- Specification

- UCO 5% FFA

- Updated

- Trend

- 6-Month High

Prices are quoted for 5 percent‑FFA UCO and update automatically every 24 hours. Comparing overseas values with the U.S. figure helps restaurants see how raw material demand in various industries—from animal feed manufacturing to biofuel production—shapes the domestic rebate they receive.

Current U.S. Market Snapshot

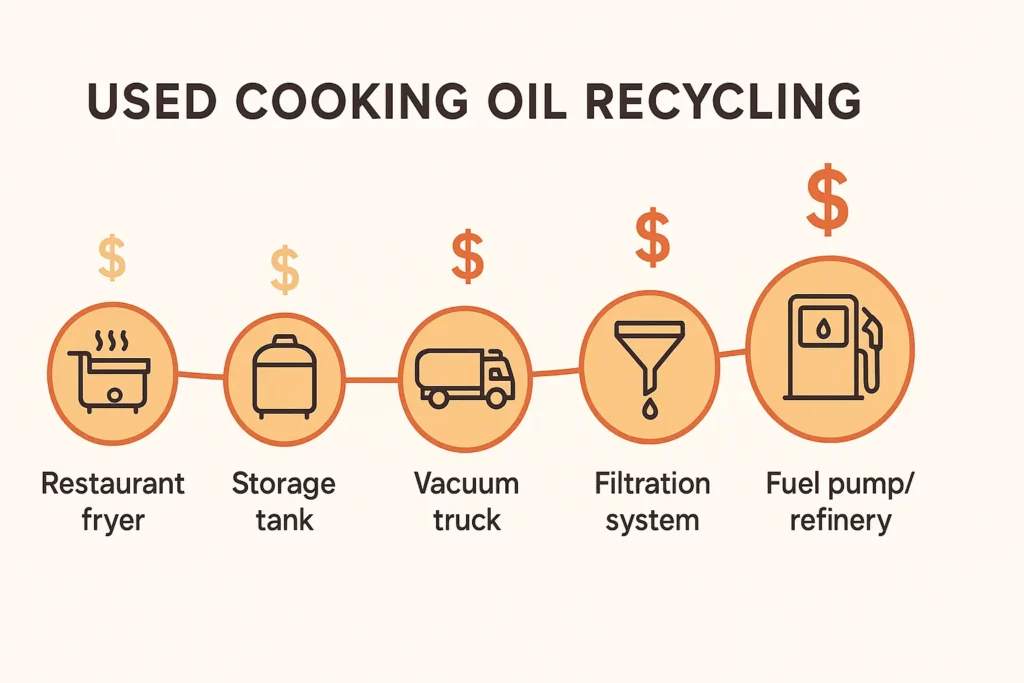

Below is a real‑time look at regional spot prices for bulk yellow grease—cleaned‑up waste oil diverted from grease traps into biodiesel production—this same waste oil powers regional cooking oil recycling routes and keeps collectors rolling.—and the rebates collectors pay restaurants. Wholesale numbers track truck‑load deals between processing companies and fuel makers, while the second column shows what commercial kitchens usually receive after transportation and handling.

| Region | Wholesale Spot Range† | Typical Restaurant Rebate‡ |

|---|---|---|

| Gulf Coast (Houston / New Orleans) | $2.60 – $3.20 / gal | $0.15 – $0.45 / gal |

| Southeast (Tampa FL / Atlanta GA) | $2.65 – $3.25 / gal | $0.15 – $0.45 / gal |

| West Coast (Los Angeles / Bay Area) | $2.85 – $3.50 / gal | $0.20 – $0.50 / gal |

| Midwest (Chicago / Omaha) | $2.70 – $3.30 / gal | $0.10 – $0.40 / gal |

| Northeast (New York Harbor / Boston) | $2.65 – $3.25 / gal | $0.15 – $0.45 / gal |

† Sources: USDA, Fortune Business Insights, state energy offices, and private price services tracking the oil market and biodiesel industry.

‡ Assumes clean grease under 10 percent FFA and pickup within a regional uco collection route.

At these levels, monthly rebate checks won’t pay the rent, but they can cover shift‑meal costs, purchase fryer‑filtration equipment, or fund small kitchen upgrades. The significant gap between wholesale prices and restaurant rebates reflects collector expenses—transportation, oil recycling logistics, dewatering, quality testing, and processing—before used oil becomes market‑ready.

Why Prices Vary

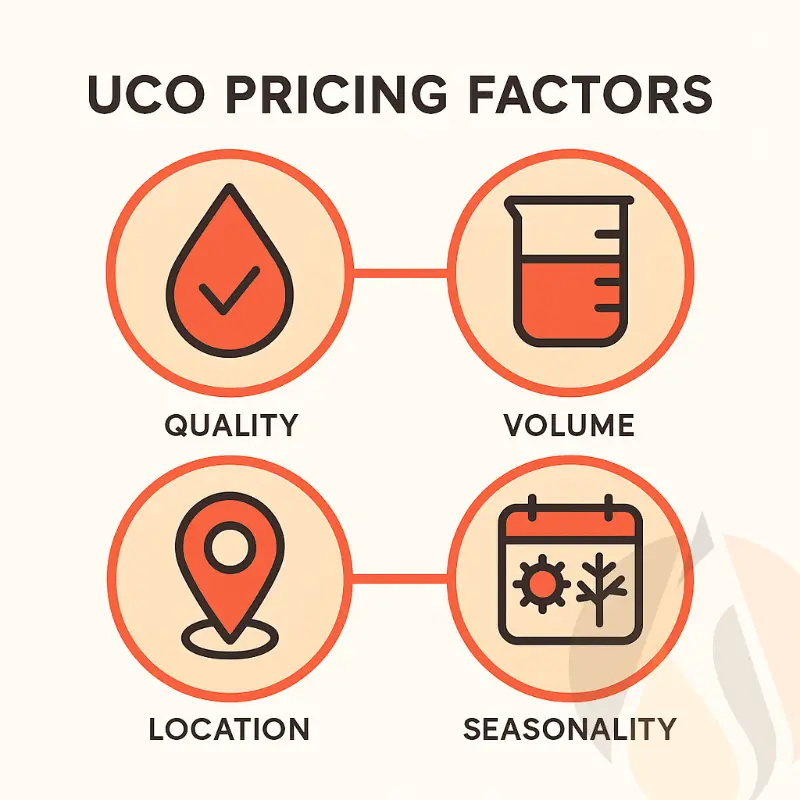

Four forces determine every quote: oil quality, volume, location, and season. Knowing these will help operators negotiate.

Quality — Guard Your Liquid Gold

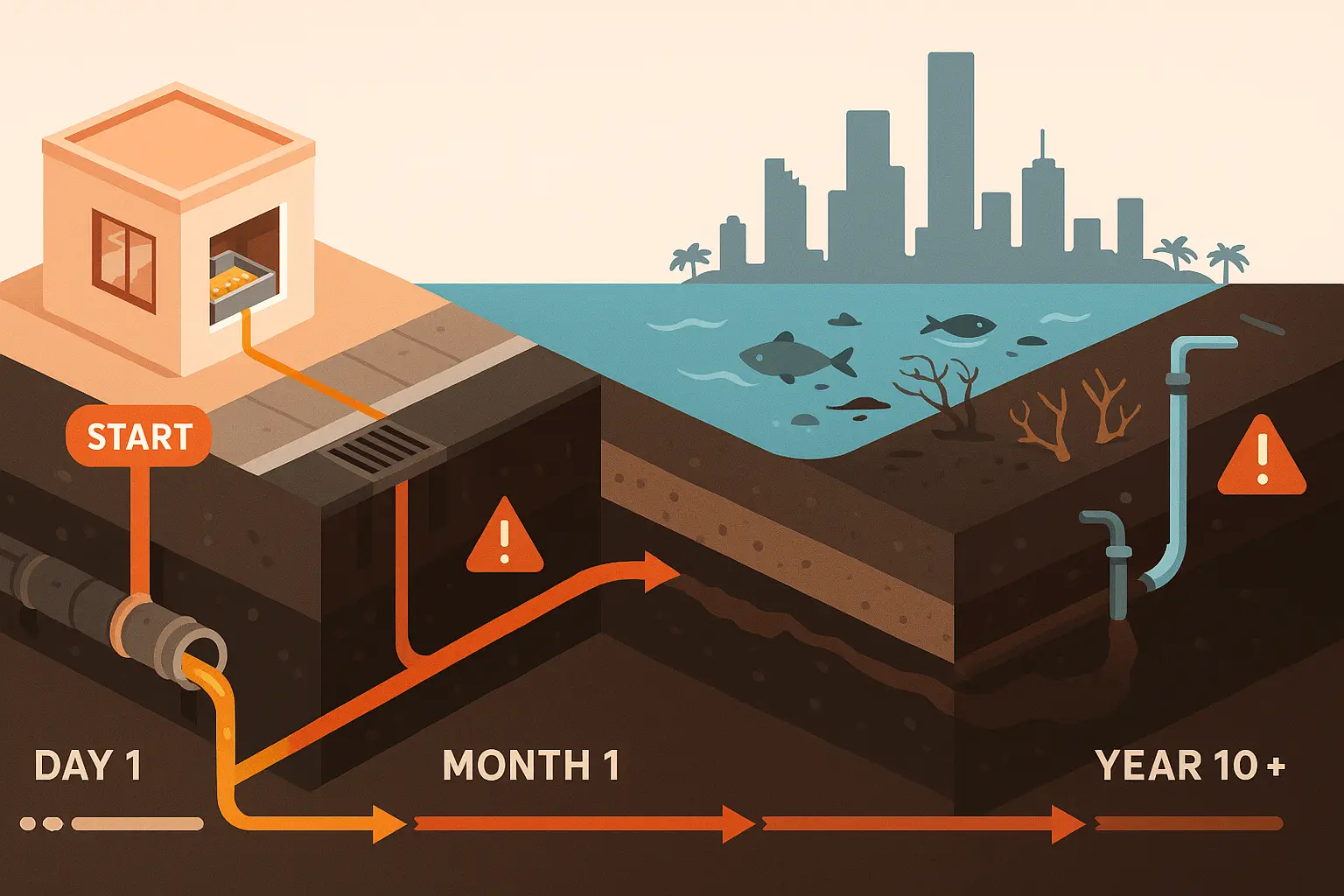

Processors test each load for free‑fatty‑acid content, water, and food debris. Grease that stays below 10 percent FFA converts into high quality biodiesel, a crucial step in biodiesel production that gives cooking grease a second life with a lower carbon footprint, so it commands a premium over dirtier cooking grease.

Volume — More Gallons, Better Rates

Collectors dispatch trucks to keep supply runs lean. Once a site tops 100 gallons a month, offers often rise 10 percent, because the same miles collect more product.

Location — Miles Cost Money

Hauling liquid waste far from processing hubs burns petroleum diesel (or renewable diesel), trimming margins. Kitchens close to Gulf‑Coast pretreatment plants see stronger rebates. California’s LCFS gives West‑Coast companies extra credits, sweetening offers there.

Seasonality — Timing Counts

Winter blending mandates lift demand for renewable diesel and sustainable jet fuel, nudging wholesale prices up 10‑12 percent. Summer travel boosts consumption too. Strategic storage can add a few cents when market dynamics tighten.

Real‑World Math: A Simple Formula

Monthly Rebate = Final Rebate Rate × Gallons Recycled

(Your rate comes from the table above, adjusted for quality, volume, and distance.)

Three Sample Scenarios

Small Café, Gulf Coast — 25 gal/month

$0.28 × 25 ≈ $7 – $10 per month.

Family Diner, Midwest — 80 gal/month

$0.32 × 80 ≈ $25 – $35 per month.

High‑Volume QSR, West Coast — 220 gal/month

$0.40 × 220 ≈ $85 – $110 per month.

Tip: Tie payouts to a transparent benchmark, ask for a cleanliness bonus, and track tax credits that improve your zip‑code premium.

Market Context for 2025

U.S. market trends show increasing demand outpacing modest growth in supply. New Gulf‑Coast refineries are adding 400 million gallons of biodiesel and renewable diesel capacity, soaking up additional brown grease and yellow grease. Simultaneously, higher vegetable oil consumption in South America and the Asia Pacific region props up feedstock costs, especially for soy and canola oil. Analysts expect a soft autumn dip as harvests arrive, but strong raw material demand from aviation and heavy‑haul fleets should preserve market stability. This rising demand accounts for a significant portion of price resilience and is reinforced by government regulations that reward proper disposal of waste oil through verified recycling channels.

Globally, companies in Europe are fine‑tuning recycling process technologies to extract by products such as glycerin and distillers oil, while Asian operators expand waste recycling for eco friendly alternative fuels. These moves show why the used cooking oil industry remains a hot commodity with solid long‑term prospects.

The Takeaway

Diverting fryer oil into oil recycling channels is a cost effective alternative to paying disposal fees. Checks may be modest, but combined with proper grease traps maintenance they offset everyday costs and showcase measurable environmental benefits, including lower greenhouse gas emissions. By keeping oil clean, batching volume, and negotiating fair distance charges, restaurateurs can capture value from a resource once thought worthless while helping cut greenhouse gases across several sectors.